[ad_1]

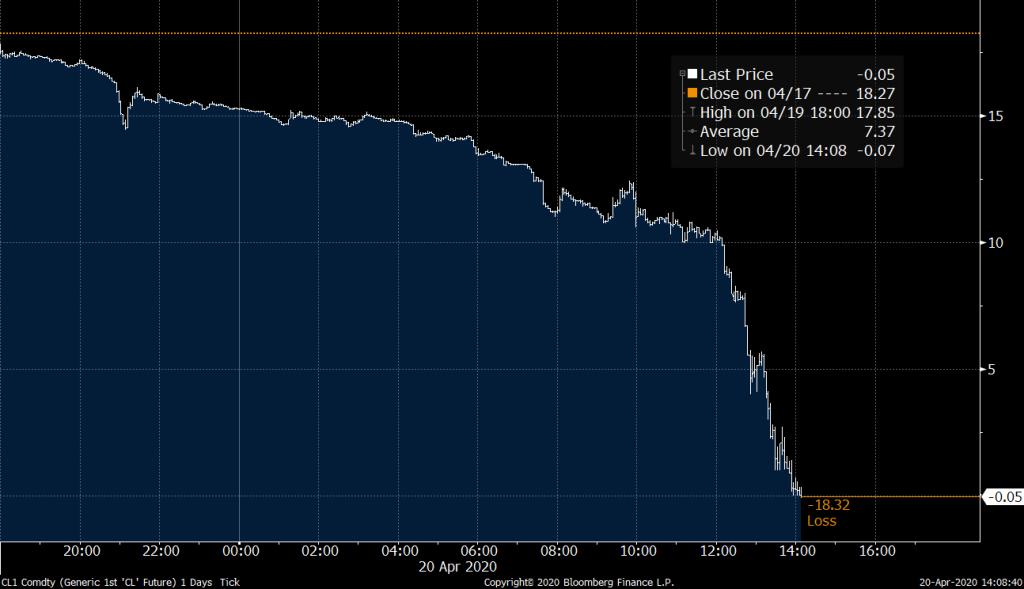

WTI oil price for May (Twitter Bloomberg / Reproduction)

SAO PAULO – The contract for the US barrel of oil WTI for May, which expires on Tuesday (21), falls more than 100% and is negotiated at a negative price.

According to analysts, the measure reflects the market perception that the cut of 9.7 million barrels per day announced last week by the Organization of Petroleum Exporting Countries and allies (OPEC +) will not be enough to face the fall in the global demand on account of the economic impacts of the coronavirus, of approximately 30%.

“The negative price shows that producers are willing to pay to store their oil, at a time when there is great supply and little demand,” explains Gabriel Fonseca, analyst at XP Investimentos specializing in oil.

The United States Energy Information Administration reported that oil reserves increased 19.25 million barrels last week.

So since the expiration of the WTI barrel contract for delivery in May ends tomorrow, investors who signed it have to find physical buyers, an almost impossible task in the current scenario if prices do not drop.

Futures contract operators generally manage to smoothly move from the expired contract to the next, but this time they are finding few buyers willing to receive the barrels since the expiration of May.

The race to get rid of the documents at any cost caused the price drop seen today. At 3:32 pm (in Brasilia), the WTI contract for May fell 162.51%, to $ 11.42 negative.

However, the June contract fell 15.98%, to $ 21.03. While the most heavily traded contract for Brent-type oil, which operates in London and expires in June, was down 8.83% to $ 25.60.

According to Gabriel Fonseca, it is important to highlight the difference between the horizon of future contracts. To plan, companies tend to target the longest oil curve, for six, twelve, or eighteen months. Within these terms, the oil market situation is expected to stabilize.

“The law of supply and demand should act and lead producers to close wells, to reduce supply, which would balance prices,” says the analyst. “It is important to note that the negotiation of the June contracts for Brent and WTI is normal. There is no dysfunction in the shorter contract, ”indicating that investors believe the situation will return to normal.

Everything you need to know to make a profit on the Stock Market that operates from your home in a free course: click here and participate!

[ad_2]