[ad_1]

Many discussions have started on how many publicly traded ATHEX companies will survive the current crisis caused by the coronavirus pandemic.

Stock markets are reassuring and estimate that:

- Most companies will be successful with relative or even great comfort, adding that there will be many listed companies that will appear. profitable result within this year.

- There will be programs state support and additional bank loans to companies that will be greatly affected by Covid-19.

- The biggest problem is with the companies and industries that were already in it. difficult position and before the outbreak of the pandemic and now they will be called to face even bigger problems. But even in such cases, efforts will be made to avoid the worst.

Everyone agrees that having strong liquidity in a company will allow you to deal more easily with the financial consequences of the pandemic.

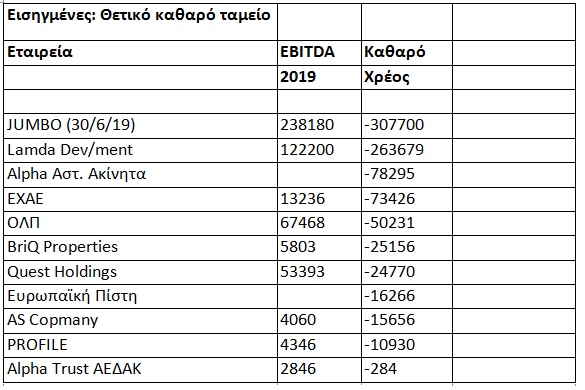

Therefore, the first table shows the companies that closed in 2019 with availability positive net cash (negative net debt, a very high liquidity indication), that is, they had cash that exceeded all their long and short term bank liabilities (Jumbo, HELEX, Lamda Development, Quest Holdings, PPA, European Credit, BriQED Alpha Trits, Alpha , Profile and Company AS).

However, the number of listed companies closed in 2019 with positive net cash expected to increase largely when the publication of last year’s annual financial results is completed. Companies expected to be added include EYDAP, EYATH, OLTH, Karelias, Plaisio, Plastika Kritis, IPTO, Centric, Mermeren Kombinat, GEKE (Hotel President), ELVE Clothing, Entersoft, Ideal, Mediterra Hellas, and possibly others. . Epsilon Net. Technical Olympic will soon be included in the corresponding list (as soon as the sale of Porto Carras is completed).

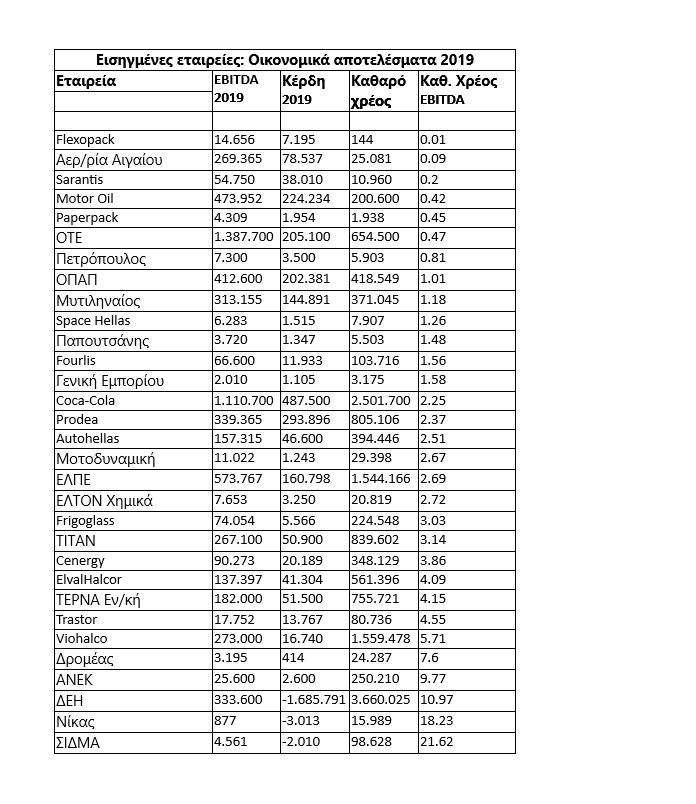

However, not only companies with a positive net fund have very strong liquidity, but many others as well. The most classic liquidity indicator is its net debt to EBITDA, where the lower the price of the index, the better the liquidity of a group will be. Theoretically, it is good for a company to have a net debt to EBITDA ratio of less than 4.5 to 5.0.

The second table lists the prices of the index mentioned above for those companies that have published their annual financial statements for 2019 and do not have positive net cash (that is, they are not included in the first table).

Therefore OTE, OPAP, Flexopack, Mytilineos, Sarantis, Motor Oil, Paperpack, Papoutsanis, Fourlis, Space Hellas, General Trade and Industry, ELTON Chemistry, etc. are among those at your disposal, among others excellent performance Regarding the relevant index (we always remember that no index is a panacea, due to its disadvantages).

In addition, there will be many cases of publicly listed companies. movements their administrations, but also state support and more comfortable bank financing will help them significantly. Measures to support specific sectors affected by the crisis (eg airlines and shipping companies) are already being discussed at a pan-European level.

In addition, several groups stopped operating for a month, reducing the amount of losses from the crisis, while investment programs were cut, to save cash flows. Additionally, we hear of cases where banks are offering companies to transfer interest-bearing fees to companies, for the same reason.

Furthermore, the pandemic will push several companies, and their creditor banks, to trade agreements. The feature is SIDMA’s now agreed takeover of Bitros’ metallurgical activity, a development that is expected to give “deep breaths” to both listed companies.

The image of PPC was also improved during the last four months of the year, a trend that seems to continue in 2020.

According to market participants, the effects of the pandemic on ATHEX-listed companies will certainly be large, but some companies are expected to be affected to a relatively small degree and more to successfully overcome this obstacle, confirming their ability to survive in times of crisis.

TABLE 1

TABLE 2

[ad_2]