[ad_1]

Loans are made to anyone without collateral

Most of the advertisements indicate that loans – up to 12-15 thousand. EUR. When calling the phone number indicated in the advertisement, a fee of less than 100 EUR is requested for identification and document processing.

“They appear to be private lenders and offer relatively good terms, but when they receive money for ‘identity cards’ or ‘notarial documents,’ they disappear like water, change their numbers and put up new ads again.

You can say any name, ID, and give everyone a loan. They say we can borrow, just transfer the fee through the “Perlo” terminal, which varies: it’s 50, it’s 79 Eur “, says Marius.

The interviewee says that several of his acquaintances have come across such scams, and he himself has repeatedly tried to contact the alleged lenders.

“I myself have tried several times to call those who offer the 10 percent. Interest. They all said the same thing. Apparently, the same group works. The texts are similar, they often write with errors, which shows that they are probably not Lithuanians or they just have no education, ”says Marius.

Scam advertisement

© Personal album

According to him, when the scammers say any personal code, first and last name, they supposedly enter this data into a computer and say that they can grant a loan. If the person agrees to transfer the fee, send a message: the person’s name and account number.

According to Marius, many are tempted by extremely good loan terms and take risks: “Good terms: individuals can lend without collateral, they don’t require credit, they don’t check credit scores. This is how they supposedly make it possible for anyone to lend. “

When asked why scammers ask for relatively small amounts, according to the interlocutor, in case of loss of up to 100 Eur, the police do not usually initiate an investigation, so these people ask for amounts less than 100 Eur – 79 or 89 Eur .

Experiment: we fulfill the contract remotely, it is delivered by courier

If you enter “unsecured loan” into Google search, you will get at least five ads offering 10% loans. annual interest.

One of them says:

“Lack of money?

Contact Us. We provide consumer loans of up to 30,000 euros, without any collateral or guarantee of ownership, we work throughout Lithuania. We will offer you the most favorable consumer loan offer and help you save!

We guarantee: extremely favorable interest rates, no hidden or anticipated fees, the possibility of early repayment. There is the possibility of refinancing existing debts. The main condition is official income. “

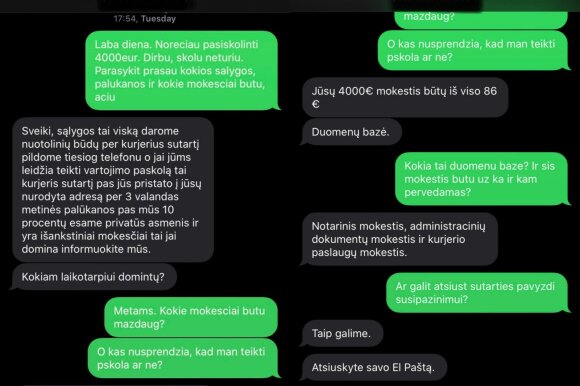

We tried to contact the phone number listed in the ad and find out the terms.

After writing an SMS message that you want to borrow 4 thousand euros, you will receive a reply:

“Conditions: We do everything remotely via couriers, we fulfill the contract only by phone, and if you are allowed to provide a loan to the consumer, the courier delivers the contract within three hours to the address you specify. Annual interest with we are 10%, we are individuals and there are fees in advance, so if you are interested, please let us know. How long would you be interested? “

After specifying that for the year, and requesting the amount of the fees, the person assures that the fee would be 86 Eur. It supposedly consists of a notary fee, an administrative document fee and a courier service fee.

When you ask who clarifies whether a loan can be issued, you get a short answer: “database”.

If you are asked to send the agreement in advance so that you can read the terms of the loan more closely, the person assures that they will send it, but by the specified email. you have not sent anything to.

Correspondence with scammers

© Personal album

Criminal police: this type of fraud is rare

Lithuanian Criminal Police Office Delphi he says the fraud scheme in question is not new and is known to the police. This type of fraud is rare compared to other fraud schemes. In the analysis of the primary information on these cases, this year 15 cases were registered, compared to 6 last year.

“By evaluating the quarantine period from March 16 to June 27 and analyzing the initial information on fraudulent reports on the virtual site during and after that period, which is in line with the definition of” online scammers, “analysts they do not observe significant activity, it does not increase.

With the increasing use of digital technologies in various spheres of life, as well as the prolonged coronavirus pandemic and the resulting social changes, the number of online scams and con artists may increase in the future, ”police commented.

During the quarantine, the police opened a total of 492 fraud investigations (153 in April, 165 in May, 174 in June), clarifying 36% and 36% respectively. and 56 percent. fraud cases. After the quarantine, in July, the police began: 197 investigations and investigated 55 percent. cases.

“Each crime is individual, so the success of an investigation depends on many circumstances. Some of the fraud is committed from foreign countries and funds seized by fraud are transferred to accounts registered in a foreign country, making it difficult to investigate a crime. For objective reasons, some crimes can be investigated faster, while others may take longer to investigate, “police said.

According to representatives of the criminal police, the amount of money seized in the event of fraud can range from a few tens to several tens of thousands of euros. In individual cases, even larger amounts are possible.

The police report on their website about the most common types of fraud:

1. Telephone fraud.

2. Anti-fraud.

3. Acquisition of purchases due to fraud (non-payment of goods).

4. Fundraising under the guise of various investment platforms.

5. Other forms of fraud.

With regard to advance fraud, it is observed that popular advertising portals often publish false advertisements about a product sold below the normal market price and request an advance payment (advance). The person does not receive the item, and after a while the ad is removed.

Another form of anticipatory fraud is for the offender to convince the seller of the item that they want to transfer the money to the seller in advance to obtain an invoice for the item. The criminal asks the person not only to tell him the account number, but also cleverly misleads the login passwords – the criminal says that the money cannot be transferred immediately and that more data is needed to make the transfer quickly.

If the seller of an item reveals electronic bank details to a criminal, the latter, after using it, leaves the person with no money in the account and often the company offering quick loans as well.

Police advice:

– Do not send an advance to people you do not know, buy only from reputable online stores, pay attention to customer reviews.

– Do not respond to suspicious calls and messages.

It is strictly prohibited to use the information published by DELFI on other websites, in the media or elsewhere, or to distribute our material in any way without consent, and if consent has been obtained, it is necessary to indicate DELFI as the source.

[ad_2]