[ad_1]

Lithuanians are sometimes criticized for their lack of financial education, but in the face of crises their deposits can increase. This was also the case during the start of the financial crisis in 2008, and also during the start of the quarantine in March of this year.

During the quarantine weeks: 150 million. euros more

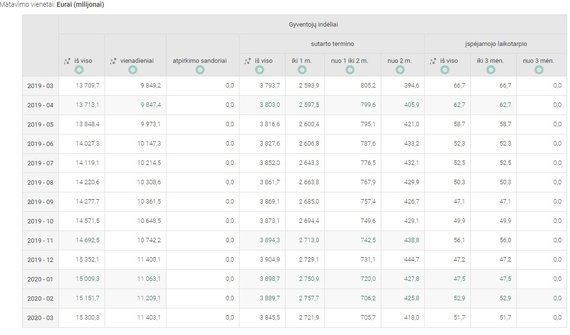

Statistics provided by the Bank of Lithuania show that the total amount of funds in retail deposits increased in March compared to the previous months. Data shows that in March, Lithuanian residents held 15.3 billion in banks. Compared to February, the amount increased by 150 million euros. euros

Statistics on deposits of natural persons.

Compared to March last year, retail deposits increased to $ 1.6 billion this year. euros

Therefore, the quarantine and other restrictions on deposit accounts that went into effect in mid-March did not fade, and part of the population managed to increase further.

Admittedly, a large proportion of depositors in the fight were likely to keep more money in checking accounts, as they spent less during quarantine when stores and entertainment centers closed.

Savings already cover loans

Some residents, it is true, have already used deposits to pay off loans, bank officials say. For example, this happened at SEB Bank.

Sigismund Gedvila photo / 15min / SEB bank

“Recently, we have noticed that some clients who are experiencing financial difficulties are in no rush to use the ability to defer the loan payment and, for the time being, cover the loan payment payments from the available accumulated financial reserves.” 15min SEB Baltic Head of Retail Banking said Sonata Gutauskaitė-Bubnelienė.

In late April, SEB Bank announced that loans to 1,300 people were experiencing difficulties due to the pandemic and quarantine.

“On the other hand, when evaluating the total amounts held by the population in deposits, so far we have not seen significant changes. The total amount retained in deposits and accounts increased slightly in April this year, by around 1%. bank deposits has grown, “said the interlocutor.

Similar deposit dynamics were recorded before quarantine. The number of cumulative deposit agreements concluded and terminated during quarantine remains similar to usual, the bank representative said.

Swedbank representative Saulius Abraškevičius also said that deposit trends in the bank did not deviate from the usual norms. We don’t see any decrease in the volume of deposits, “he said.

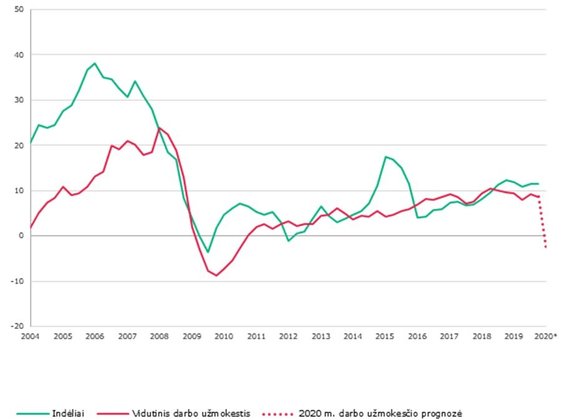

Relationship between deposits and income.

The April and May numbers, when quarantine and some trade restrictions are still in effect, may be different. Depositors who have stopped operating or have lost income can remember their savings. The Bank of Lithuania notes that there is a strong relationship between annual changes in wages and deposits. This is also shown in the statistics of the Bank of Lithuania.

Statistics of the Bank of Lithuania

“Therefore, as the population’s income decreases, deposits in banks may decrease or their growth may decrease. Especially if the economic crisis in Lithuania would last longer than currently anticipated. Part of the funds held in banks they could be used to pay off loans or meet consumer needs. ” 15min said Paulius Morkūnas, Chief Economist of the Macroprudential Analysis Division of the Bank of Lithuania.

Bank of Lithuania Photo / Paulius Morkūnas

On the other hand, the change in deposits will depend not only on the change in income, but also on the change in the consumption and saving habits of the population, says the Bank of Lithuania economist.

Accumulate for even more difficult times?

The crisis, he said, showed that the decrease in household income due to the economic shock led to an increase in the population’s saving rate.

“Therefore, even with the decrease in the population’s income, the greater need to save due to the uncertainty of the future will not necessarily reduce the population’s deposits in banks,” says P. Morkūnas.

Residents still tend to accumulate savings for even more difficult times than they do now, bankers say. “Quarantine can be expected to reduce household costs, and people who are not currently financially affected by the COVID-19 pandemic are likely to accumulate additional savings due to increased uncertainty,” said the SEB retail banking manager. Baltic. S.Gutauskaitė-Bubnelienė.

Furthermore, the amount of deposits is determined by the underground economy. “During the economic recession, the shadow economy tends to increase and the savings rate tends to decrease. This makes it even more difficult to predict the change in deposits in the near future,” said the Bank of Lithuania economist.

[ad_2]