[ad_1]

OR Motor vehicle property tax (IPVA) It is a tax that vehicle owners pay every year. Do you know who is required to pay the annual tax? The answer is simple, but it varies from state to state. Know everything!

Vehicles with more than 10 years Manufacturing facilities are exempt from IPVA in the following states: Roraima and Rio Grande do Norte. Also worth mentioning are the states that provide exemptions for a longer period:

- 15 years: Amapá, Amazonas, Bahia, Ceará, Federal District, Espírito Santo, Maranhão, Goiás, Pará, Paraíba, Piauí, Rio de Janeiro, Rondônia, Sergipe and Tocantins.

- 18 years: Mato Grosso,

- 20 years: Alagoas, Acre, São Paulo, Paraná, Mato Grosso do Sul and Rio Grande do Sul.

In Santa Catarina, vehicles manufactured until 1985 are exempt from the tax. In Pernambuco and Minas Gerais, there is a different system for collecting the IPVA, promoting a progressive reduction in the value of the tax.

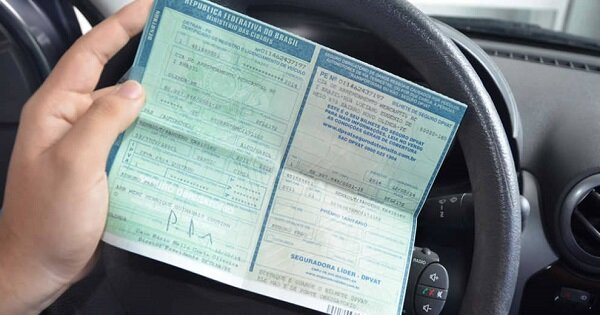

The bill, worth mentioning, is simple. The owner must consult the official document of his car to verify the year of manufacture and make the account regarding the validity of each state mentioned above.

The CRV or CRLV contains the “year of manufacture” and the “model year”. For the calculation of the IPVA, the “year of manufacture” is taken into account for the market value assessment.

Tenants, people, and the FIPE table consider the “year of manufacture” to establish a benchmark for market value.

See also: PL wants CNH free for all of Brazil; see how it will work