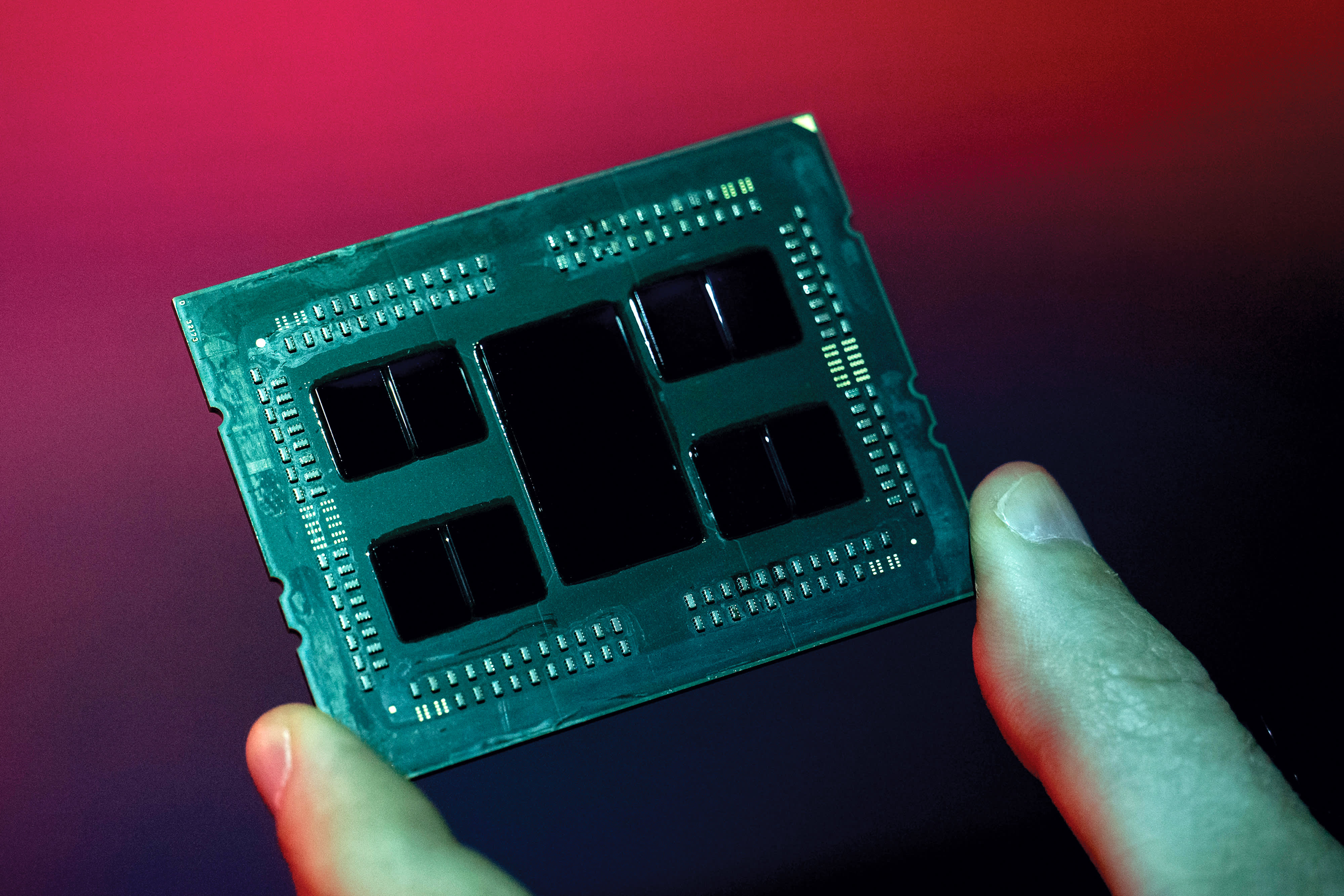

AMD’s shares hit another record on Monday, continuing to outperform its rival chipmaker Intel.

Intel’s stock plummeted to end last week after delaying the launch of its 7-nanometer chip by six months.

The two actions tell a very different story in the chip space. As AMD has recovered 49% this year, Intel has fallen 16%.

Nancy Tengler, chief investment officer at Laffer Tengler Investments, said it may be time to give Intel a chance.

“Since these stocks are trading on a relative price / sales ratio basis, you’ll want to take a fresh look at Intel. They pay you a 2.6% return, it’s growing around 7% a year, the earnings were actually good , the report was good, it’s just the 7 nanometer delay, “Tengler told CNBC’s” Trading Nation “on Friday.

Intel is trading at 2.65 times anticipated sales, compared to AMD’s nearly nine times multiple.

Intel “could be ready for a change in growth in the relative price / sales ratio. And I think that’s why we’re choosing it,” said Tengler.

Craig Johnson, Piper Sandler’s chief market technician, is part of the AMD team.

“Everyone likes a winner, so we would be buying AMD,” Johnson said during the same segment. “It is clearly a story of two different tapes at the moment.”

Johnson notes that most of AMD’s revenue comes from Sony and Microsoft, “clearly on the graphics and processor side,” while Intel gets its revenue from Lenovo and Dell.

“For me, moving to a smaller chip size is not as important as making the end markets stronger for AMD,” he said.

Johnson said the charts suggest AMD may have another 16% rise, bringing a measured target to $ 80. The stock was trading at $ 68.61 on Monday.

“I am an AMD buyer and I avoid Intel right now,” he said.

Disclosure: Laffer Tengler Investments owns Intel.

Disclaimer

.