[ad_1]

BRASÍLIA – This Monday begins the period to register the information of future users of Pix, a new means of transactions and transfers of the Central Bank (BC).

The system goes into effect on November 16, but registration is the first step. With Pix it will be possible to pay bills, electricity bills, taxes or purchases.

Did you see that? Battle for Pix intensifies the dispute between banks and fintechs for new clients

The service was built by the Central Bank in conjunction with other actors in the financial system, such as banks, fintechs and cooperatives.

In practice, registration means registering the “Pix key”, which functions as the user’s identification. The intention is to facilitate transactions, which will no longer need much information, such as account number, agency, CPF and name, as it is today.

Pix is part of the BC # agenda, which seeks to stimulate competition and modernize the system in Brazil. Pix will be another means of payment, like the ticket, and another way to transfer resources, such as TED and DOC. However, you will have the advantage of allowing operations at any time and faster.

Investments: Did Selic Treasury have negative variation? Don’t be alarmed and know what to do

Understand how it will work

What is it?

Pix is a means of payment created by the Central Bank that must allow instant transfers and payments 24 hours a day, seven days a week. It will be another means of payment, like the ticket, and another way to transfer resources, such as TED and DOC.

Consumption: Pix can be used to pay electricity bills and the rate should decrease

Who can use it?

Any natural or legal person who has a checking account, deposit account or prepaid payment account.

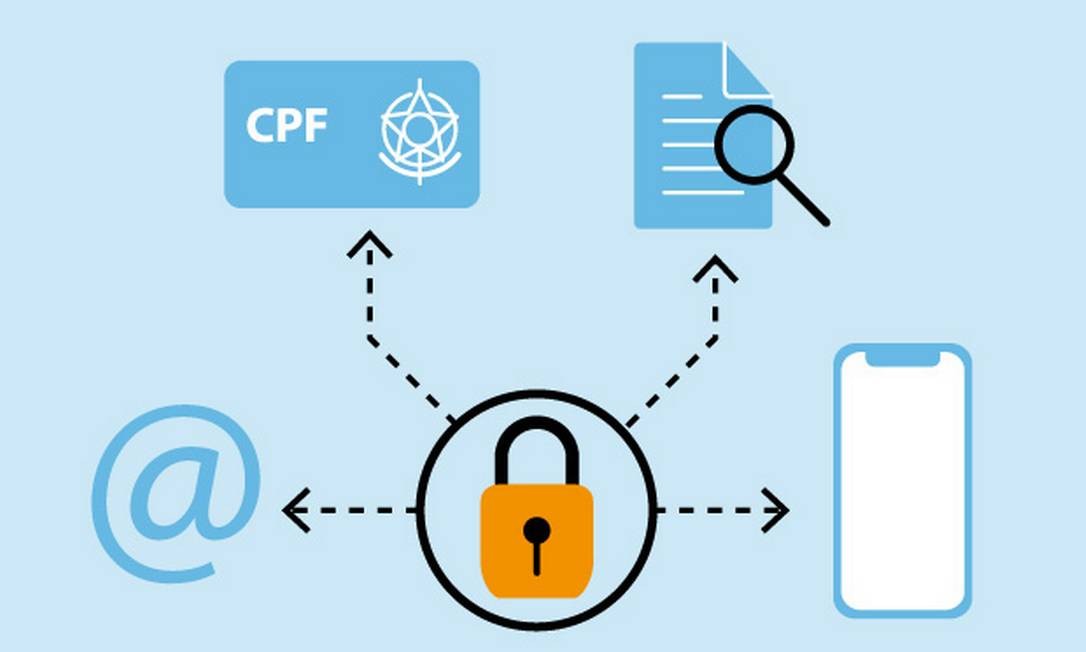

What is a Pix key?

The key is a means of identifying the user’s account. There are four types of keys: CPF or CNPJ, email, cell phone number, and a random number and lettered security key.

At the time of the transfer, instead of the user having to enter their name, Social Security number, account and agency number, as is currently done, in Pix they only have to enter the Pix key. Registration begins on Monday.

Interest at 2%:See alternatives to invest your money with earnings beyond fixed income

Is password registration required to use Pix?

Keylogging promises ease and speed in daily Pix use, but it is not required. Instant payment can be made or received in a longer time by completing all the account details for each transaction, as occurs today when taking a TED.

How to register the keys?

The registration of keys will be carried out through one of the access channels of the institution where the client has an account, be it an application or website. To perform this registration, the customer must confirm ownership of the key and link to the Pix account.

For example, in the case of using email or cell phone as a password, the user will receive a code by SMS or by email that they must insert into the application to confirm their identification.

The Central Bank emphasizes that this identification is not made by phone call or by link sent by SMS or email.

Rate: Brazilian pays, on average, a minimum wage per year in bank commissions

How many keys can I register per account?

The individual can have five keys for each account he owns (it is possible, for example, to register two mobile numbers, or two emails). In the case of legal persons, the limit is 20 keys per account.

In case the user has more than one account, it is possible to link different passwords in different accounts. However, it is not possible to link the same key to more than one account. For example, it will not be possible to use the cell phone as identification in a checking account at Banco do Brasil and another at Itaú.

If the user wishes to receive all transfers in one account, regardless of the password, it will be possible to link all the keys to a single account.

Fintech: Digital banks diversify their products to attract more customers

I have previously registered with banks or fintechs. Do I need to re-register my details?

No, but the institutions must confirm the data to make the registration effective.

When does Pix start to count?

Pix will only begin operations on November 16. The trial phase with a limited number of users begins on November 3.

Money: Cash withdrawals should be available in the first half of 2021, says BC director

How to make a transfer through Pix?

Pix will appear in the banking or fintech app where you have an account as another transfer option, along with TED and DOC.

By selecting the option, whoever is using the service will be able to enter an identification of who will receive the money, be it a CPF, email or cell phone, the Pix key. Whoever sends the funds places the amount to be transferred and approves the transaction.

Whoever receives it can also generate a QR code and present it to the payer.

Warren Buffet: At 90, recommends the ‘Methuselah technique’ to become a billionaire

How to make a payment through Pix?

To make purchases, Pix can also be used via QR Code. The consumer opens the banking or fintech application, selects the Pix option and directs the cell phone camera to the QR code provided by the commercial establishment.

The store can also, as with transfers, report your Pix key.

What is the cost?

For transfers between individuals and payments from individuals to companies, Pix will be free.

For individual microentrepreneurs (MEI), the tip will be for purchases and transfers. In the case of sale for commercial purposes, it can be charged.

In business-to-business transactions, financial institutions may charge a fee.

Pronampe;Government should release another R $ 10 billion for micro and small businesses

How do I access Pix?

Pix can be available on any platform decided by the financial institution. However, the Central Bank expects the cell phone to be the most used channel.

Initially, it will be necessary to have Internet access, but the BC foresees that an offline service will be available in 2021.

Will there be a value limit for each transaction?

The Central Bank did not establish a limit for Pix, but financial institutions may establish maximum amounts for each transaction that cannot be lower than the limits of other payment options.

Until the end of the year: The government extends the IOF exemption to credit until the end of the year.

How does it work if I make a mistake in a transaction?

It continues to function as it currently does. Cancellation of a transaction can be done just before it takes place.

However, Pix will have a refund feature, which must be initiated by the recipient. That is, if the wrong amount is sent, it will be necessary to negotiate the return of the amount.

It is safe?

Personal information is protected by bank secrecy and Pix will use the security measures already adopted by financial institutions in TEDs and DOCs.

In case of analysis and reimbursement, the payment service provider will be responsible.

What is the role of the Central Bank?

The Central Bank will provide the Pix infrastructure, a centralized database with data from the recipients’ accounts.

In this way, participants in the payment system will be able to take advantage of the unique infrastructure to accelerate the entire process of transferring and paying resources.