[ad_1]

The Financial Supervisory Authority (FSA) published on Tuesday the report on complaints / requests in the insurance market in the first half of this year.

How the number of insurance claims has increased: 18,111 unique claims per petitioner in the first half of 2020

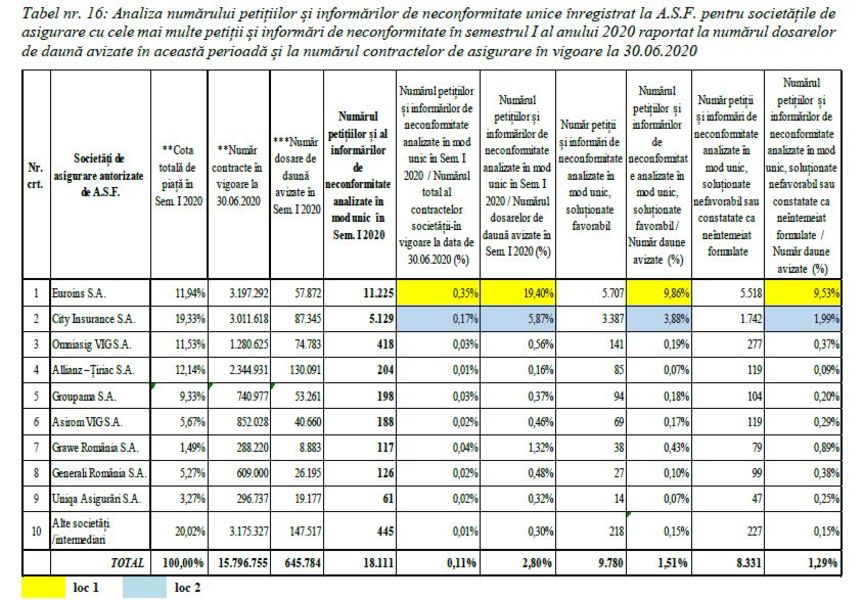

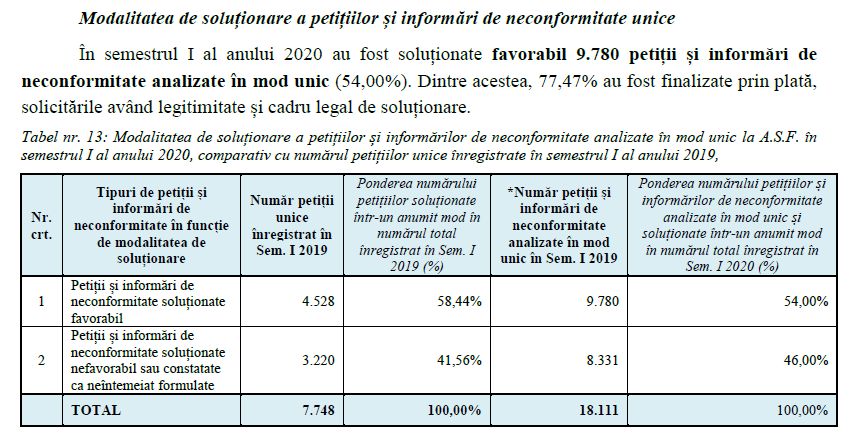

During that period, ASF registered and resolved in a unique way per petitioner 18,111 petitions and non-compliance information, increasing by 133.75% compared to the number of petitions registered in the first half of 2019. ASF resolved in favor of consumers only 54% of them, respectively 9,780 requests. Of these, 77.47% were fulfilled through payment, the requests having legitimacy and legal framework for liquidation.

Click to open

What do the petitions mean only to the petitioner?

- These are complaints from the same consumer, which refer to a single case. There are petitioners who return to the same case several times – or they do not wait 30 days and write again, or they send the petition through various communication channels – and by email and portal and in writing – or they are petitioners dissatisfied with responding and returning without bringing new items. ASF combines practically all of these complaints, which in fact refer to the same problem and have the same sender, in what it calls a single petition on the petitioner.

However, ASF notes that the number of 18,111 unique complaints per petitioner, although it is growing significantly, represents only 2.80% of the total number of approved corruption files by insurers in the first half of 2020 and 0.11% of the number of insurance contracts in force as of 06.30.2020.

Most of the claims per petitioner refer to irregularities in class A10: compulsory motor civil liability insurance (RCA and Green Card), with 17,346 requests and non-compliance information (95.78% of the total), increasing by 141, 79% compared to the number of requests registered in this promotion in the first half of 2019.

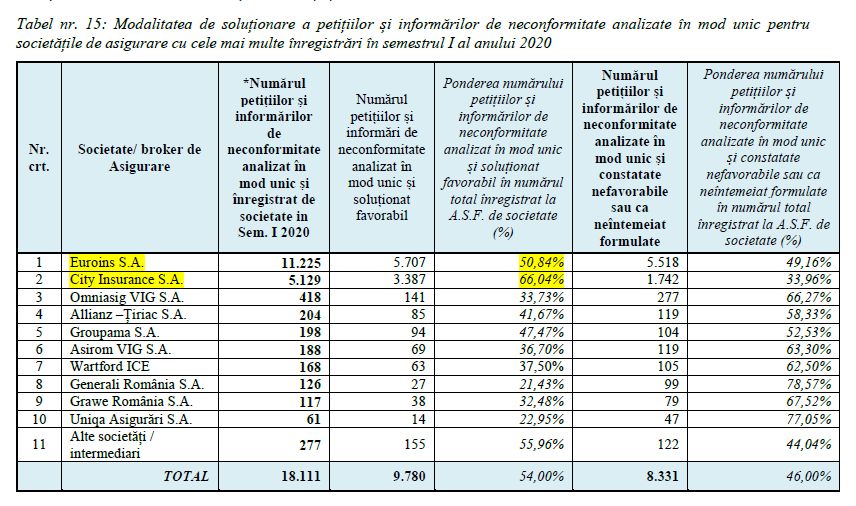

The most claimed insurer was Euroins with 11,225 requests, but only 50.84% of the claimants received a claim from ASF

Click to open

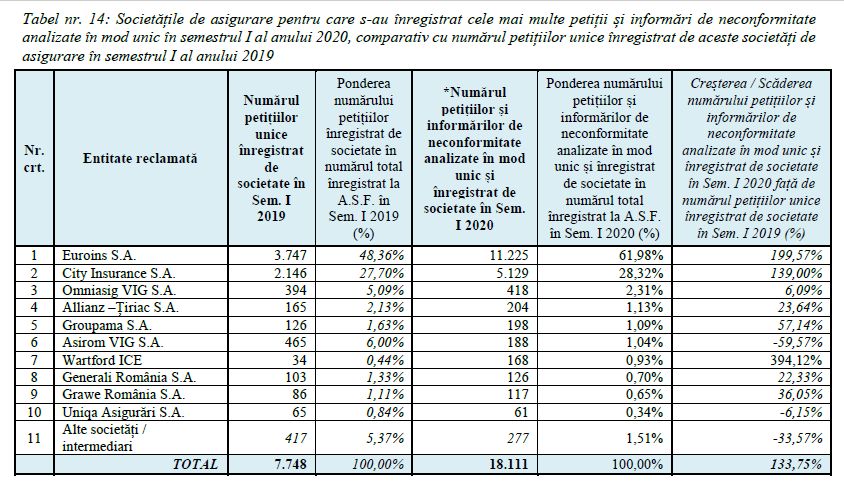

From the point of view of the insurance companies with the highest number of requests, the following were found:

- The insurance company with the highest number of requests and non-compliance information analyzed in a unique way in the first half of 2020 is Euroins Romania Insurance Reinsurance, with 11,225 requests and non-compliance information (61.98% of the total number), increasing by 199 57% compared to the first semester of 2019;

- City Insurance SA registered 5,129 petitions and non-compliance information analyzed in a unique way in the first half of 2020 (28.32% of the total), increasing by 139% compared to the first half of 2019;

- With the exception of the insurance companies Asirom VIG SA and Uniqa Asigurări SA, which registered a decrease in the number of petitions and non-compliance information, the other insurance companies analyzed registered increases.

Click to open

For comparison, the second largest insurer to complain was City Insurance with 5,129 claims, of which more than 66% (3,387 claims) were resolved in favor of consumers.

Number of claims against current contracts: the situation of each insurer

Another important aspect is related to the proportion of claims against insurance companies related to their claims or to the total number of contracts in force.

Click to open

It can be seen that the 11,225 unique claims against Euroins represent only 0.35% of the total insurance contracts in force that this insurer has in the first half of this year, and 19.4% of the total claims filed in the same period.

What irregularities were identified after the claims of the insured: Delays in the payment of compensation, the most demanded aspect.

Click to open

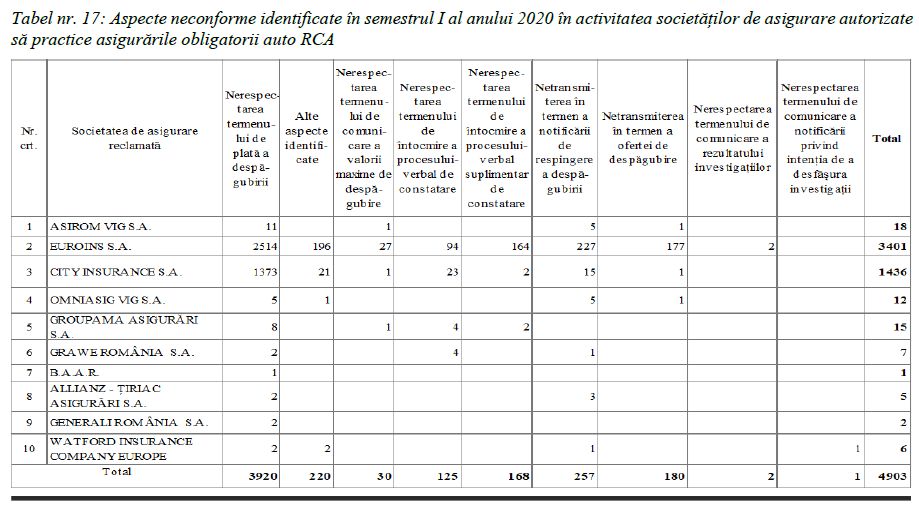

From the activity of resolution of requests for the insurance market – reinsurance, the following non-compliance aspects were identified:

- 1. Exceeding the legal term for the payment of compensation related to the files of damages opened based on the contracts of the MTPL;

- 2. Failure to inform the injured party within the legal term about the maximum amount of compensation;

- 3. Exceeding the legal term to make the conclusions / reconstitution;

- 4. non-registration by the insurers of all the documents related to the files of damages opened based on the MTPL contracts;

- 5. Failure to send the notice of denial of compensation on time;

- 6. Failure to submit the compensation offer on time;

- 7. breach of the deadline for preparing the record of the finding and / or supplementary statement;

- 8. the determination of the market value by the insurers in the event of total damage, without taking into account all the equipment of the vehicles in question;

- 9. insufficient justification of the solutions adopted by the insurers and communications from the ASF for the resolution of requests;

- 10. non-payment of fines for delay with the payment of compensation;

- 11. The offer of compensation sent to the injured parties is not prepared in accordance with the legal provisions.

Other problems identified in the request resolution activity:

– Failure to grant by the insurer the amount of compensation requested by the injured person, by not accepting the labor fee entered in the repair documents by the automobile repair unit;

– Failure to grant by the insurer the amount of compensation requested by the injured party, by not accepting the rental rate recorded in the supporting documents issued by the authorized entity.

[ad_2]