[ad_1]

A tax working group created by the Finance Ministry will meet for a second public meeting on Wednesday to discuss savings and investment incentives.

The Ministry of Finance presented three alternatives to the discussion on the current benefits for accumulation of pensions and unit-linked life insurance, reveals the presentation presented to the participants.

In all cases, the current level II pension scheme is maintained, which would mean that benefits are maintained.

In all cases, however, it is proposed to suppress the benefit of personal income tax (PIT) for unit life insurance (IGD) and level III pensions.

The only difference between the alternatives is whether or not an investment account would be created and whether it would be invested through these instruments.

For example, the first alternative: without an investment account, the current EPA preferences are waived. The second option is to invest in all financial market products through the investment account, including IGDs and level III pension provision, but GPM benefits do not apply. An added benefit would be the tax deferral provided by the investment account. Option 3: The GPM exemption would also be removed and it would not be possible to purchase IGD or pension savings products through a new investment account.

The ministry sees a disadvantage that with the decrease in incentives to invest in Level III, part of the population may refuse to do so, but fiscal neutrality in terms of investment would be assured and residents could choose products without being affected by the benefits, the budget would benefit.

The Ministry of Finance presents general proposals to the tax working group for discussion, including the abolition or review of benefits (for example, not applying benefits to pension and life insurance contributions, or applying them only to recipients of income of less than 1.5 VMU, not to apply profits to the sale of securities), and the proposals maintain the existing benefits for life insurance.

After discussions with market participants, final decisions may change: they will be clarified in the fall, when the working group finishes its work.

Half a million people received 107 euros each in benefits

During 2019, 454.6 thousand people benefited from various benefits for investment and long-term savings. population, with an average profit of € 107.1 each. The budget lost 48.7 million for benefits. income in euros, compared to the Ministry of Finance.

Most of it, 33.1 million. € 1 billion in benefits derived from investment life insurance contracts (IGD) and for pension funds. 293.6 thousand people invested in this way.

169.8 thousand individuals have received interest and interest of up to € 500 is tax-free. This benefit was used mainly by the elderly population, with an average age of 62 years, and most of the time interest was received on deposits. However, the benefits to this population were small, averaging € 8.8 each, and the budget PIT losses amounted to € 1.5 million. euros.

It profitably sold stocks, bonds or other securities and benefited from the profit of EUR 500 GPM of LTL 2.4 thousand. individuals, their average benefit from GPM savings was € 62.5. They are mostly metropolitan residents with a salary of 70 percent. above the national average, they receive many other incomes.

The highest monetary return to the population was made up of GPM’s tax-free pension income (€ 658 per person), GPM’s tax-free benefits under pension accumulation contracts or IGD (€ 613 per person) , but relatively few residents received such benefits.

Finance Minister

© DELFI / Valdas Kopūstas

“Investment life insurance dominates – 342 thousand. spent LTL 236 million on unit-linked life insurance and / or pension fund contributions. EUR, of which both the population and the contributions to the pension funds themselves account for 8% each ”, estimates the Ministry of Finance.

Among these investors, profit utilization is high: 86 percent. The beneficiaries benefiting from the benefit recovered an average of € 113 PIT each.

4.6 percent The population also received additional benefits from the employer: their employer paid them an average of 960 euros and they themselves transferred an average of 1010 euros each.

The Ministry of Finance recognizes that the benefit is used uniformly: the beneficiaries benefit the population in terms of occupation, average salary and place of residence. The average age is 45 to 48 years, depending on the instrument.

Draw the outline of the investment account.

According to the report of the Ministry of Finance, in the future only two types of benefits can be expected for investors: first, the income received through the investment account (IS) of various investments is not subject to additional benefits. Second, investment income outside the investment account may be covered by the Personal Income Tax Law, but these benefits would not be covered by the investment account.

The investment account would aim to ensure investment neutrality and encourage small and medium investments by facilitating the calculation of taxes.

Presentation of the Ministry of Finance

© Ministry of Finance

“Eligible” investments: financial instruments (government bonds, corporate securities, derivatives, etc.) distributed on the stock exchanges of any country, as well as investments through crowdfunding platforms or mutual loans “, suggests the Ministry of Finance .

Two models are presented for discussion, both IS would be taxed at 15 percent. However, in one case, the contributions made would be deducted from the IS first and in the second case, the earnings obtained would be deducted first and immediately taxed if the value of the investments held in the account exceeds the amount deposited.

100 euro banknote

Investment restrictions will be considered through IS. One option is to set only the maximum amount of funds allowed to invest per year. In the second case, it is proposed to limit not only the annual size, but also the total allowed size of the IS account.

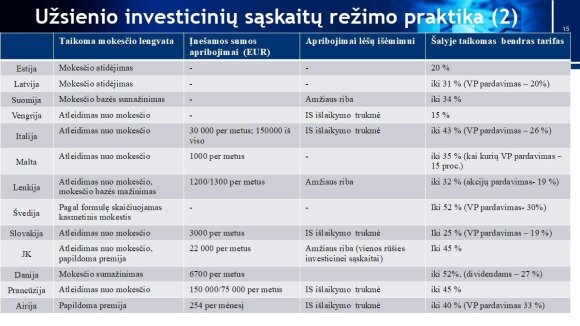

Different countries have different restrictions. For example, in Estonia and Latvia, there is no limit to the annual or total amount contributed to IS, and there are no restrictions on withdrawals. In other countries, however, there are limits and, in some cases, limits on the period of time during which funds can be withdrawn, when they are accumulated for old age.

The Ministry of Finance mentions the advantages of an investment account: uniform taxation of products would create healthy competition, the population would be encouraged to reinvest, the capital market would develop, and administration and taxes would be simplified. However, there are downsides: the introduction of SI would temporarily reduce budget tax revenues and non-professional investors may underestimate the products.

Insurers think negatively: there must be stability

Artūras Bakšinskas, president of the Lithuanian Association of Life Insurance Companies (LGDĮA), assures that he negatively evaluates the alternatives examined by the Ministry of Finance

“We see negatively our desire to maintain the status quo, because not long ago, back in 2016, the problems that state institutions were seeing were resolved. There should still be stability in the reform, ”explains A. Bakšinskas.

Mat Seimas 2016 In December, it restricted the state incentive for voluntary accrual through life insurance and pension funds by introducing a € 2,000 cap for life insurance and pension contributions, reducing the maximum amount of GPM reimbursed at € 300 per year.

It should be noted that 300 euros is not the amount that would motivate the rich to save through life insurance. They insure because they have more financial knowledge and understand the values of life insurance ”, says the director of the association.

Artūras Bakšinskas

© Personal album

He doubts that an investment account is a viable alternative.

“We don’t see much of what it offers through the investment account, so it could be a viable alternative,” Bakšinskas said.

The head of the association asks why there cannot be a fourth alternative.

“We offer ours – to maintain existing profits and create an investment account, to give all market participants the same rights to participate there – not just” credit institutions “- says A. Bakšinskas.

According to him, the association fears that the suppression of the benefit creates market asymmetries, promotes banking in the financial market, does not incentivize but rather narrows investment and savings, since IGD currently has the largest market share. There are also questions of legitimate expectations, as contracts are concluded for a very long period.

Currently, the state encourages residents to save independently through life insurance contracts by making it possible to recoup GPM from accumulated life insurance premiums paid.

“The benefits cannot be seen only in fiscal terms. They also play a regulatory role: they promote the development of socially oriented products (accumulation for old age, children’s studies, disability, illness, disaster) in the still underdeveloped Lithuanian market, where there is still a lack of awareness of people to take care of their own future.

With such a poor demographic situation in Lithuania, when the population ages rapidly, it emigrates, when the number of retirees is constantly increasing and the number of employees is decreasing, the budgetary opportunities of the state and Sodra to guarantee sufficient pensions are very limited, and these Los problems will only increase in the future, letter to authorities.

The association emphasizes that residents benefit from the benefit only when the accumulated funds are withdrawn no more than 5 years before the retirement age, or are accumulated for the future of the children of at least 10 years when the benefit is received by a person under 26 years of age. age. Also, 40 percent do not pay taxes. a person with work capacity, if he has accumulated it for at least 5 years.

“A life insurance consumer is the average Lithuanian resident, who worries about his financial security in the event of a disaster, who seeks to accumulate long-term in the future. These are mainly young families with financial responsibilities that accumulate children for the future and old age. This is also confirmed by statistics: in 2020, the average accumulated life insurance premium amounted to 46 euros per month for an insurance contract ”, argues A. Bakšinskas.

It is strictly forbidden to use the information published by DELFI on other websites, in the media or elsewhere, or to distribute our material in any way without consent, and if consent has been obtained, it is necessary to indicate DELFI as the source.

[ad_2]