[ad_1]

The simplified system was opened on the 15th of next month … It automatically reflects the data about the purchase of glasses and the insurance of actual loss

National Tax Service website Q&A, chatbot query provided … Guide video was also released on YouTube

In this year’s year-end settlement, the card use income deduction and the tax deduction for pension payments over 50 will be extended, and service workers can also receive a reduction in income tax of SMEs.

As in last year, the amount of internal student aid and medical loss insurance (insurance against losses) are not eligible for the income deduction.

The National Tax Service announced on the 23rd that it will use the simplified service deduction certificate provided from this year-end agreement, YouTube tax help data, and the real-time advice service of the ‘end-of-year chatbot. year ‘from Hometax (www.hometax.go.kr) to save taxes.

Various income and tax credits and chatbot services provided by the streamlined service will be available starting on the 15th of next month.

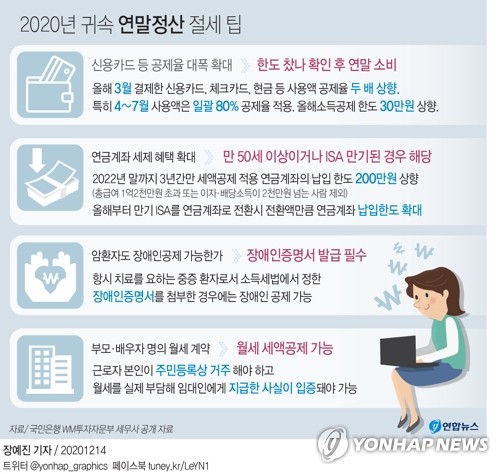

◇ 80% credit card deduction rate applied from April to July … The limit is raised by 300,000 won.

Since this year’s year-end liquidation, workers in service industries such as arts and creative businesses, sports, libraries, historic sites, and similar leisure-related service businesses are also eligible for a reduction in income tax. for those employed by SMEs.

Income tax reduction for small and medium-sized businesses is a system that reduces income tax from 70% for three years (90% for five years) to 1.5 million won per year for 15-year-olds. to 34 years, over 60 and disabled.

Marriage and the education of children are added to the reasons for the recognition of women interrupted in the career who receive the income tax reduction, and the period of interruption of the career is extended to 15 years after retirement.

Even if they return to work in the same industry other than the same company, it is recognized as a female reemployment with a career break.

Among the requirements for the non-imposition of taxes on overtime wages for production workers, the standard of total wages for the previous year will be reduced from 25 million won or less to 30 million won or less.

In this year’s year-end settlement, the credit card income deduction is applied significantly based on time of consumption.

Depending on the type of card and where it is used, the deduction rate, which is 15-40% in January-February, doubles in March and increases to 80% in April-July.

For use from August to December, the same deduction rate applies as from January to February.

The credit card deduction limit was also increased by 300,000 won from 2 million won, 2.5 million won, and 3 million won, based on the total salary segment.

The amount used for traditional markets, public transportation, books, shows, museums, and art museums can receive an income deduction of up to 1 million won each, regardless of this limit.

The limit for the payment of pension accounts subject to tax credits has been temporarily increased to 6 million won for three years only for those over the age of 50 with a total salary of 120 million won or less.

So even now, people over 50 have scope to increase their tax credits by paying additional pension savings.

Interest income generated by employees of small and medium-sized businesses who borrow money from businesses at low or no interest on the purchase and lease of homes are excluded from earned income this year.

In addition, as of this year’s end-of-year settlement ▲ New establishment of tax exemption for maternity leave for spouses ▲ Reduction of income tax for excellent staff returning to Korea ▲ Extension of limit of Tax exemption for venture company stock option earnings at 30 million won can be used for tax reduction.

◇ Personal deduction is not included for families exceeding 1 million won in ‘income amount’

You should also be careful not to charge penalties for “unfair deductions” as well as to receive no-omission deductions.

Items that workers often differ in year-end settlement include personal deductions for dependents with an income greater than 1 million KRW, duplicate deductions for children of workers with double income, duplicate deductions for parents of siblings, housing funds or unfair monthly tax deductions.

Here, the amount of income refers to the amount obtained by subtracting the deduction from earned income, necessary expenses, deduction from pension income, etc. of the total salary, the total income, the total pension and the transfer difference.

In particular, if there is an error in the personal deduction for dependents, in addition to the basic and additional deductions, the special deductions (insurance premiums, education expenses, credit cards, donations, etc.) of the family that are misapplies personal deductions.

For example, a worker with a total salary of 120 million won applied a deduction for dependents and a special deduction (insurance premium 1 million won, use of credit card 10 million won, donation of 10 million won), but A’s mother applied capital gains 3 She had 10 million won and was not subject to personal deduction.

Consequently, as the basic deduction of 1.5 million won, the additional deduction of 1 million won, and the credit card income deduction of 2.8 million won decreased, Mr. A’s taxable income increased by 5.3 million won and the contribution tax deduction and the insurance premium deduction were reduced. You have to vomit 10,000 won.

There are many items where the deduction or the amount of the deduction varies based on the total salary.

Earned income deduction, earned income tax deduction, non-taxable overtime allowance, credit card income deduction, basic deduction deduction, small business and owner deduction income deduction Long-Term Collective Investment Securities Savings Income Deduction, Pension Account These are the tax credit limit and the monthly tax credit rate.

In some cases, only the worker himself is eligible for the deduction.

Insurance premiums (public insurance), pension insurance premiums (public pension), housing funds, personal pension savings, deductions for small businesses and small business owners, home savings payments, pension accounts, investment associations for small business start-ups, savings in long-term collective investment securities, graduate education expenses, work Training expenses, political funds and donations to the association of owners of employee shares cannot be deduct from dependents.

◇ Submit easily by completing all deduction reports for small business and hometax employees

Starting this year, data on the monthly rent for public rental housing, the cost of purchasing glasses, and the amount of actual loss insurance received will be provided in the simplified year-end settlement system.

In addition, this year’s national emergency disaster support grant data is also reflected in the simplified system.

The simplified system data will be available from the 15th of next month.

For small businesses that do not have their own year-end settlement program, workers can complete a deduction report and submit it to the business through the Hometax ‘Fill All’ service.

For this year-end settlement, the fill service creation process has been reduced from the previous 4 steps to 1 or 2 steps.

If the company has recorded basic data such as salary with Hometax, the employee can complete the Hometax deduction report and send it to the company.

Various year-end liquidation guide materials are also provided via website and video.

The National Tax Service provides a complete guide on the revised tax law and deduction preparation in the ‘Complete Guide to End-of-Year Settlement’ on the website (www.nts.go.kr), and provides 5 types Help desk including self-checklists and question-and-answer compilation.

In addition, a video about an end-of-year deal running on a chart was produced and posted on YouTube.

In addition, a chatbot advisory service will be created so that the professionals and workers of the company can easily complete the year-end agreement, and they will provide advice by text message in real time 24 hours from the 15th of next month. .

The mobile end-of-year settlement service has also been improved, adding a function to modify and submit a deduction report and a ‘Tax guide for dual income workers’ function.

/ yunhap news