[ad_1]

Members of the committee of “interest rate increase next year” increase by 3 in 3 months

The US growth forecast was also revised up 2.3% P

Jerome Powell, president of the United States Central Bank (Fed). AP Yonhap News

The central bank (Fed) event that the New York Stock Exchange was waiting for is over. The Federal Open Market Committee (FOMC) was dissolved after a two-day schedule, and Fed Chairman Jerome Powell spent about an hour reading a statement and giving a press conference. The next FOMC will be from the 27th to the 28th of the following month.

Of course, the FOMC members unanimously frozen the current rate of zero (0.00 ~ 0.25% per year). We also decided to maintain our $ 120 billion monthly bond purchase program.

The FOMC carried out a big cut in March last year, lowering the previous interest rate (1.00 ~ 1.25% per annum) by 1 percentage point at a time.

Compared to the regular meeting in December last year, it was notable that they expressed strong confidence in the economic recovery. However, they dismissed concerns about rising inflation, which had attracted market attention.

The FOMC statement announced today and the gist of Powell’s press conference are as follows.

① Increased the US growth rate forecast for this year to 6.5% (4.2% forecast at the end of last year)

② Next year’s growth rate should also be good at 3.3%. After that, 2.2% growth.

③ The unemployment rate from 6.2% last month fell to 4.5% at the end of the year (5.0% expected at the end of last year)

④ This year’s inflation increased 2.2% (1.8% was expected at the end of last year)

Thanks to the widespread distribution of the corona vaccine and massive stimulus, the Fed has officially confirmed that expectations for an economic resumption are rising and that it is actually improving.

Two things came to attention in Powell’s briefing after the FOMC’s statement.

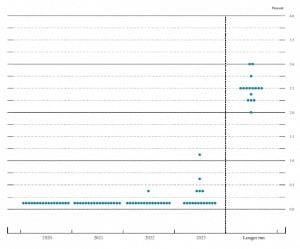

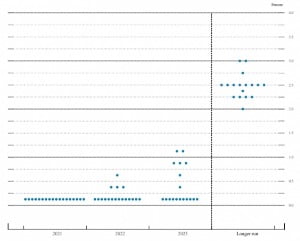

First of all, this is a dot plot in the Summary of Economic Projections (SEP). The dot plot is an interest rate forecast submitted anonymously by 18 FOMC members (12 meeting attendees). It is announced four times (March, June, September, December) of the regular FOMC meetings that are held 8 times a year

Compared to the end of last year, you can see that the propensity of the committee members has changed to aggressive (preferring to adjust the currency) at a faster rate than originally expected.

At last December’s meeting, only one in 18 people thought a rate hike would be possible next year, but this time it has risen to four. At the end of last year, there were 5 committee members who predicted the interest rate increase in 2023, but this time it has changed to 7 members. The number of FOMC members who think, “At the same rate as the current economic recovery and the rate of inflation, the zero interest rate should change next year,” he said.

A dot plot released last December. Only one committee member predicted an increase in the standard interest rate next year.

A dot chart released by the Fed on the 17th (local time). Four committee members came out who predicted an increase in the standard interest rate next year.

However, Chairman Powell was eager to consider the impact this change would have on the market.

When asked about the question, he emphasized: “The SEP is not an official perspective for the FOMC, it is simply a complement to compare the opinions of the various committee members.” Each member of the committee may have a different view of the economy, and this perspective does not change policy.

“Policy change is possible when the employment and inflation situation meets our standards,” Powell said. “It will take time for the economy to advance significantly,” he said.

What the Fed has proposed as a premise to change the tone of its policy is maximum employment and adequate inflation. The Fed’s view of maximum employment is slightly above the unemployment rate (3.5%) in February last year, and the appropriate inflation rate is around 2.0%.

While the FOMC saw an inflation forecast of 2.2% at the end of this year, the introduction of the Average Inflation Target (AIT) in August last year does not mean that even if inflation temporarily exceeds 2%, it does not mean that the pitch will change.

Fed Chairman Jerome Powell (second from top left) will give a video briefing on the 17th (local time).

Another concern was whether there would be a recipe for increasing US Treasury yields.As a result, the Fed did not respond at all. It has not extended the control of the yield curve (YCC) or the turn of the operation (OT), as well as the deregulation of the bank complementary leverage ratio (SLR).

Part of the market thought that the SLR deregulation measures would come out this time. The Fed relaxed SLR regulations on banknotes for a year shortly after the March pandemic last year. The expiration date for this share is the 31st of this month.

If this is not extended, banks will have to sell some of their Treasury bonds to comply with equity regulations. When government bonds are sold in the market, bond prices are expected to fall and market interest rates to rise.

President Powell, aware of this, said: “I will announce the SLR regulation in a few days,” but said: “I will not give an additional answer. CNBC explains that Powell’s refusal to answer herself is highly unusual.

The interest rate on the 10-year US Treasury bonds used as a reference in the bond market on this day was 1.63% per year, only 0.01 percentage points more than the previous day. Considering the fact that it shot up to around 1.67% just before Powell’s press conference, it calmed down a lot.

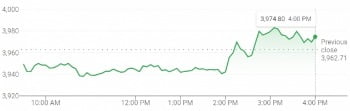

The New York Stock Exchange also welcomed the FOMC meeting. The Dow Jones was up 0.58% to 33,015.37, the S&P 500 was up 0.29% to 3,974.12 and the Nasdaq Index was up 0.4% to 13,525.20, respectively. It weakened in the morning and turned into a sharp rise shortly after the release of the FOMC statement. The Dow and S&P 500 index continued to hit all-time highs.

On the 17th (local time) on the US New York Stock Exchange, the S&P 500 index showed weakness during the morning and turned bullish shortly after the FOMC announcement.

It is true that the Fed has expressed some concern about inflation, but analysis predominates reflecting expectations that economic and business performance will improve enough to offset this. There is also an effect that the Fed has once again shown that the market is in dove (preferably to relax the currency).

However, it is worth paying attention to the fact that the Fed’s economic outlook and dot plot have changed considerably in just three months. When economic and market conditions change, the Fed may change earlier than expected.

New York = Correspondent Jae-Gil Cho [email protected]