[ad_1]

Obligation for the buyer.

As Saulius Šuminas, deputy director of the Regitra company, told journalist Vitoldas Milius on the Žalia rodyklė program in Žinių radijo, the buyer, not the seller, should know more about the registration fee.

“First of all, buyers need to know everything they need to know about the tax, because the seller, no matter what polluting car he has decided to sell, will have no obligation.

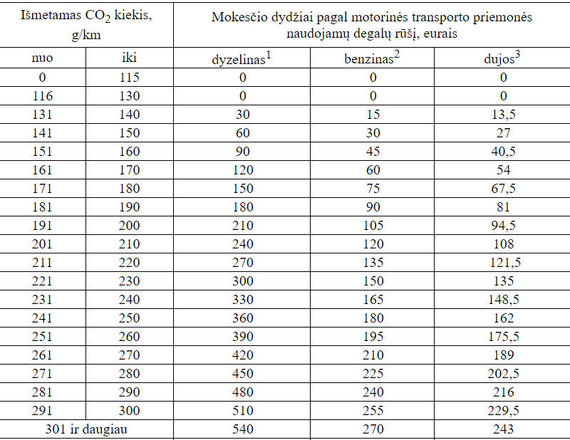

I would suggest paying attention to the “Description of the registration of the motor vehicle”, which contains a table indicating the amount to be paid for one or the other vehicle according to the CO2 emissions of the car, “said S. Šuminas.

Motor Vehicle Registration Tax Rates

It is true that not all cars can detect CO2 emissions so easily.

READ MORE: Where can I find information about a car’s CO2 emissions and how to calculate the pollution tax?

And if CO2 levels cannot be detected based on equivalent vehicle data. Then it will be calculated according to the formulas provided by law when entering the technical data of the specific car.

It will be possible to use a spreadsheet prepared by Regitra.

The use of formulas, according to S. Šuminas, will be the third option to be used if the information is not found in the previous forms.

The fee will be recalculated

According to Vitold Milius, the host of the show, after the diesel scandal (Volkswagen acknowledged that it had falsified diesel car pollution data since 2009), the pollution measurement system has changed and now shows a bit more in terms of consumption fuel and CO2 emissions. And what system will Regitra use?

S. Šumin says the European NEDC standard will be used this year, and the new WLTP will be used next year.

He also emphasized that based on the Consumer Price Index, the tax will be indexed and recalculated annually. However, such a recalculation will have nothing to do with the parameters of the car.

Every second buyer would pay

According to SE Regitra data, in 2019. (until November 22) for the first time, about 219.8 thousand passenger cars were registered in Lithuania (categories M1 and N1). Of these, around 169.8 thousand. CO2 was known (from the documents), and around 133.9 thousand. exceeded 130 g / km of CO2 (this is the threshold above which the registration tax is already paid). This means that you would have to pay almost every second registered car.

And around 224.7 thousand registered again. Of these, around 97.7 thousand. CO2 was known (from the documents), and about 87.2 thousand. exceeded 130 g / km CO2. Therefore, in such a case, almost every Lithuanian third to re-register a car would pay.

What does it not apply to?

There are some exceptions The tax will not apply to temporarily registered vehicles (up to one month) leaving Lithuania, nor to historical cars for which historical registration plates have been issued. There will also be no charge for registered cars whose drivers do not change. For example: after paying the lease, change the person’s last name, request a duplicate of the registration certificate instead of the lost or damaged certificate, and so on.

It is important to note that in case of re-export, the tax will have to be paid, but it will be refundable if after registering a completely new car, it will be deregistered and withdrawn from the territory of Lithuania within 90 days from the first date of registry.

S. Šuminas ensures that in one way or another the tax will be applied to all polluting vehicles and will at least slightly rejuvenate the country’s automobile fleet. However, we will probably see the results only in a few months.

[ad_2]