[ad_1]

Salary and pension increases, tax exemptions, tax deductions for families with children, reduction of labor taxation are just some of the measures with which the main Romanian political parties want to get the votes of Romanians on December 6.

Before the parliamentary elections, we will present the socio-economic measures that the National Liberal Party (PNL), the Social Democratic Party (PSD) and the USR-PLUS Alliance propose in the government programs, for the development of Romania in the next four years.

Today we summarize the main proposals made by the three parties in terms of increasing the standard of living and purchasing power, increasing employment and labor integration of vulnerable groups, but also measures to increase pensions and allowances.

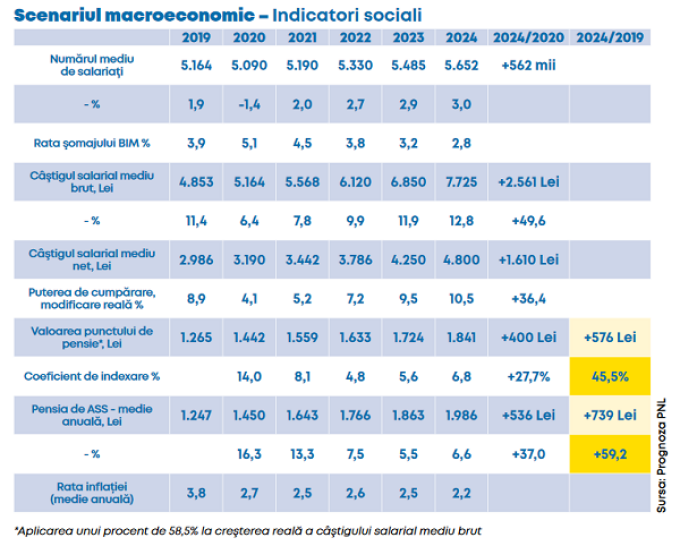

NLP: Average net salary of 4,800 lei and higher pensions by 46%

NLP Claims, in government plan called “Development of Romania”, that if he remains in power for the next four years, the economy will have an average annual rate of 5.6% increase in the period 2021-2024. The average net salary would amount to 4,800 lei in 2014, and the average gross salary to 7,725 lei, which would mean an average annual increase of 10.7% in the next term.

The minimum wage will be increased annually through negotiation with the social partners, taking into account both the inflation rate and the increase in productivity from the previous year. Inflation will remain around 2% by the end of 2024, close to the NBR target, and purchasing power would increase by more than 36%.

At the same time, NLP proposes increasing the value of the pension point by approximately 46% at the end of 2024, compared to 1,265 lei in the first 9 months of this year, including the increase already operated by 14% in September and with a difference of around 30 percent in the period 2021-2024. Therefore, the value of the pension point will be 1,841 lei and the average pension will increase to 1,986 lei.

Too, Contributions to Pillar II of pensions will increase by one percentage point, from 3.75%, as it is now, after the transfer of social security contributions to employees, to 4.75% in 2024. According to the law that establishes mandatory private pensions, the percentage should have been 6% right now. . Over the years, governments, with the support of Parliament, have called for derogations to reduce pressure on the public pension system, which is fed mainly by social security contributions. In addition, earlier this year (before the outbreak of the pandemic) the Minister of Finance, Florin Cîțu, announced that as of 2021 the part of the gross salary that would go to Pillar II will be 5% and then 6%, according to the law.

NLP expects the average number of employees will increase by about 560,000 people, accumulated in the period 2021-2024, which would bring the total number to more than six million people, an unprecedented level since 1996, before the massive layoffs in the Romanian state industry.

For the vulnerable categories in the age group 16-29 and those over 50, including Romanians returning from the diaspora, liberals come with raising European funds as a solution for integration into the labor market. In the case of people without studies, the requirements for access to training courses for people with 4 graduate classes should be made more flexible, the final objective being to support citizens to work.

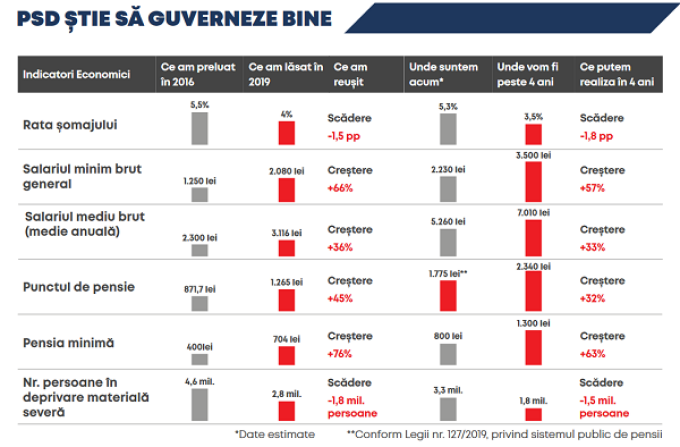

PSD: Salaries above 1,000 euros for 1.6 million Romanians and tax deductions for families with children

PSD government program It abounds in increases in benefits and allowances for employees and children, tax breaks and tax deductions, even as Romania continues to run a high budget deficit as a result of the health crisis caused by the coronavirus this year.

PSD’s economic objectives for the next four years are a average annual economic growth of 4.4%, a GDP of 292 billion euros in 2024 (77,000 million euros more in four years of government), reaching the objective of the EU budget deficit below 3% and a GDP per capita of 80% of the European average.

Too, The Social Democrats want to increase the purchasing power of the minimum wage by 37%, to add a million new employment contracts to the economy, and 1.6 million Romanians with salaries above 1,000 euros.

As for the minimum wage, the goal is to increase it to 3,500 gross lei, in 2024, respectively 4,150 gross lei for employees with higher education. Too, the minimum wage must represent 60% of the average wage.

Pensions would increase annually with the inflation rate to which 50% of the increase in the average salary in the economy would be added. By 2021, PSD promises a increase of the pension point to 1,875 lei. As of September 1 of this year, the pension point has a value of 1442 lei.

The Social Democrats propose a large increase in income tax deductions, which correlate with the number of children in a family, and any loss of income in local budgets will be offset by transfers from the state budget. The deductions would be indexed annually to inflation and growth from the previous year.

To reduce labor taxation, PSD proposes zero tax on minimum wage, the reduction of the tax on employees with children, the reduction of the tax on salaries below 6,000 lei and the zero tax on food stamps. The proposals also include a series of financial incentives for employees with children, double allowances and a pension bonus for mothers (1% for 1 child; 4% for two children; 10% for at least 3 children).

USR-PLUS: Introduction of flexible labor contracts and zero taxes on the minimum wage

Under the slogans “Revolution of good government” and “A Romania without a thief”, the USR-PLUS Alliance proposes 40 governance commitments, including “No offenders in public office”, the elimination of special pensions, the reduction of the number of parliamentarians, “curative justice” and the restart of DNA activity.

In the area of employment and social protection and pensions, the USR-PLUS Alliance proposes the following:

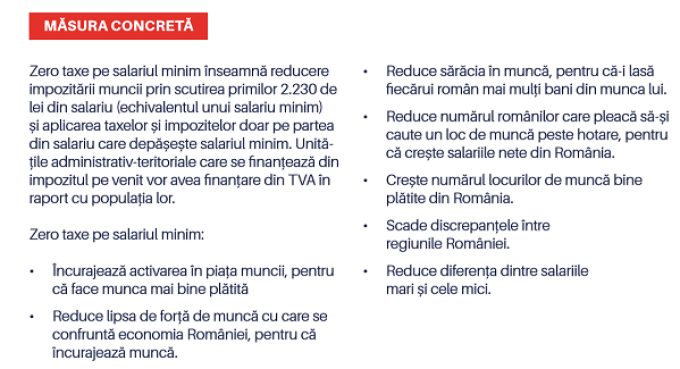

Zero taxes on the minimum wage. Reduction in labor taxation for exemption from taxes and duties of 2,230 lei of gross salary (equivalent to the minimum salary for economy). The application of taxes and duties should be made only on the amount that exceeds the minimum wage in the economy.

The USR deputy, Claudiu Năsui, declared that the measure of “zero taxes on the minimum wage” would be implemented gradually, over five years, targeting mainly the social strata with the lowest wages.

“We can eliminate the impact in two ways and we need an implementation schedule. First, for the first thousand lei or the first 500 lei, after which we continue like this. And progressively, step by step, we managed to get to the point of not taxing the entire minimum wage and carrying out this measure. The second way it can be applied, and will apply if USR PLUS is in power, is by starting with the lowest paid social strata, where the Romanian state, however, takes even less money, and which have the highest tax evasion and undeclared work, undeclared work. That five-year calendar is set out in our position paper. We started with agriculture and industry, then we went to all sectors. “, specific.

Gas from the Black Sea contributes to Romanians’ pensions through investments. Start the strategic project to exploit natural gas in the Black Sea and use the income obtained to invest, through privately managed pension funds (Pillar II).

Facilitate the return to the country of Romanians from the diaspora who want to return. Clearly targeted assistance programs to inform, return, accommodate and encourage entrepreneurship in the country.

Ithe introduction of multi-flexible employment contracts, which allow employers and employees to individually decide the conditions under which an employee works. Solutions such as remote work (teleworking), the adaptation of the 8-hour work schedule, the compression of the work week, the measurement of results with objective and atypical hour indicators, the distribution of work, the choice of days off, benefits flexible.

A job: the best social protection. Implementation of the Minimum Income Inclusion law that encourages job search because people who receive social assistance no longer have to choose between a job and maintaining social assistance.

National programs “All children in kindergarten” and “School for all”. Increase the number of children from poor backgrounds attending kindergarten, through the development and expansion of the “All Children in Kindergarten” program. Reduce school dropouts by expanding the “School for All” program from 500 to 1,200 vulnerable schools.

Psocial rotation and legal work in the field of services. Creation of a simplified legal framework in the field of services, providing a simplified form of payment (vouchers) for seasonal workers, day laborers, cleaning and care personnel. These categories will obtain social benefits (pension, medical insurance) and at the same time the base for the collection of contributions and taxes will be expanded.