[ad_1]

The government ordered the presentation of a financing plan to avoid speculative transactions by corporations and prohibited the sale of pre-sale rights in unregulated areas in metropolitan areas and local metropolitan cities. The photo shows the apartment complex in Suwon. Yonhap News

The reason the government brought a knife into the corporate housing business is because these transactions are used as a means of speculation or tax evasion. It has also been pointed out that it is disturbing the market order, such as increasing the price of homes in some areas, since corporate investment is concentrated in unregulated areas in the metropolitan area. That is why the government has expanded the scope of surveillance throughout the country by requiring it to present financing plans for all corporate housing transactions, regardless of region and market price.

○ Investigation of corporate transactions in unregulated areas in the metropolitan area

On the 11th, the Ministry of Land, Transport and Maritime Affairs targeted the southern part of the Gyeonggi area in the metropolitan area by launching a plan to deal with speculative corporate housing transactions. Ansan Danwon, Sangrok, Siheung, Hwaseong, Pyeongtaek, Gunpo, Osan, Incheon Seo · Yeonsu, etc. These are places where the “balloon effect” has been seen as investment demand increased after the real estate measures of December 16 last year.

Previous agreements include: △ Selling a home to a corporation with an executive officer △ Buying a minor’s home △ Buying frequently by others in other cities and provinces. Suspicious speculative trading transactions are subject to an intensive investigation into tax evasion and violations of loan regulations.

The Ministry of Land, Infrastructure and Transport plans to analyze the cases in which the balance payment has been completed during the transaction since October 1 of last year, when the corporate loan regulations for regulated areas have been strengthened to 40% of LTV. . If the investigation determines that there is a problem, follow-up action is taken, such as the IRS tax investigation.

In the real estate industry, corporate real estate transactions have served as a trick to saving both the real estate tax and the capital gains tax. This is because the number of houses managed by individuals can be distributed to corporations. When a person sells an apartment, a transfer tax rate of 6 to 42% applies, depending on the retention period, the period of residence and the transfer margin. On the other hand, corporations pay 10 to 22% of corporate tax regardless of the retention period. It is also possible to decrease the tax burden because the subject of the final tax payment is divided into individuals and corporations.

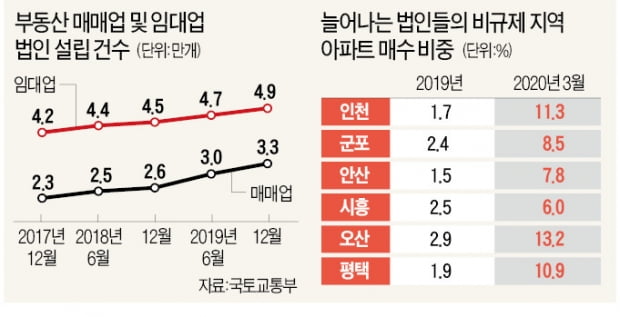

For this reason, the proportion of corporate department purchases in some regions has increased rapidly in recent years. Incheon’s share of corporate department purchases increased 10-fold, from an average of 1.7% last year to 11.3% in March. According to the Korean Evaluation Board, this year, apartment sales prices rose 4.5%, the highest level in the country.

The establishment of real estate sales and rental companies is also increasing. More than 26,000 sales corporations were established in June-December 2018, but increased to 33,000 during the same period last year.

○ Mandatory corporate financing plan

Currently, in case of purchasing more than 300 million won in regulated areas and more than 600 million won in unregulated areas, a financing plan must be presented. However, corporations are required to submit a financing plan regardless of the region and the value of the transaction. An official from the Ministry of Land, Infrastructure and Transport explained: “In the case of unregulated areas, most of the value of the transaction was less than 600 million won. According to the Ministry of Land, Infrastructure and Transportation, in the unregulated area of 600 million won in January-April this year, Ansan was 98.0%, Hwaseong 93.4%, and Incheon Seo-gu 98.1%.

The Ministry of Land, Infrastructure and Transport prepares a separate report on the actual transactions of the corporations. In the actual transaction report for corporations, basic information about the corporation is added, such as capital, industry, and executives, the purpose of buying a home, and whether there is a special relationship (kinship) between business partners. Currently, a single declaration form is used for individuals and companies.

The government plans to prepare amendments to the Real Estate Transaction Reporting Act containing this content and make legislative notices this month. After the related procedures, it will be implemented in July-August.

This measure was not directed at general companies. An official from the Ministry of Lands, Infrastructure and Transport said: “The purpose is to detect shortcuts of individual investors with corporate masks.”

Reporter Choi Jin-seok [email protected]