[ad_1]

BRASILIA – On the opening day of Pix’s registration period, this Monday, some banking applications experienced instability and even went offline. As of 12:30 pm, more than 1 million “Pix keys” have already been registered.

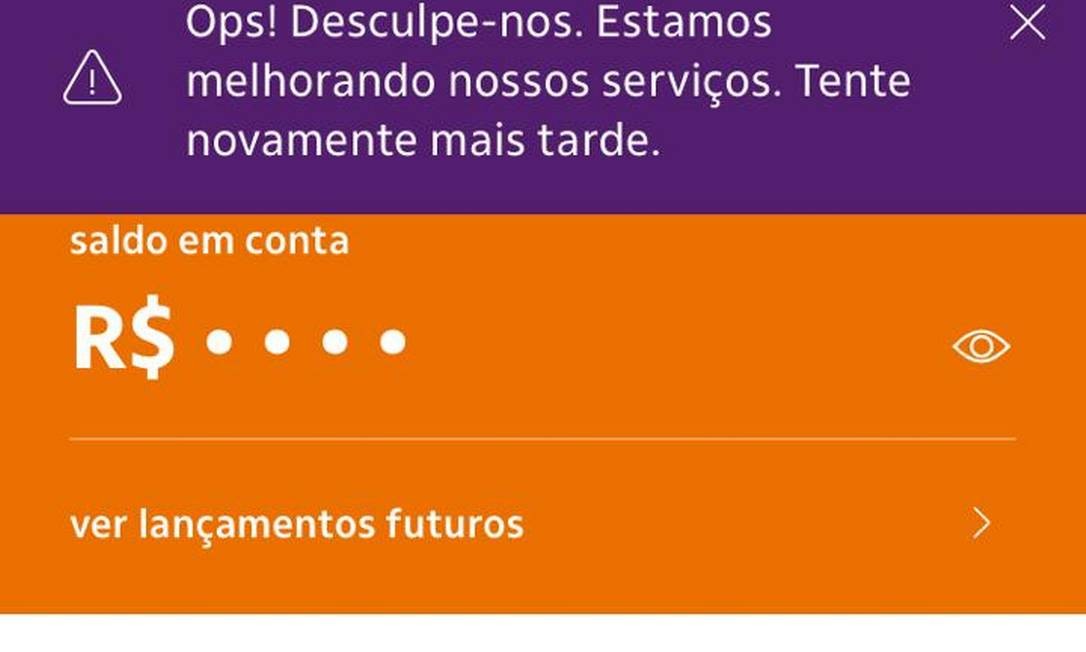

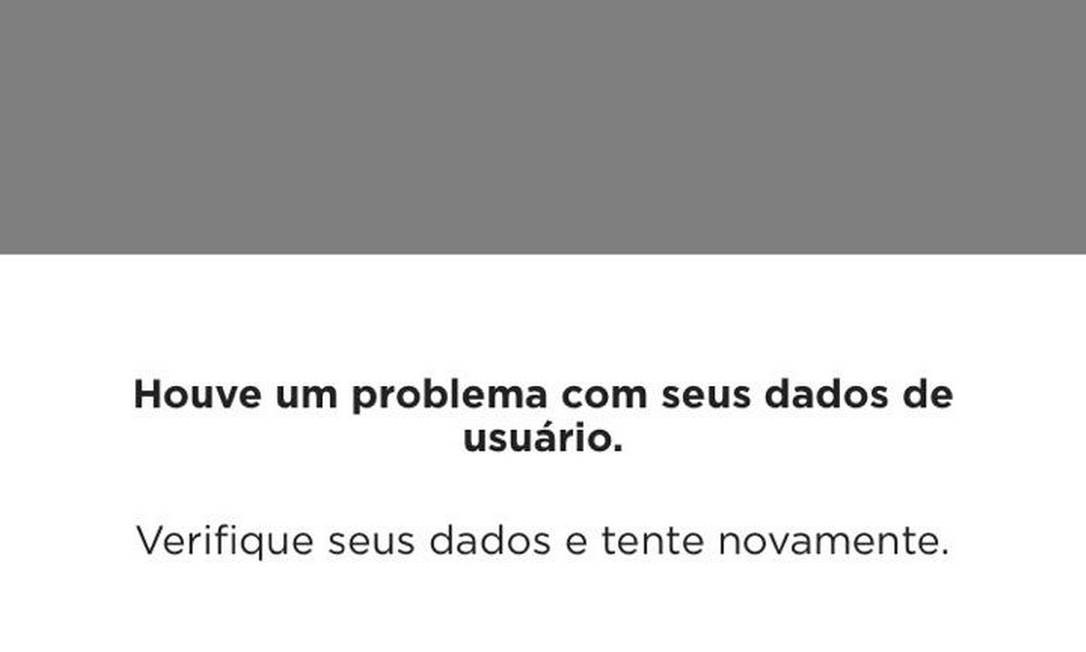

Despite the large number of registrations, some users complained on social networks that they could not register their passwords. According to the institutions, the problems were temporary and most of the applications have returned to working normally.

Pix: See how the new instant payment system will work

The “Pix key” acts as an identification of the user within the system of transfers and instant payments. In the case of TED, for example, data such as agency, account, CPF and beneficiary name are required. Pix requires only one of the following data: CPF or CNPJ, email, cell phone number or alphanumeric random key. More than 600 institutions can register.

On social media, some Itaú clients reported difficulties accessing the institution’s application. Wanted, the bank admitted that it had problems, but stressed that they were not caused by the registration of the keys.

“Itaú Unibanco clarifies that access to the application for individual clients is already being restored. The bank apologizes to its clients for any inconvenience and continues to act to eliminate any instability that may still occur. It should be remembered that access to Itaú through Internet banking, branches, ATMs and call centers is working normally ”.

Nubank, for its part, said it received reports from customers that they found “fluctuations” in the load of information in the application, but that the operation has returned to normal. The company emphasized that this is Pix’s first real test in apps.

“Today is the first real test of the changes made to applications to accommodate Pix. Furthermore, in addition to the customers who have registered their passwords, today is also the first business day of October, which always increases the number of people who access the application in the morning. “

In a live broadcast, the Central Bank’s Deputy Director of Competition and Financial Market Structure, Carlos Eduardo Brandt, said that the monetary authority system had no problems this morning, only “specific issues.”

– What we had were occasional questions with some institutions, very few, in fact they had a connectivity issue in the first hour, which is normal for something that is coming into operation, but the operations storage platform is fully operational No there is a problem.

Podcast:How does Pix work, which can replace DOC and TED?

Did you see that? Battle for Pix intensifies the dispute between banks and fintechs for new clients

Wanted, Banco do Brasil said it did not see any instability in its application on Monday.

Bradesco, for its part, reported instability in the application, but stressed that services should return to normal soon.

“The bank’s teams are already working to fully normalize the services, which should happen soon. It is important to clarify that the other channels are still active.” pix-0510