[ad_1]

“The year has been really hard, with many changes, with a lot of adaptation to the new environment. But when it comes to the performance of pension funds, we have good knowledge, the year has been good.

Residents who accumulate additional funds for their old age earn an average of 5.2 percent. return and it is appreciated that all pension funds, both the youngest and the oldest, have obtained a positive return.

All Lithuanians who accumulate funds in the second stage have a positive result, ”said Tadas Gudaitis, director of the association, at a press conference on Thursday.

Tadas Gudaitis

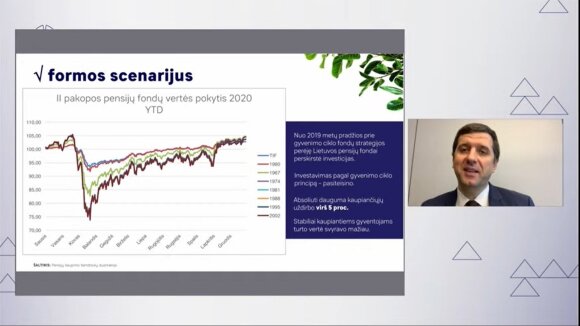

He noted that last year’s generalization is reminiscent of a square root mathematical sign.

“Initially, during the first wave of the pandemic, we had a big and serious drop. However, during the rest of the year, the results of the pension funds returned to positive territory.

The momentum of the vaccine put a fun and good accent on those who accumulated it late last year, ”he said.

© Lithuanian Association of Investment and Pension Funds

T. Gudaitis further emphasized that the life cycle funds have paid off.

“As we can see in the graph, the pension funds with the lowest risk for benefits – for people of retirement age – their fluctuations were minimal. Most of their investments are in safe instruments.

At the time, young people were really taking advantage of the volatility of the stock markets. The performance of its pension funds fluctuated more. So, those who were not distracted, kept accumulating, did not try to take anything, and accumulated their pension in their cycle fund, they won ”, he said.

© Lithuanian Association of Investment and Pension Funds

T. Gudaitis further summarized that those born in 1968 and later earned nearly 5 percent. and more.

“Those who were 50 years old or older at the time, the purpose of their funds is to beat inflation, to maintain the equity.” This has also been done and their returns range from 3 to 4.5 percent. limits. Inflation was overcome and money did not depreciate, ”he said.

Risks 2021

Andrius Adomkus, director of Luminor’s pension asset management group, who also participated in the remote press conference, spoke about the risks in 2021 that are most frequently identified by professional asset managers.

“Among the most mentioned about Covid-19 is that the virus mutates, the vaccine becomes ineffective, there may be some side effects of the vaccine. This has even outweighed the popular risk that market estimates are high and that the technology sector may be vulnerable to potential loss of profits.

Among the most mentioned are the sudden recovery from the pandemic, which could generate inflation and the early withdrawal of stimuli by central banks. But for now, it appears that the recovery will develop moderately, “he said, according to a Deutsche Bank survey.

9 months of data

At the moment, the Bank of Lithuania only publishes the results of pension funds for the first three quarters of 2020. According to these data, the value of most second-tier pension funds fell last year, but has maintained positive since its inception.

The results of your fund can be found in the table by year of birth and the name of the company that manages it.

Third-tier pension funds have done it in a similar way. Only some fixed income pension funds and mixed investment funds maintained positive returns due to the decline in variable income pension funds. However, in terms of average annual performance over the last 3 years, all tier three funds have won.

It is strictly forbidden to use the information published by DELFI on other websites, in the media or elsewhere, or to distribute our material in any way without consent, and if consent has been obtained, it is necessary to indicate DELFI as the source .

[ad_2]