[ad_1]

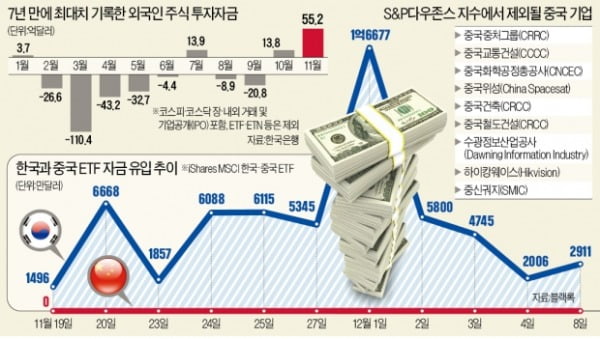

Following the UK’s FTSE, the S&P Dow Jones Indices, which calculates the S&P 500 index, has decided to exclude Chinese companies from the equity and bond index. MSCI, the world’s largest index calculator, is also pushing a plan to subtract Chinese companies from the index. If the three index calculation institutions, which have great influence on the global market, exclude all Chinese companies, the global funds entering the Korean market will increase rapidly.

S&P Dow Jones Disys announced on the 10th (local time) that it will exclude 21 Chinese companies from the equity and bond index. The decision was based on the Donald Trump administration’s sanctions on Chinese companies. Missing SMIC, China’s largest foundry (consigned semiconductor production) company, and Hikvision, a manufacturer of surveillance cameras.

Last month, Chinese companies were excluded from the FTSE Russell index. MSCI, which is working towards the end of excluding Chinese companies, plans to announce its policy sooner or later. If you break out of the major world indices, it is inevitable that foreign funds will escape the Chinese stock market. It is unusual for indexing agencies to simultaneously exclude companies from one country.

The market reflects this. Global funds have targeted Korea, avoiding the growing risk from China. A total of $ 597.09 million (approximately 6,518 billion won) was a net inflow to the ‘iShare MSCI Korea’ exchange-traded fund (ETF) managed by asset management company Blackrock. This is the first time since March that a significant inflow of funds has appeared in global ETFs that only invest in Korean companies. On the other hand, there was no inflow of funds to Chinese ETFs during this period.

Excluding Chinese companies up to MSCI, funding for Korea is expected to rise further. The reason they turn to Korea is because of their performance. According to F & Guide, the forecast operating profit for 289 domestic publicly traded companies next year is 188.2 trillion won, the highest ever.

Consequently, the prospect is spreading that the KOSPI 3000 Index is imminent. On the 11th, the KOSPI index ended at 2,770.06, up 0.86%. After the day before, it again hit an all-time high based on the closing price. He has only 230 points left and 8.3% left until he breaks the 3,000 line. Individual investors’ equity deposits worth more than 60 trillion won serve as the foundation for the prospect of opening the age of cash. 3,000 with inflows of foreign capital.

Kospi running towards 3000

2770.06. It’s the closing price of the KOSPI index on the 11th. If it goes up just 8.3%, it’s over 3000. The biggest factor in the KOSPI index that sets a record every day is foreign funds. This is because even though they sold net on the domestic market for the past two days, they have consistently bought Korean stocks over the past month, breaking the box area for 10 years. The development of the Corona 19 vaccine has raised expectations of a global economic recovery, and global financing has focused on emerging countries with the prospect of prolonged dollar weakness.

Here a variable was added. As investment risk in Chinese companies increased due to the US sanctions, Korea has become a ‘one-size-fits-all’ among emerging countries in the global investment industry. The inflow of funds into Korea is expected to rise further as ‘Chinese companies are pushed out’ of the major indices that are benchmarks for global passive funds.

World leading index, excluding Chinese companies

On the 10th (local time), S&P Dow Jones DJI, which calculates the S&P 500 index and the Dow Jones industrial average, announced that it will exclude 21 Chinese companies from the components of the stock and bond index. It was in accordance with an executive order signed by the President of the United States, Donald Trump, on the 12th of last month. The order contains details that prohibit US financial companies and pension funds from investing in shares of more than 30 Chinese companies that the US Department of Defense has included in the “black list” as of next November. S&P DJI decided to exclude the shares and stock certificates of 10 companies, including SMIC, China’s largest semiconductor foundry (consignment maker) and surveillance camera maker Hike Vision, from all stock indices. The revised index will be reflected before the market opens on the 21st. Additionally, you have decided to subtract an additional 11 stocks from the bond index before opening in January of next year.

On the 4th, FTSE Russell, an index provider to the London Stock Exchange in the UK, announced that it would exclude eight companies, including Hike Vision, China Railroad Construction (CRCC) and China Satellite, from the FTSE global stock index.

MSCI, the world’s largest index calculator, will also reveal its policy sooner or later. MSCI received comments from investors regarding the delisting of Chinese companies that have been subject to sanctions on the 4th of this month. The market is seeing that MSCI will also eliminate Chinese companies. It means that Chinese companies are being kicked out of the world’s three largest indexing institutions.

Benefits of Korean Stock Market Reflection

The absence of Chinese companies in the key indices that serve as benchmarks for passive funds is a boon for supply and demand in the Korean market. The flow of funds from the Global Listed Index Fund (ETF) has already changed since last month.

There is no inflow of funds from the 19th of last month to the 8th of this month in the ETF ‘iShare MSCI China’ operated by Black Rock. On the other hand, the company’s MSCI Korea ETF had a net inflow of $ 597.09 million (about 6,518 billion won) during the same period. This is the first time since March of this year that a significant capital inflow tax has appeared on global ETFs that only Korean companies invest. While the KOSPI index rose more than 5% this month, China’s Shanghai Composite Index fell more than 3%.

To Korea among emerging countries

The flow of market capital is already showing the effect of “excluding China”. The difference is clear when you look at the difference in fund inflows between the world’s largest ETFs, iShares emerging country ETFs, and top emerging country ETFs. Both indices contain emerging market stocks, but there has been no rise on the left since 19 last month in ’emergency ETFs’ with Chinese companies reaching 40%. This means that there was no inflow of funds. On the other hand, China’s share of China is 3.11 percentage points lower, while ‘core emerging market ETFs’, which have a higher share of Korean and Taiwanese companies, have increased their left hand by about 3 % during the same period.

In-Hwan Ha, researcher at KB Securities, analyzed that “the demand for investment in emerging countries and for hedging risks in China is increasing. The domestic stock market is expected to benefit at least by the end of the year.” The exchange rate is also contributing to the rise in share prices. The won-yuan exchange rate, which had fallen from 168-174 won this year, fell below the cash range this month (increasing the value of the won), approaching 165 won per yuan.

Private Stock Market Funds Still Overrun

In addition to the entry of foreigners, the individual investor funds that supported the stock market this year are also acting as a strong barrier. As of the 10th of this month, net individual investors bought a total of 62.507.9 billion won on the domestic stock markets such as the stock market and the KOSDAQ market. Investor deposits that investors entrust to brokers to buy stocks also exceed 61 trillion won. It means that 120 trillion won is new money in the stock market.

JP Morgan recently presented the KOSPI index forecast for the next year at 3200, explaining the most important reason as the liquidity pool overflowed in the stock market.

Reporter Seol Ji-yeon [email protected]