[ad_1]

According to the report, residents can also find out the amount of the tax by logging into the My STI system or calling 1882. About 408,000. Registered My STI and EDS users who have specified their e. email address in the systems, you will receive notifications about the declaration made to them. Those landowners who are not STI e. service users will receive land tax returns in the near future by classic mail.

Property tax must be paid before this year. subway. Nov. 16

“This year, there are 1.027 million landowners, but not all will have to pay this tax this year. Some municipalities have decided to reduce the land tax in response to the COVID-19 situation.

In total, various benefits were applied for 322.7 thousand. therefore, property tax returns will reach 704.7 thousand. landowners, ”says Stasė Aliukonytė-Šnirienė, Director of the STI Fiscal Responsibility Department, adding that property owners can verify the calculated property tax and pay it by logging into My STI.

It is planned that the municipal budgets in 2020. will be paid about 39.4 million. 33.2 million euros. The population will pay 6.2 million euros. euro – companies. 2019 the estimated amount of the tax was 39.4 million. EUR, in 2018 – 40.28 million. 31.4 million euros in 2017. euros.

- Residents and companies must pay the property tax before November 16 of this year.

- The tax for 2020 will pay 704.7 thousand. landowners, who would have to pay 39.4 million. euros.

- The STI calculates the land tax in accordance with the tax values of the land provided by the Registry Center and in accordance with the land tax rates set individually by each municipality.

- The highest land tax was calculated in Vilnius county, the lowest – in Tauragė county.

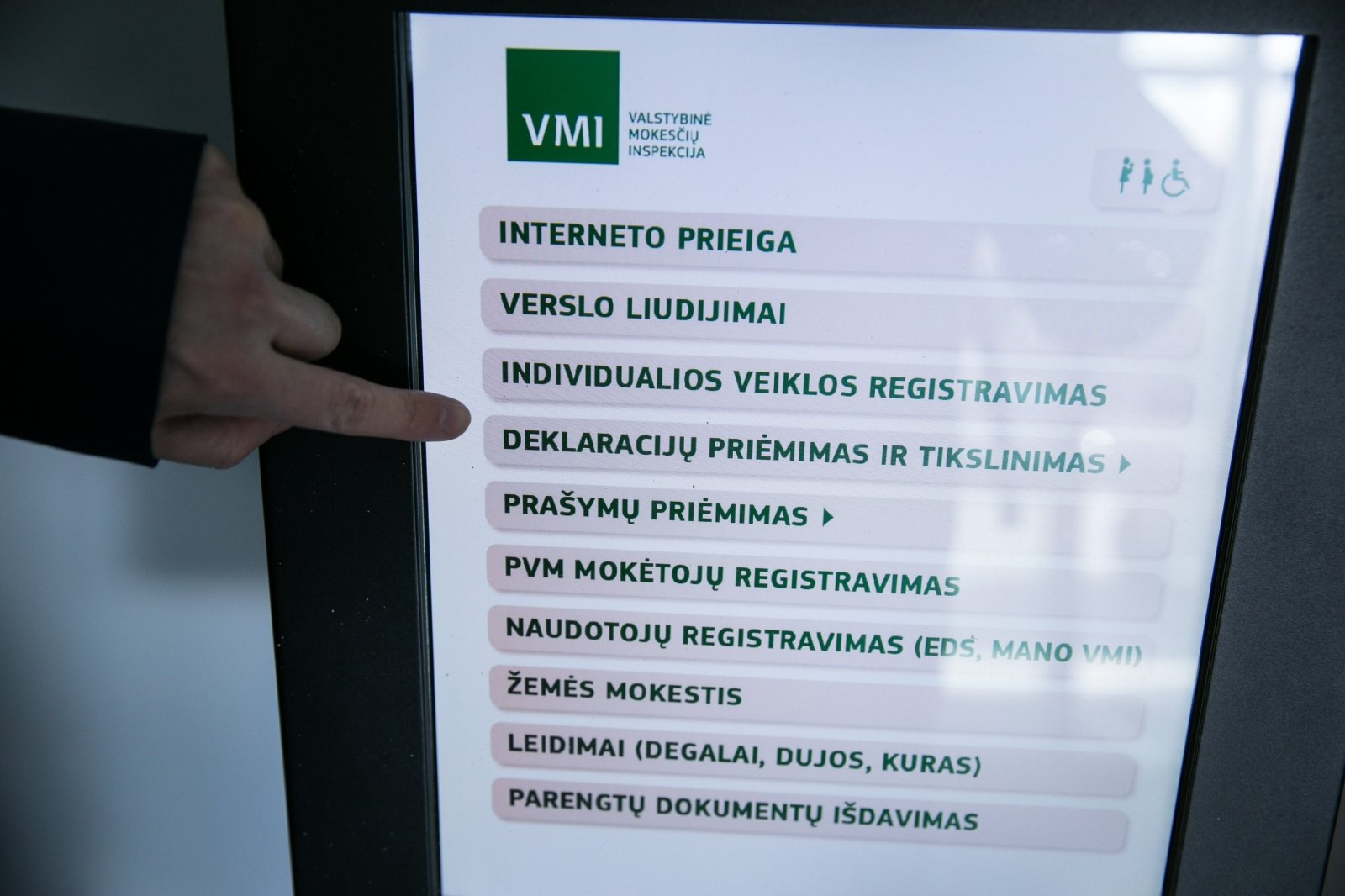

- All land tax returns can be found in the STS EDS electronic filing system, in the column “Declaration” – “Land Tax”. You can connect to the EDS by accessing online banking or with the connection tools provided by STI.

- You can see the amount of land tax formed and pay it by entering My STI, in the section “Taxpayer’s card” – “Accounting data”.

Land tax is paid on private land owned by residents and businesses, with the exception of forest land and agricultural land planted with forests. It should be noted that the STI calculates the property tax in accordance with the tax values of the parcels provided by the Registry Center and in accordance with the property tax rates set individually by each municipality1, which can vary from 0.01 to 4%.

Property tax can be paid not only in banks (an STI checking account has been opened in many banks in the country), but also in post offices, MAXIMA LT boxes, Perlo terminals, newsstands and other institutions that accept payments. When paying the property tax for another person, it is important to indicate in the payment document the name, surname, personal identification code and property tax code, which is 3011. The new owners pay the tax if they acquired the land before the 30 of June and after July 1. . – You will begin to pay the land tax from next year.

It is strictly prohibited to use the information published by DELFI on other websites, in the media or elsewhere, or to distribute our material in any way without consent, and if consent has been obtained, it is necessary to indicate DELFI as the source.

[ad_2]