[ad_1]

Klaipėda residents involved in the import and trade of used cars are suspected of paying no more than 3 million. value added tax (VAT) and other taxes, the Financial Crimes Investigation Service (FNTT) said on Thursday.

The investigation revealed that the director of a Klaipeda-registered company engaged in customs broker activity and the organizer of a criminal scheme, together with a group of at least five accomplices, could create a tax evasion scheme to transport cars to and from Lithuania., Using seven shell companies under his control, he simulated car import and purchase and sale transactions.

It is considered that, under this system, VAT, profits and part of customs duties may not have been paid to the State budget. It is estimated that the total amount of unpaid taxes may exceed 3 million. euros.

Two people were charged with large-scale fraud and forgery. The most severe preventive detention order imposed on the director of a port brokerage firm is arrest. Another 12 people were interviewed as special witnesses.

Shell companies used

According to law enforcement data, around 201 thousand people were brought to Lithuania as of 2019 using bogus and dormant companies. automobiles with a total sales value of more than 15 million. euros. A fictitious company was used to import cars for several months and then replaced it with another. The directors of the companies were antisocial people from Ukraine, Moldova and Kyrgyzstan, who had been repeatedly convicted, served sentences in prisons or even lived in foreign countries and had no idea how to run their own companies. Most of the member-run companies did not carry out any activity and submitted incorrect reports to state authorities.

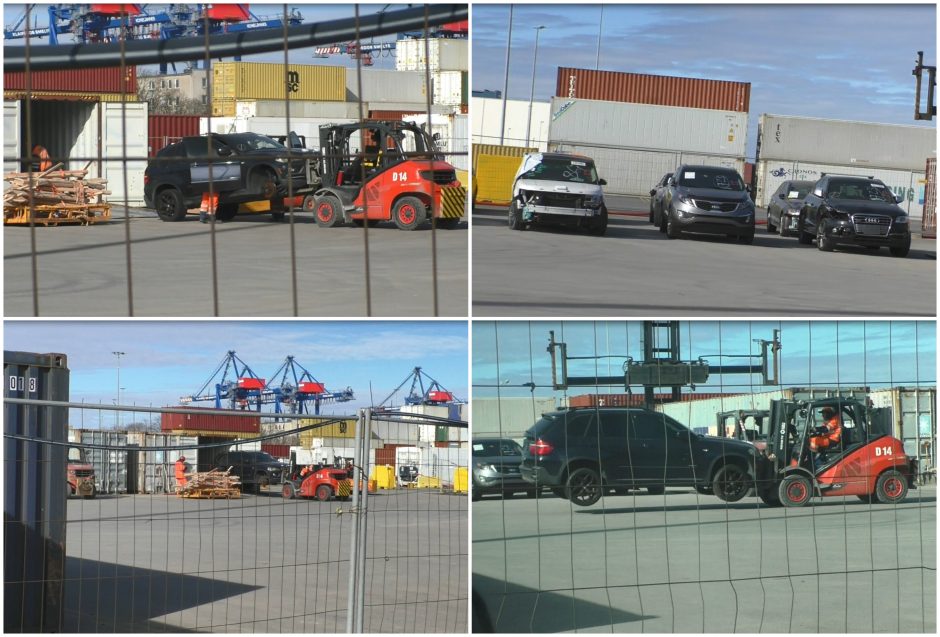

Photo FNTT

When the cars arrived in Lithuania, their actual possible owners, the resellers, collected them from the territory of the seaport. Without declaring acquisitions, the resellers sold the cars under the guise of three other shell companies, whose directors were also antisocial foreigners, convicted.

The end buyers allegedly bought the car from a fictitious company and, after receiving possibly falsified vehicle documents, registered the car in Lithuania. The taxes they had to pay did not reach the state budget because the fictitious companies did not file any reports, were not registered for VAT and did not pay any taxes.

Right restricted to 6 million. cars worth euros

After gathering sufficient data on possible criminal activities, officers from the FNTT, the Criminal Customs Service, the Customs Immunity Service and the Klaipėda County Police Chief Commissioner conducted more than 20 searches of places of residence. and work of suspects, cars and other related places. to research throughout Lithuania. During the search, data and objects that confirm the criminal activities of the people were confirmed.

During the investigation, the property right of the director of the port city company was temporarily restricted: available cars, house, cabin, apartment, administrative building. Ownership of imported cars on behalf of 505 bogus companies has also been restricted. It is estimated that its value may exceed 6 million. euros.

Photo FNTT

“According to available data, the suspect loved a luxurious lifestyle, often traveled to exotic countries, bought not only expensive cars, but also real estate in picturesque areas,” the FNTT said in a statement.

The FNTT states that it has all the information about the real owners of the cars who actually bought them from third parties. The sale of the mentioned cars is restricted both in Lithuania and abroad, so the attempt to hide, sell and register such cars may incur liability for the people who try to carry out these actions.

According to Arvydas Navickas, the prosecutor of the Second Prosecution Division of the Klaipėda Regional Prosecutor’s Office, which controls the investigation, a temporary restriction of property rights has been applied to these vehicles. The issue of returning these cars to the people who have bought the cars will be resolved only after all mandatory taxes in Lithuania have been paid.

The investigation is carried out by the Klaipėda Regional Board of the Financial Crimes Investigation Service together with officials from the Klaipėda Section of the Criminal Customs Service, as well as in cooperation with the Immunity Service of the Customs Department, the police and the State Tax. Inspectorate.

Photo FNTT

[ad_2]