[ad_1]

Every year, vehicle owners must make the mandatory payment of the Vehicle Tax, the known IPVA. However, despite the annual requirement, some people may be exempt from the tax, guaranteeing extra money.

But is it possible to stay?tax payment and have the Free IPVA in 2021? The answer, although simple, varies according to the taxpayer’s condition.

Free IPVA in 2021

Vehicles with more than 10 years manufacturing are exempt from IPVA in the following states: Roraima and Rio Grande do Norte. It is also worth mentioning the states that provide exemptions for a longer period:

- 15 years: Amapá, Amazonas, Bahia, Ceará, Federal District, Espírito Santo, Maranhão, Goiás, Pará, Paraíba, Piauí, Rio de Janeiro, Rondônia, Sergipe and Tocantins.

- 18 years: Mato Grosso,

- 20 years: Alagoas, Acre, São Paulo, Paraná, Mato Grosso do Sul and Rio Grande do Sul.

In Santa Catarina, vehicles manufactured until 1985 are exempt from the tax. In Pernambuco and Minas Gerais, there is a different system for collecting IPVA, promoting a progressive reduction in the amount of the tax.

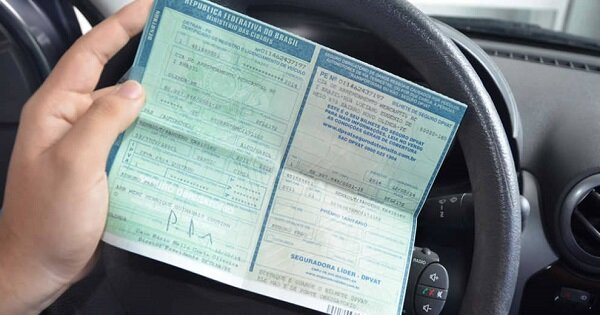

The bill, worth mentioning, is simple. The owner must consult the official document of his car to verify the year of manufacture and make the account regarding the validity of each state mentioned above.

The CRV or CRLV contains the “year of manufacture” and the “model year”. For the calculation of the IPVA, the “year of manufacture” is taken into account for the market value assessment.

Traders, individuals and the FIPE table consider the “year of manufacture” to establish a benchmark for market value.

See also: PL wants CNH free for all of Brazil; see how it will work