[ad_1]

Workers at the Oasis logistics center in Seongnam, Gyeonggi province, check and package customer orders with a mobile app. About 400 workers in logistics facilities are employed 100% full time. Oasis offer

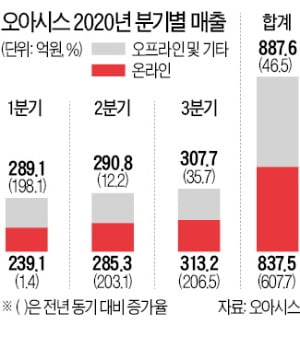

With the slogan of ‘popularizing organic farming’, Oasis, which jumped into delivering fresh food first thing in the morning in August 2018, is drawing attention due to a growing storm. The estimated operating profit for last year was about 10 billion won. It has increased more than ten times since 2019 (960 million won). Sales are also estimated to have more than doubled to KRW 250 billion. Oasis ‘substantial growth contrasts with distribution startups’ focus on growing their appearance amid the shortfall. Seeing this potential, domestic and foreign investors including Kakao Investment (5 billion won) invested a total of 41.6 billion won last year.

○ ‘Powerful’ in fresh food integrated on-off

Oasis is considered to be the only opponent of Market Curly. The common denominator of the two is that it is a distribution service that delivers fresh food quickly through logistics innovation combined with information technology (IT). The rest are almost the opposite.

First, the founder’s background is different. Seoul-ah Kim, founder of Market Curly, attracted an investment of 420 billion won, receiving splendid attention as a student in the United States. Kim Young-jun, the founder of Oasis (chairman of the board of directors), is an ‘oil spoons entrepreneur’ who has been through every prenatal treatment in the distribution market, from semiconductor engineers to distribution of carbon products. vegetable and organic lifestyle cooperatives.

It also contrasts that Oasis started offline. President Kim started organic distribution in 2011 under the mission of Woori Networks. A total of 39 offline distribution stores started this way, including Deungchon in Seoul, which opened earlier this month. These offline stores are a competitive environment for consumers to find what they ordered on mobile devices in nearby stores and to keep inventory rates close to “zero” at Oasis.

In marketing, Oasis’ actions with competitors like Market Curly are the opposite. Jeon Ji-hyun (Market Curly) and Gong Gong (Sep.com) are expanding their knowledge through aggressive marketing with top-notch CF models in Korea, while Oasis is quietly expanding their market share without changing star marketing. .

○ Capture both cost performance and performance

The performance is more contrasting. As the proportion of online sales increased compared to offline last year, operating profit is also improving significantly. Ahn Joon-hyung, Vice President of Oasis, said, “For the third quarter of last year, we had an operating profit of approximately 7 billion won.” Considering that ‘Zipcock consumption’ peaked in the fourth quarter of last year, annual operating profit is estimated to have exceeded 10 billion won.

Oasis’ greatest competitiveness is profitability. Oasis maintains close to 100% of the direct purchases from the production areas. Approximately 70% of the products handled are organic and organic fresh food. The number of items sold is inevitably less than that of hypermarkets, but thanks to the reduction of distribution stages, it is possible to sell at the lowest price. For example, 2,200 won for two organic tofu and 2,900 won for 10 sprouted fertilized eggs. It is half the price compared to the online mall of a hypermarket.

○ Increase productivity by developing your own logistics system

Parent company JierSoft is playing a role in the background to Oasis’ ability to capture the “two rabbits”, which is cost-performance and surplus. ZaireSoft is a publicly traded software development company and Chairman Kim is the CEO. Jiersoft is in charge of the software development necessary to improve Oasis productivity. Vice President Ahn said, “I visited Amazon in the US and Okado, UK, and studied logistics efficiency for several years. We decided that we couldn’t afford the cost with hardware-based automation like robots, so we decided to innovate. logistics through software development “. did.

This is the mobile application called ‘Ruta Oasis’. Workers can check the entire ordering, warehousing, warehousing, sorting, packing and delivery process through the app in real time. Oasis is seeking patent registration for this system.

Another Oasis potential that the retail industry is paying attention to is the collaboration with Kakao. Kakao Investment declared in its investment contract with Oasis as a strategic investor, not just a financial investor. A distribution industry official said: “As Naver added grocery shopping, Kakao Commerce is also very interested in the fresh food online delivery market. We will have to see if Oasis will become Kakao’s wing.”

Reporter Park Donghui [email protected]