[ad_1]

At the Seimas Environmental Protection Committee meeting on Wednesday, Saulius Šuminas, Deputy Director of Regitra, stated that by July 21, on the afternoon of July, there were 8,000 registered vehicles for the first time subject to the tax. And another 8,000 cars that changed owners.

“With these 16,000 measures, we had no major problem in calculating the tax and 1.5 million was raised.” Eur. “Said S. Šuminas.

Photo from the log / Saulius Šuminas

As he said 15 minutes, of course, and so far the most popular tax limits.

“The most popular rate is 90 to 150 euros. If we talk about diesel cars, from 70 percent. The Lithuanian car fleet consists of diesel cars, which would be 150-180 g / km of CO2 emissions,” he said. S. Šuminas.

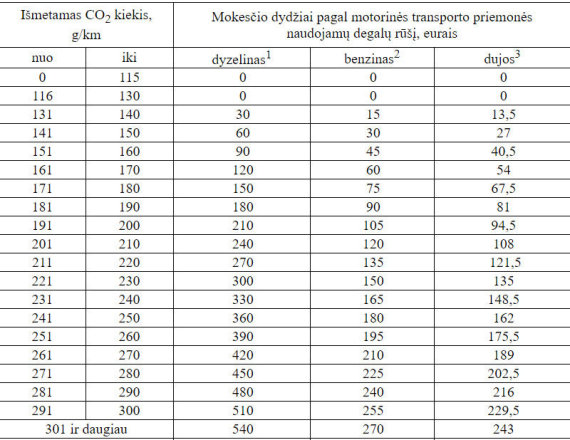

Motor Vehicle Registration Tax Rates

Problems with hybrid cars

The issue of tax calculation for diesel hybrid cars was also raised at the Wednesday meeting, as the formulas do not specify the option to calculate their emissions.

According to the Chancellor of the Ministry of the Environment, Arminas Mockevičius plug Hybrids are a controversial vehicle in terms of reducing pollution.

“No matter how you look at it, the batteries age, and if the car is already in use, the distance traveled by electricity decreases. Also, if the car is heavier and requires more fuel, it pollutes more.

And even international NGOs consider that these traditional hybrid cars, which often drive up to 50 km, do not contribute to mitigating climate change.

These cars should be treated with caution and we have discussed the few cases where the formula might need to be changed, but then we would try to make it smarter than the European Commission, we would have to buy an additional study, ”said A. Mockevičius.

This position is also supported by S. Šuminas, Deputy Director of Regitra.

“I think it is not realistic for us or the legislator to create another formula on our own. One needs to know how diesel hybrids were developed and why they were not excluded. We had several of these cases, but then an equivalent vehicle appeared and we calculated it from according to his CO2, which was indicated. ” 15 minutes set. S.Shumin.

What documents to ask for when buying a car

S. Šuminas also draws attention to the fact that when buying a car and knowing that the registration tax is assessed on the basis of CO2 emissions, it would be worth dealing with the necessary documents.

“When buying a car imported from abroad, it is necessary to check if the CO2 emissions are indicated in the documents of origin. And if not, you should ask the dealer to provide you with a certificate of conformity, also known as the car’s birth certificate, which always indicates the amount of CO2.

With us, people somehow buy a car, come to us and then there is the problem that one parameter or another is missing. Until it becomes an object of our registry, a person must take care of himself and evaluate all the risks when buying a car ”, says S. Šuminas.

According to him, the reliable amount of CO2 used to calculate the registration tax is indicated in various documents.

“Legislators have provided reliable sources, it cannot be a certificate from a seller or service on one or another amount of CO2. Reliable documents are very clearly identified. It is a certificate of automobile conformity or a registration certificate of the country where it is bought the vehicle, ”says S. Šuminas.

If you don’t have the necessary documents, you may have to contact the car dealers, who can request several hundred euros for the required document.

[ad_2]