[ad_1]

Carlos Gustavo Rodríguez Salcedo

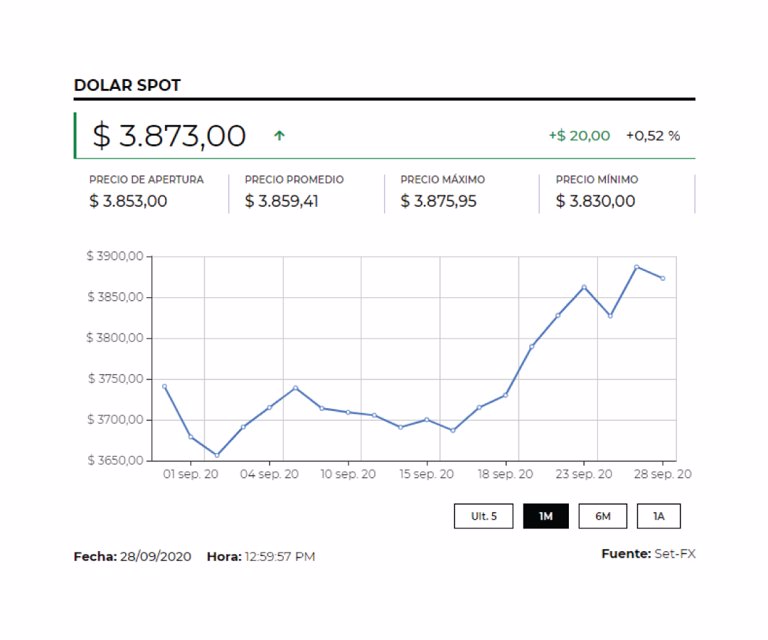

At 1:00 pm, the dollar reached an average price of $ 3,878.74, which represented an increase of $ 18.84 compared to the Representative Market Rate (TRM) that stood at $ 3,859.90 for today.

The currency opened the day with a price of $ 3,858.99 and its close was $ 3,886.95. The minimum price that was registered on the Set-Fx platform was $ 3,858.25, while the maximum was $ 3,896.85. The amount negotiated during the day was US $ 1,007 million in 1,458 transactions.

The closing of the dollar was marked by the announcement that “US consumer confidence rebounded more than expected in September, thanks to an improvement in current perceptions of the labor market, although the indicator remained below the levels seen before the covid-19 pandemic reached the country. “

At 8:13 am, the dollar registered an average trading price of $ 3,869.36, which represented an increase of $ 9.46 compared to the Representative Market Rate (TRM), which today stands at $ 3,859.90.

The currency opened the day with a price of $ 3,858.99, while the minimum price reached $ 3,858.99 and the maximum was $ 3,880. The amount negotiated was US $ 6.2 million in 12 transactions.

The strength of the dollar comes amid the fall in oil prices, as concerns mount about the increase in cases of the coronavirus. With the trend, and the new restrictions, a drop in oil demand is anticipated.

Around 7:38 in the morning, the WTI barrel lost US $ 0.31, after falling 0.76% and reaching US $ 40.29. In the case of Brent, a benchmark for the Colombian economy, it stood at US $ 42.18, with a rise of 0.59% after gaining US $ 0.25. “The increase in new cases of coronavirus in the United States and Europe is limiting the upside potential of oil prices,” said Carsten Fritsch, an analyst at Commerzbank, reported by the Reuters news agency.

Yesterday the number of more than 1 million people killed in the world by the coronavirus pandemic was reached.

Despite these doubts, oil did not fall further after Democratic congressmen presented a stimulus package of US $ 2.2 trillion to face the economic crisis in the US, which could boost the recovery.

In the case of stocks, around 7:30 in the morning, London’s Ftse 100 fell 0.59%; the German DAX lost 0.52%; France’s CAC 40 had a variation of -0.24%, and the Eurostoxx 50, which represents the performance of the 50 largest companies in 19 sectors in Europe, lost 0.29%.

Investors are also on the lookout for the first debate tonight between Joe Biden and Donald Trump, amid the battle for the White House. “We definitely need another round of stimulus here, not just for the confidence of the American public and workers, but also for the markets,” Michelle Connell, owner and president of Portia Capital Management, said on Bloomberg Television. “Going to this election would definitely help.”

In the case of gold, it gained 0.1%, to US $ 1,883.55 an ounce, while gold futures in the United States advanced 0.4%, to US $ 1,889.30 an ounce. “We could see some strength (from gold) in the medium term, but sentiment seems to have shifted a bit to the downside,” CMC Markets UK’s Michael Hewson told Reuters.

The metal has fallen more than 4% this month and is heading for its biggest monthly decline since November 2016. Hewson added that investors appear to be preferring US tech stocks over gold.