[ad_1]

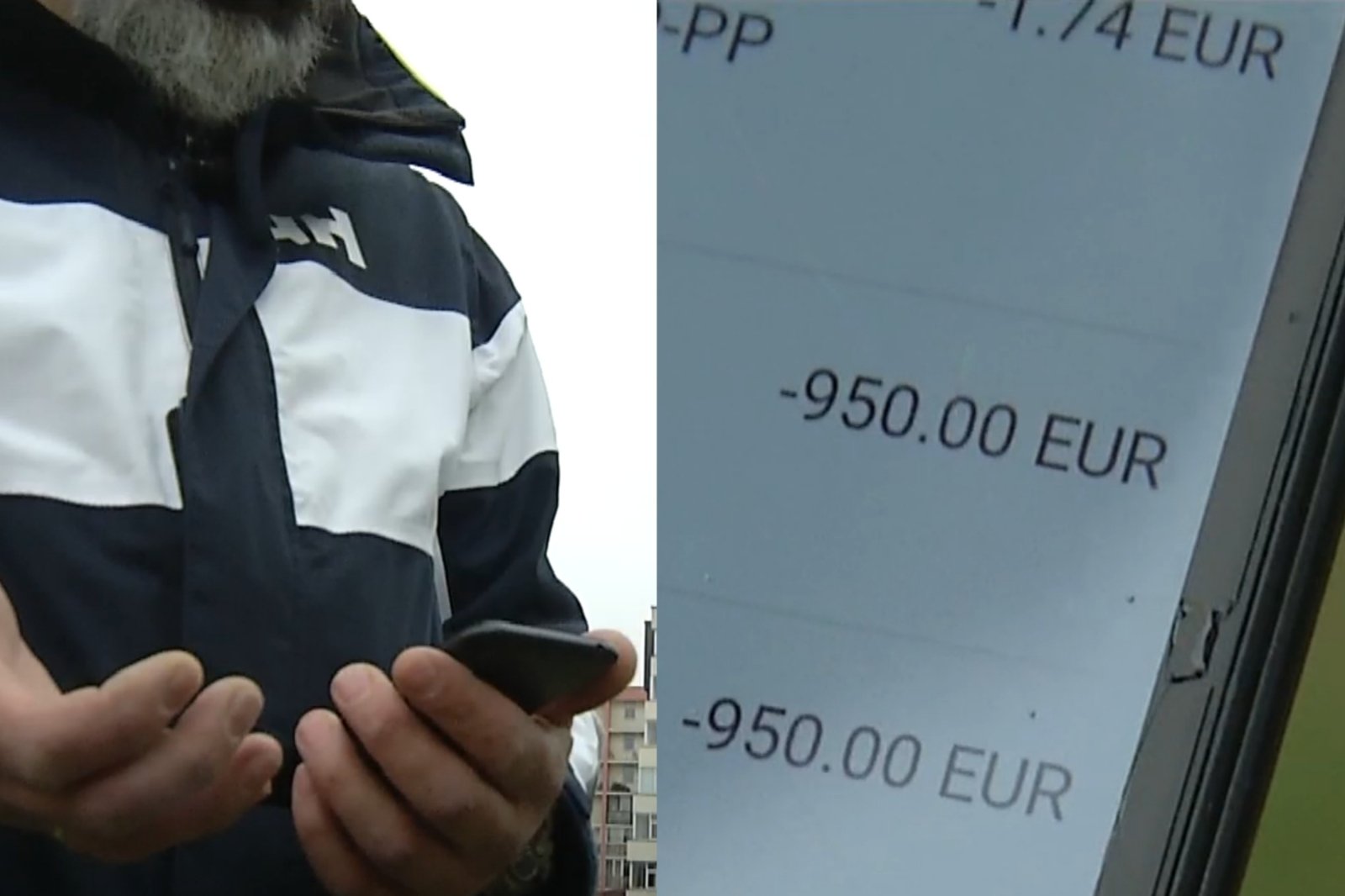

“At night, sitting with the child and playing, the audience began to send me messages on the phone. I open and the money is deducted from my account. Wondering what’s in here?

My account is in Swedbank, I keep money in two currencies: Norwegian crowns, because I work there and receive a Norwegian salary, and I have an account in euros, “he told LNK reporters.

According to the man, after about half an hour, the money returned to the account, but the bank returned the deducted Norwegian krone after converting it into euros at an unfavorable exchange rate and deducting additional money for the conversion.

“To be returned in Norwegian crowns, it would still be possible to remain silent. But such indifference returns in euros and everything must be fine for you”, – surprised J. Okuličas from Vilnius.

According to Juozas, when he immediately contacted the bank, he did not find the truth, because at that time there were no responsible specialists at the bank. As a result, he was promised that they would contact him the next day.

“I wonder what this will be like during the day when the money disappears from my account and we ‘call’. It’s so cold and nonchalant.”

Armed with patience, the man received a response the next morning that he could not immediately correct the possible error, as the case is being investigated within 14 days.

“Then it was replied that maybe wait for the response from the IT specialist, I mean, after all, it was not returned to me in Norwegian crowns. I may one day want to change them because I will need them, and the next day I may not need them. It’s my private money, my personal money, how are you? That’s how I didn’t understand everything, “he said.

According to Swedbank representative Saulius Abraškevičius, the situation is under review.

“We communicate with the client directly on this matter, following the procedure established by law. Due to data protection requirements, we do not have the opportunity to comment on the details of this event to third parties, including the media. In the general context, the client did not suffer any financial loss. “

Kęstutis Kupšys, the director of the association that defends the interests of consumers, says that misunderstandings with banks are common.

There are cases where you call asking for money “eaten” at the ATM, when you wanted to put some amount, the ATM took that amount of money, but wrote on the screen that the operation failed and apologize and offer to try again later. Don’t give the customer a check, throw away their card. “

According to K. Kupšis, people seek advice on how to behave when they do not hear from the bank. The interlocutor says that then the Bank of Lithuania, which deals with such disputes, remains.

“The Bank of Lithuania investigates consumer complaints and also draws its own conclusions. Sometimes it is easy to use, sometimes it is not easy to use. The court of last instance remains. “

According to the Bank of Lithuania, the number of disputes between banks and consumers has recently increased. This may be due to the fact that many services have been moved to cyberspace during quarantine.

“It just came to our attention then. We also see cases where financial market participants also make some mistakes. Consumers are also often reluctant to read the agreements they have entered into, so those appeals to the Bank of Lithuania are also unfounded ”, Assured Rasa Cicėnienė, representative of the Bank of Lithuania.

According to the representative, the most common cases are the incorrect execution of the payment of the transaction, unclear tax deductions, as well as a number of fraud cases in which it is believed that the mistake was made by the bank, which is actually a swindle. .

“When people simply trust scammers, pass on their credential passwords or confirm operations initiated by scammers. However, please enter your SMART-ID PINs. “

The Bank of Lithuania urges people to be careful, to pay attention to which payment they approve and not to carry out a transaction if there is even the slightest suspicion of fraud.

[ad_2]