[ad_1]

With the abolition of the VAT rebate for imported products up to 22 euros as of July 1, the changes are immediately visible in e-shops.

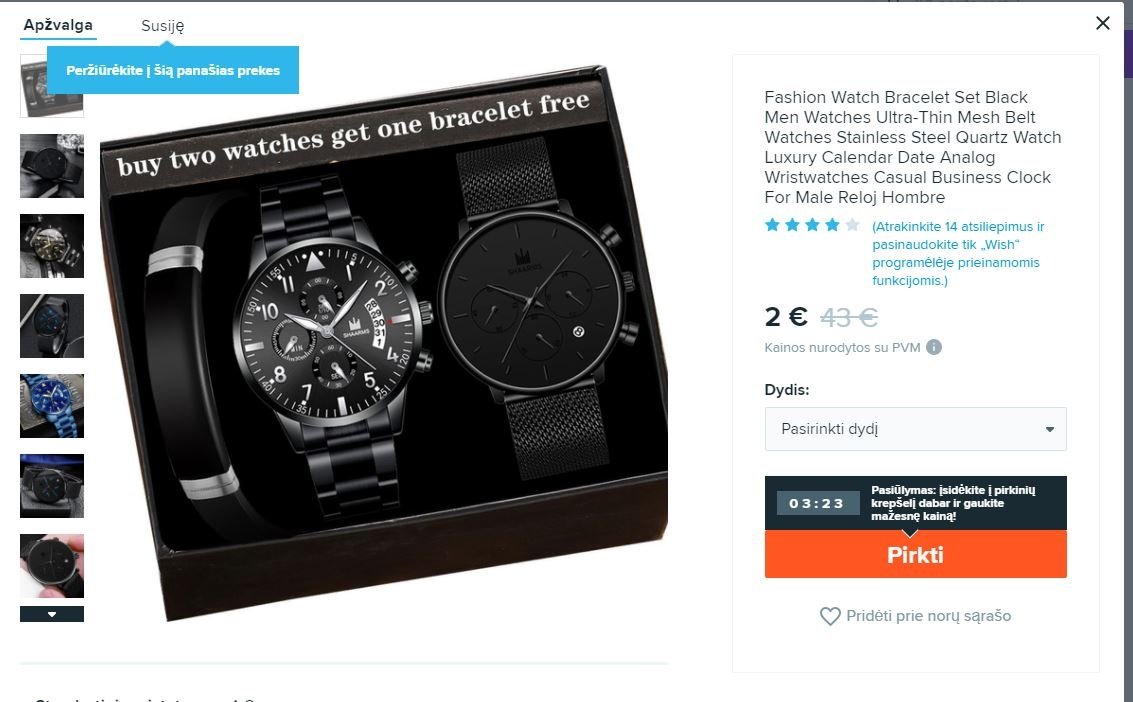

The Merchant Wish welcomes all customers with a message informing them of the obligation to pay VAT. Prices include VAT.

“VAT (value added tax) now applies to all purchases shipped to the EU from all retailers. Wish has taken every precaution to ensure that this new policy does not cause you any inconvenience,” write the visitors of the Wish website.

Wish here promises that VAT will already be included in the prices and the total amount to be paid will be indicated, and buyers will not have to take any additional steps: the merchant will collect and send the VAT. It is promised that this will not cause trouble for customs, and the changes will help to reduce and avoid the period of customs warehousing of goods, speed up the delivery.

© Wish.com

“Prices remain affordable. VAT applies to both domestic and international products, and this policy applies to all retailers. However, Wish works directly with merchants, so prices will remain low.” , promises the website.

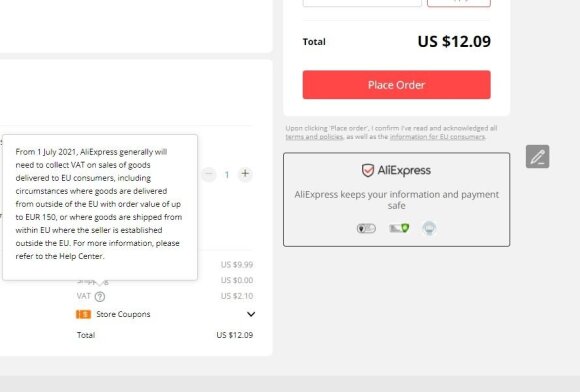

On the Aliexpress website, VAT is already included in the prices automatically.

“Starting in 2021. Starting July 1, Aliexpress will have to collect VAT on goods sold to EU customers, including cases where goods up to 150 EUR are delivered to the EU or shipped within the EU but the merchant is outside the EU “, – written to Aliexpress customers.

© Aliexpress.com

This means that VAT will also be paid automatically for purchases of goods of more than 22 EUR; it is included in the price automatically. In the past, Chinese merchants used to quote extremely low prices for products when shipping more expensive shipments, allowing recipients to avoid the tax.

Until now, other merchants, such as Gearbest, Banggood, do not indicate at the time of purchase if VAT is included in the price; There is a risk that VAT will not be paid, and then the product may need to be declared and taxed. itself.

Declarations may be required in exceptional cases

When merchants apply VAT themselves, the delivery scheme is simplified, as VAT is paid at the time of purchase, a special code is indicated on the customs declaration, and the shipment is delivered to the buyer.

In order to facilitate and simplify the declaration and payment of VAT, a Special Regime was established for the taxation of distance sales of goods from third territories or third countries, also known as the One-Stop-Shop System (IOSS), for distance trade between the EU and third countries, it will be operational throughout the EU from 1 July.

“If a seller of an external electronic market applies this scheme, he will be responsible for paying VAT on the goods purchased by the buyer, that is, the buyer will pay VAT to the seller and the seller will have to transfer the tax to the EU Member State In Lithuania, if the postal operator or express parcel carrier completes the customs formalities, it will be possible to deliver the goods to the buyer, “Customs previously explained to Delfi.

Lietuvos Paštas explains that when the customer pays import VAT to the seller at the time of purchase, Lietuvos Paštas will only submit a formal import declaration to customs on behalf of the buyer, i.e. the consignee.

“In this case, unlike now, additional customer information for declaration purposes may be required only in exceptional cases, at the request of customs,” explains Lietuvos Paštas.

Lithuanian Post

Postal agents state that they reserve the right to apply a 1 euro administrative fee from October 1 if this procedure requires more work, but such a fee may not exist.

It is strictly forbidden to use the information published by DELFI on other websites, in the media or elsewhere, or to distribute our material in any way without consent, and if consent has been obtained, it is necessary to indicate DELFI as the source .

[ad_2]