[ad_1]

“What I would like to see (…) is that the benefits that will be offered to leave are logical, economically justified. And those tax costs, which are costs, would allow us to achieve a result no worse than the one we would obtain by applying direct subsidies of the same things from the budget ”, said I. Šimonytė during a press conference in the Government.

He spoke with the Finance Ministry the day before the deliberations to review some of the tax benefits in place in Lithuania.

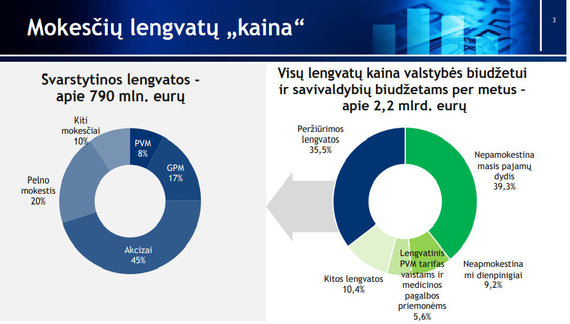

According to the ministry, due to the benefits that will be reviewed, the state budget will lose almost 800 million. annual euros.

Ministry of Finance / “price” of tax benefits

I.Šimonytė said the goal is not set for the Finance Ministry to “bring” additional revenue to the state budget after the benefit review, especially since the abolition of benefits may impose an additional burden on the budget.

“Abandoning tax breaks may require more budget spending,” he said.

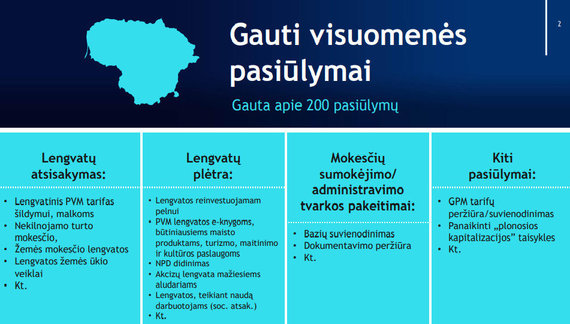

Part discussion offers to remove all benefits, the other party offers exactly the same to add new ones.

“It just came to our knowledge then. It is necessary to see the general context, because not in vain both taxes and social benefits are a common package of support for individuals, families or even companies,” he added.

I. Šimonytė also ironic that the debate on tax benefits is “excellent, very Lithuanian”.

“Part discussion proposes to abolish all benefits, the other party proposes to add exactly the same amount, ”said the Prime Minister.

“I believe that the Ministry of Finance, using all its wisdom and its ability to find logical solutions, will present them to the government,” he said.

Photo by LRV / Ingrida Šimonytė

The Finance Ministry is planning a review of tax incentives in six lines.

First, it is planned to review the mechanism that incentivizes companies to reinvest profits. The second direction refers to the implementation of the green course and the denial of benefits for fossil fuels.

The third chapter of the review of tax incentives will be related to efforts to reduce income inequality. The fourth is the special tax benefits and conditions. This is mainly due to VAT incentives in various areas.

Ministry of Finance / public proposals

The fifth direction of the benefits review is related to the investment model and long-term savings instruments, and the last one, with the possibility of granting municipalities the right to decide which benefits to apply when calculating property or land taxes. .

[ad_2]