[ad_1]

They were presented by Deputy Finance Minister Rūta Bilkštytė at the meeting of the task force for the review of tax benefits on Wednesday.

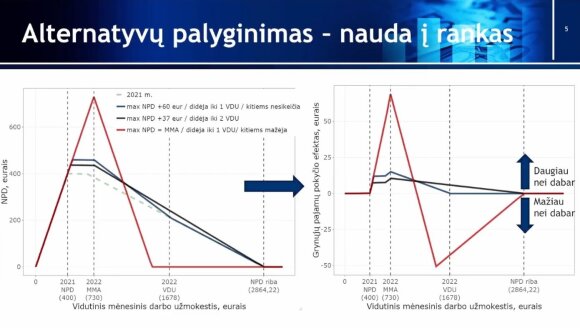

According to the first, increasing the maximum applicable NPD from 400 to 460 euros, introducing an additional “notch” in the NPD formula would increase the income “in the hands” of those who earn up to 1 median salary (VMU), and not change the others.

According to the Department of Statistics, the average salary of the national economy (excluding sole proprietorships) in the second quarter of 2021 amounts to 1,566.4 euros “on paper” and 994.4 euros “available”.

According to the second, increasing the maximum NPD from 400 to 437 euros, maintaining the current structure of the formula, would benefit all those covered by the NPD, that is, those who earn up to 2 VMU.

According to the third alternative, presented by the Bank of Lithuania in the summer, comparing the applicable maximum NPD with the monthly minimum wage, together with the reduction of the NPD application limit to 1 VMU, would benefit the latter, and would earn from 1 to 2 VMU. the income would be

© Ministry of Finance

R. Bilkštytė also presented how these alternatives would affect income inequality in Lithuania.

“The Gini index, which measures income inequality, is projected to reach 32.33 percent in 2022. (before NPD changes).

With the alternatives, the index could decrease by -0.05 (according to the second,), -0.09 (according to the first) or 0.33 percent. (under the third) ‘, he stated.

It is estimated that the cost of the first and second alternatives to the budget – 68 million. 34 million euros for the third. euros.

“Increasing the NPD encourages participation in the labor market, but its impact on income inequality is limited.

Together with the amendments to the NPD, the improvement of the social benefits system will have a more significant effect on income inequality, ”said the deputy minister.

He further said that an individual NPD for the disabled and handicapped is being considered.

“Currently, the NPD is 600 euros, 30-55 percent. in case of moderate or mild incapacity for work; 645 EUR 0-25% in case of severe disability.

The decision on the individual NPD will be made by choosing the NPD increase model, proportionally keeping the gap of the applicable general maximum NPD ”, said R. Bilkštytė.

From 2022 – NPD only

Speaking at the beginning of the meeting, G. Skaistė said that the working group first understands how a platform for discussions and arguments can be expressed when it comes to the concept of taxes.

“With regard to specific bills, you will certainly be able to react in accordance with the legislation, and it will be time for us to conclude the thematic discussions. Then we will present generalized solutions, a draft law will be presented, which you can evaluate and respond to. We will have another final meeting of the working group, where you can also react, comment on specific documents.

I would like to reassure you because I hear rumors that some of the legislation could be put into the budget and come into effect soon. Most of it will go into effect in early 2023, and the only proposal we will make with the budget is a change in the amount of tax-free income.

Gintarė Skaistė

The sharp increase in the monthly minimum wage is, of course, a major change for companies. Changing the NPD along with the MMA is an important incentive for people to return to the labor market, we would like the reduction of exclusion to be done through opportunities and incentives for people to work and earn.

When changing the NPD, it is important to assess its impact on inequality. It is a very expensive tool for the budget. I would like your benefits to be concentrated on the lowest income beneficiaries. Obtain higher benefits for those who receive up to an average salary. In this way, the money lost by the budget could provide greater benefits, “he said.

As you know, the government plans to establish a MMA of € 730 in 2022, up from € 642 this year.

The last meeting of the tax benefits review working group on the decisions to be presented to the government is scheduled for October 12.

It is strictly forbidden to use the information published by DELFI on other websites, in the media or elsewhere, or to distribute our material in any way without consent, and if consent has been obtained, it is necessary to cite DELFI as the source. .

[ad_2]