[ad_1]

View larger

View largerThe US presidential elections on the 3rd are imminent and the global financial market is also interested in the results. Democratic Party candidate Joe Biden is ahead of the polls, but it is noted that the gap with President Donald Trump has narrowed recently and the electoral system, which ensures electoral groups by state, cannot guarantee the results.

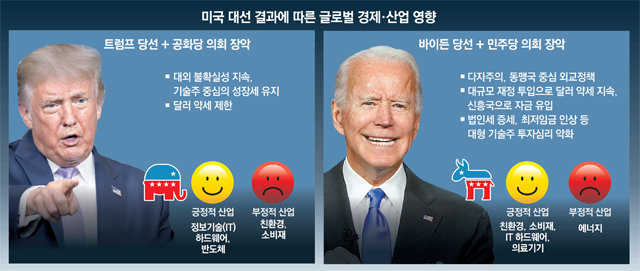

The world trade order and the beneficiaries of each industry are expected to change depending on whether President Trump will succeed in re-election or Biden’s success in re-election. In particular, there are concerns that the global financial market could fluctuate significantly if delays in counting votes and discontent with election results become a reality.

○ Trump’TechnologyEnergy Stock ‘and Biden’s’Eco-friendlyValue Stock’

Even if President Trump and candidate Biden are elected, the current post-Chinese stance and protectionist stance are expected to continue. The Trump “American First” and Biden “Buy American” policies are aimed at securing jobs at home and boosting manufacturing. At the core of Biden’s economic policy are tax increases and green investing. Biden pledged to invest $ 2 trillion in green infrastructure over the next four years and achieve 100% green power by 2050. That is why eco-related items such as electric vehicles and solar power are seen as the beneficiaries. of Biden’s election. Additionally, Biden plans to increase the corporate tax and income tax that Trump had lowered at the same time, making it likely that big tech stocks like Google, Apple and Amazon, which have led the uptrend of the stock market, are adversely affected. On the other hand, there are many observations that if President Trump is successful in re-election, the growing market, focused on big tech stocks, will continue as it is now and the energy sector will also be empowered. This is because President Trump is expected to maintain his stance of reducing corporate taxes and strengthening America’s energy independence. The results of the elections for the Senate and House of the United States Congress, along with the presidential elections, are also important. This is because policy coordination with the new president may differ depending on which party controls the Senate and House. For example, if the outcome of the ‘Biden-Republican Senate victory’, which is assessed as the worst combination, is likely to disrupt the massive economic stimulus plan that candidate Biden was trying to pursue, it is very likely to negatively affect to the financial market. In Korea, which is heavily reliant on exports, there is also concern that the conflict between the United States and China will ease. When Biden comes to power, unilateral trade policies, such as retaliatory Trump-style tariffs, are expected to decline. KOTRA predicted: “If candidate Biden is elected, reform of the World Trade Organization (WTO) system and adherence to the Pacific Rim Economic Partnership Agreement (CPTPP) will be seriously promoted, thereby expanding the scope of economic activities in the US ” .

○ Delayed count, more tactile for electoral dissent

Financial markets today are more interested in delays in counting and dissatisfaction with results. In the past presidential elections in the United States, the winner is generally decided on the night of election day or at dawn the next day. However, this year, in the wake of the new coronavirus infection (Corona 19), the number of pre-voting votes, such as voting by mail, has increased, so it may take several weeks for the result to win. or lose. In particular, there is concern that in the actions of the main competition, if the victory or loss is reversed in the future, and in the process, dissatisfaction with the results of the count occurs, the entire United States may be confused.

Because of this, the market is already fluctuating. Last week, the leading index on the New York Stock Exchange fell 5-6%. Subsequently, Korea’s KOSPI also fell 2.56% on the 30th of last month. Ahn So-eun, a researcher at IBK Investment & Securities, said: “Confusion over the results of the presidential elections can lead to fundamental concerns beyond political uncertainty as it causes a political vacuum.”

Reporter Kim Ja-hyun [email protected]· Kim Do-hyung

Copyright by dongA.com All rights reserved.