[ad_1]

The amount of inheritance tax that bereaved family members, including Vice President Lee Jae-yong, owed to Samsung President Lee Kun-hee’s stock ownership was estimated at 11.366 billion won. It is the greatest of all time. Chairman Lee’s stock valuation and individual stock valuation also posted the highest.

In the two months after President Lee’s death, the inheritance tax on stocks increased by about 600 billion won.

According to the Korea CXO Research Institute, which specializes in corporate analysis on the 22nd, President Lee’s ▲ share inheritance tax is 11.366 million won, the largest in Korea. ▲ Chairman Lee’s highest stock valuation was recorded on the 16th of this month at 22.29 trillion won. ▲ Among individual stocks, the value of Samsung Electronics shares held by Chairman Lee Kun-hee increased to 18.421.3 billion won.

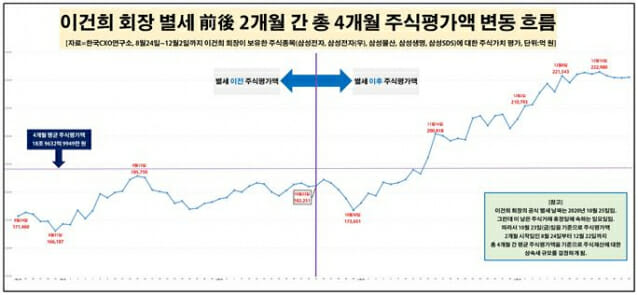

President Lee Kun-hee’s death date is October 25 this year. From this point on, the amount of the inheritance tax on the social property of President Lee Kun-hee is determined based on the average valuation of the market shares for a total of four months, every two months before and after. October 25 of this year is the Sunday on which the stock trading closes, so October 23 is the base date for calculating the stock valuation. In fact, it is the amount of inheritance tax that is calculated by calculating the average valuation of the shares for four months from August 24 to December 22.

As of the date of his death, Chairman Lee Kun-hee is Samsung Electronics (249,273,200 shares), Samsung Electronics preferred shares (619900 shares), Samsung Life Insurance (41519180 shares), Samsung C&T (542.5733 shares) and Samsung SDS (9701 shares). Note) Stock in stock.

Between August 24 and December 22, Chairman Lee Kun-hee’s share value was at its lowest level on August 31. At the time, President Lee’s stock valuation was 16.6187 million won. The amount is 527.3 billion won less than the 17.14 billion won on August 24, which is the start date for President Lee’s stock inheritance tax assessment.

As of the date of President Lee Kun-hee’s death, the stock was valued at 18,225 trillion won. From August 24 to October 23, the average value of the shares during the two months prior to the death of President Lee Kun-hee was estimated at 17.5 trillion won.

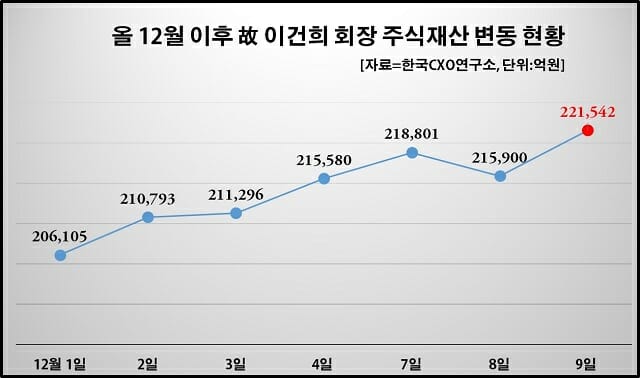

The stock price declined for about a week after the death of President Lee Kun-hee. On October 30, the stock’s valuation amounted to 17,365 trillion won, which has fallen by about 1 trillion won since the date of death. On November 16, it surpassed 20 trillion won at 20.818 trillion won, and on November 2 it surpassed 21 trillion won at 21.79 trillion won. On the 8th, it was from 22 trillion won to 22,154.3 billion won, and on the 16th, it was from 22 trillion to 29 trillion won, breaking Lee Kun-hee’s all-time record for highest-value property.

As of the date the stock’s valuation was the lowest in four months, the asset value of the shares rose to more than 5.67 trillion won (34.1%).

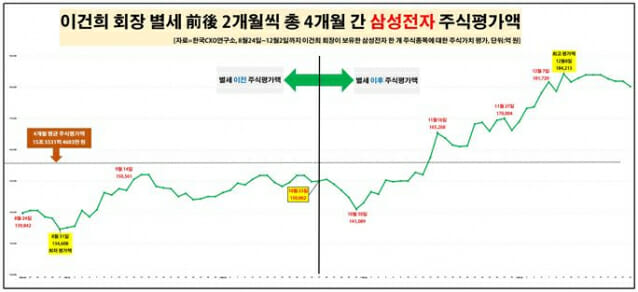

“The average valuation of the stock during the two months after President Lee’s death was around 20 trillion won,” Oh said. “The reason why the value of Samsung Electronics shares held by President Lee has increased is due to the increase in the value of Samsung Electronics shares held by President Lee. More than 80% of Samsung Electronics shares “.

At the time of August 31 (closing price 54,000 won), President Lee’s stake in Samsung Electronics was 13.46 billion won, and at the time of death (60,200 won), it reached 15 billion won. won. On November 16 (66,300 won), it broke the wall from 16 billion won to 16.5268 billion won, and rose to 17 billion won on the 17th of the same month (65,700 won).

Then on December 7 (72,900 won), it went up to 18 trillion won with 18 trillion out of 1,172 billion won, and on the 8th (73,900 won) of the next day, it went up to 18,421.3 billion won. This is the highest equity value among individual stocks held by individuals.

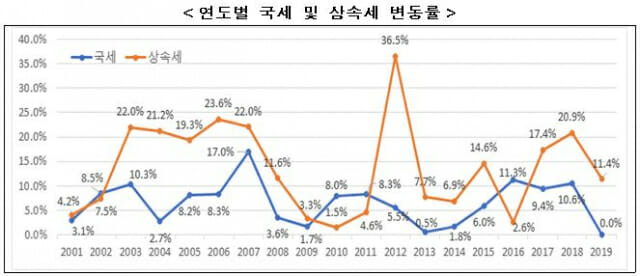

For four months starting on August 24, the average valuation of President Lee Kun-hee’s shares was calculated at 18.9632.994.9 million won. Based on this, the stock inheritance tax payable by President Lee’s family was estimated at 11,366,40.3 million won. The amount of inheritance tax is calculated by subtracting the premium of 20%, the maximum tax rate of 50% and the deduction rate of the voluntary declaration of 3% for the shares of the largest shareholder from the valuation of the shares that exceed the KRW 18.96 billion. The actual inheritance tax rate is 58.2%.

Also, if real estate, cash assets, and other assets held by President Lee Kun-hee are to be added to the share inheritance tax, the actual total inheritance tax may exceed 12 trillion won.

The shareholders’ interest is whether Chairman Lee Kun-hee’s share price will move up or down. In particular, Samsung Life Insurance shareholders held by Chairman Lee have more room to react more sensitively than usual. In the case of Samsung Life Insurance, only in the first half of 2018, there were many cases where the share price was around 130,000 won, but in April and July this year, it plummeted to around 40 ~ 50,000 won.

Related Posts

The late Lee Kun-hee stock inheritance tax is 11.366 billion … Biggest ever

Samsung’s inheritance tax alone is ’10 billion ‘… “In 19 years, the inheritance tax burden increased 7.1 times”

Lee Kun-hee’s 22 ac share ownership ‘highest ever’ … likely to reach $ 11 trillion in inheritance taxes

Samsung Life expects to increase its dividend payment rate … Samsung family inheritance tax support?

“Recently, the share price has been around 70,000 won,” said Yoo-sun, director of the CXO Research Center, “but with the inheritance of ownership from Chairman Lee Kun-hee, the share price is at a crossroads, whether it goes up or down again. ”

Meanwhile, according to the inheritance tax deadline, Vice President Lee and other heirs must prepare an inheritance plan for President Lee’s estate before April next year.