[ad_1]

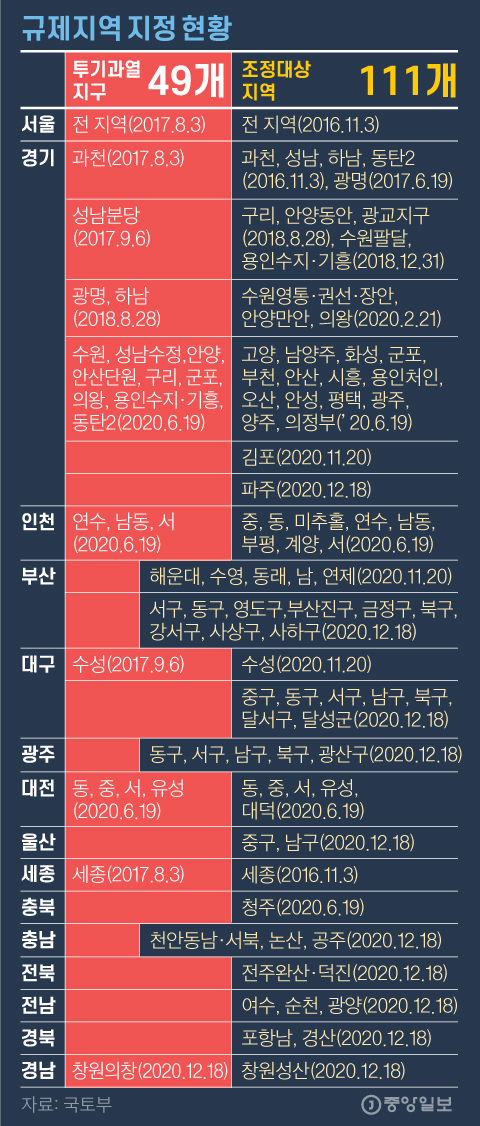

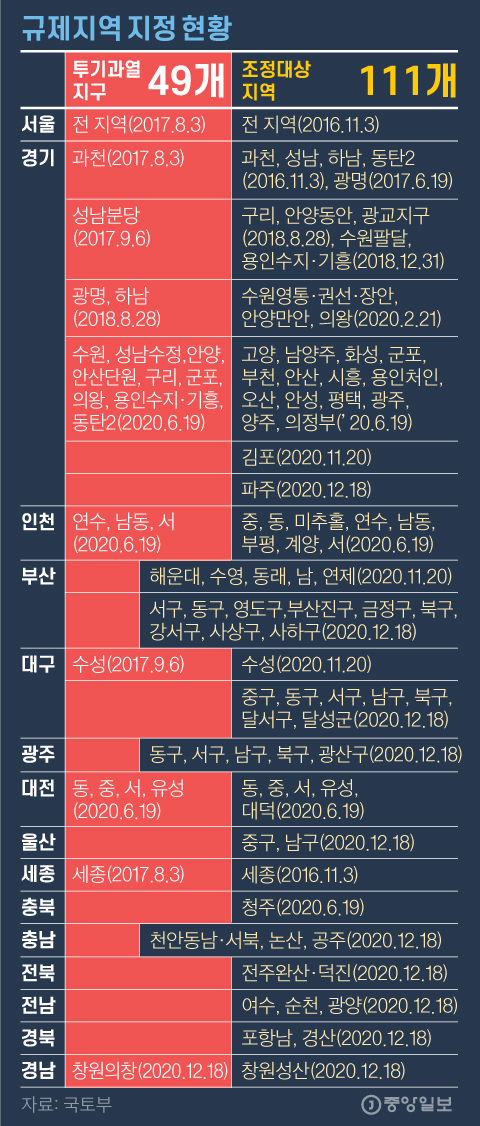

On the 17th, the government announced 36 new target areas for adjustment. Including Uichang-gu, Changwon-si, recently designated as an overheated speculation district, a total of 37 additional areas were designated as regulated areas. Regulated areas, which were mainly concentrated in the metropolitan area, have been expanded nationwide. However, despite the fact that various real estate regulations have been enacted, apartment prices are not serious. Apartment prices in the 4 districts of Gangnam (Gangnam, Seocho, Songpa and Gangdong-gu), which have been stable for more than three months, are increasing at the same time. The Ministry of Land, Transport and Maritime Affairs is the target area for adjustment on this day. 9 Busan (Seo, Dong, Yeongdo, Busanjin, Geumjeong, North, Gangseo, Sasang, Saha-gu), Daegu 7 (Jung-dong, West, South, North, Dalseo-gu, Dalseong-gun), 5 places in Gwangju (East, West, South, North, Gwangsan-gu), 2 places in Ulsan (Jung-nam-gu) and Paju, 2 places in Cheonan (Southeast and Seobuk-gu), Nonsan, Gongju, 2 Jeonju (Wansan and Deokjin -gu), Changwon Seongsan-gu, Pohang Nam-gu, Gyeongsan, Yeosu, Gwangyang and Suncheon were also designated.

37 additional tuning targets, including Paju

National house prices rose 0.29%, the highest rate of increase … “Government regulation raises house prices the most”

On the other hand, Eulwang, North and South, Deokgyo and Muui-dong, Jung-gu, Incheon, Baekseok-eup and Nam, Gwangjeok and Eunhyeon-myeon in Yangju, and Miyang, Daedeok, Yangseong, Gosam, Bogae, Seoun, Geumgyewon , etc. Juksan-myeon, etc.

The government initially introduced the ‘pincer regulation’, but with this designation, the number of areas subject to adjustment will increase from 76 to 111. It takes effect on the 18th. The government’s diagnosis is that the proportion of non-speculative transactions such as foreigner purchasing and multi-household additional purchasing has increased in designated additional areas due to abundant market liquidity and rising jeonse price rate. In particular, for homes with a listing price of less than 100 million won, local sales of less than 100 million won were in short supply due to a gap that did not result in a high acquisition tax.

Status of designation of the regulation area. Graphic = Reporter Kim Young-ok [email protected]

However, the side effects are more pronounced than the regulatory effects. During the measures on June 17, when Gimpo moved out of the area subject to adjustment, house prices rose significantly. When Gimpo was regulated a month ago, Paju skyrocketed. In the case of 84㎡ for the exclusive use of Unjeong New Town Central Prugio, Mokdong-dong, Paju-si, Gyeonggi-do, the transaction was worth 725 million won (18th floor) on the 7th of last month for 910 million won (11th floor) on the 26th. That’s about 200 million won in three weeks. Heo Yun-gyeong, a researcher at the Korean Institute of Construction Industry, noted: “Due to the ultra-low interest rate, the continued designation of regionally regulated areas by the government has only caused a balloon effect of raising the prices of buildings. houses in adjacent unregulated areas.

According to the Korea Real Estate Agency, apartment prices in Seoul this week also increased by 0.04%, a higher rate of increase than in Jeonju (0.03%). The 4 districts of Gangnam rose more than the average of Seoul, leading the uptrend. The rate of increase nationwide also surpassed last week’s record (0.27%), which was the highest in history. In the second week of this month, the price of apartments nationwide rose 0.29%, the highest rate since May 2012 when the Korea Real Estate Agency launched the statistics.

There is also an atmosphere of “turn around and eventually Gangnam”. An official from a brokerage office in Daechi-dong, Gangnam-gu said: “The demand is constant, but the government cuts off the supply, so in the end, the value of the shortage increases.” Young-jin Ham, head of the Jikbang Big Data Laboratory, said: “In the end, the purchase demand moves in anticipation of ‘a smart one.

There is also an analysis that the discriminatory increase targeting high-priced homes of more than 900 million won has driven demand for mid- and low-priced homes below 900 million won. According to KB Kookmin Bank, the median sale price of apartments in Gangbuk (14 districts) last month was 83.6 million won, the highest since December 2008, when the statistics were released. The demand to buy a house is increasing, as it is difficult to obtain a rental contract and the rental price is high.

Deok-rye Kim, director of the Housing Policy Research Department at the Housing Industry Research Institute, diagnosed: “What people want is a new apartment and prices are skyrocketing, but the government only talks about the total supply, so there is a ‘mismatch’ “.

Reporters Eunhwa Han and Hyunjoo Choi [email protected]

[ad_2]