[ad_1]

On the 5th, Hong Nam-ki, Deputy Prime Minister of Economy and Minister of Strategy and Finance, leaves the platform after a briefing on the introduction of ‘Korean-style fiscal rules’ held at the Sejong Government Complex. News 1

On the 5th, Hong Nam-ki, Deputy Prime Minister of Economy and Minister of Strategy and Finance, leaves the platform after a briefing on the introduction of ‘Korean-style fiscal rules’ held at the Sejong Government Complex. News 1The late introduction by the government of the “financial rules” that are in place in many countries is due to the judgment that it can no longer neglect the risk of growing debt and fiscal deficits.

However, there are criticisms that the government can easily change standards, such as the proportion of national debts specified in fiscal rules, such as the ‘Bengtang Rules’ and the ‘Rubber Band Rules’, which are less effective at as needed. However, the application of this fiscal rule has been delayed for five years, so the current government does not need to comply with the fiscal rule.

○ Officially abolished the fiscal margin line ‘40% national debt ‘

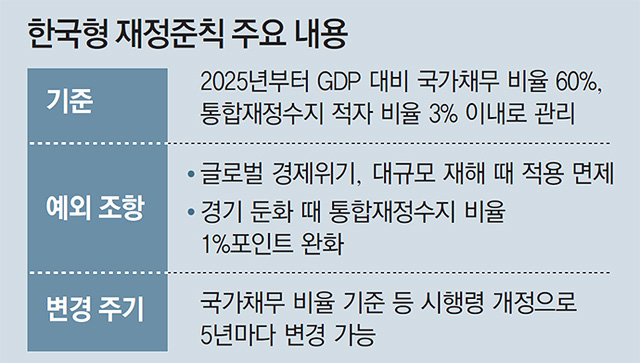

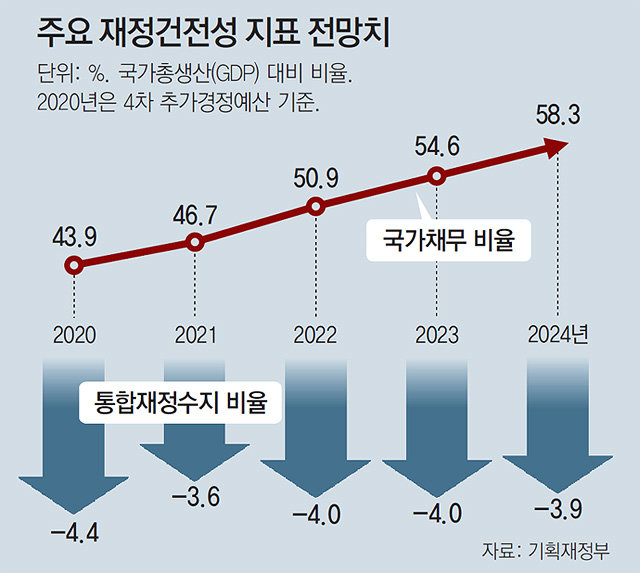

The core of the ‘Korean fiscal rules’ announced by the government on the 5th is that starting in 2025, the ratio of national debt to gross domestic product (GDP) will be managed within 60% and the ratio of deficit of the integrated fiscal balance within 3%.

According to the National Fiscal Management Plan 2020-2024, the national debt ratio will increase from 46.7% next year to 58.3% in 2024, and the plan is to maintain this level as much as possible. The 3% ratio of the consolidated fiscal deficit was also set taking into account the forecast for 2024 (3.9%). The government said: “The two standards are universally consistent in the international community.” According to the report of the Planning and Finance Committee of the National Assembly, 63 countries have adopted the national debt ratio as a fiscal rule, of which 40 countries, including France, Germany, Spain and the United Kingdom, have a limit of 60% in the national debt index. As a result, Korea also officially abolished 40% of the national debt, which had been considered the “financial margin line.” At the National Fiscal Strategy Meeting in May last year, President Moon Jae-in pointed out to Hong Nam-ki, Deputy Prime Minister of Economy and Ministry of Strategy and Finance, “What is the 40% basis?”

He explained that the time of application of the 2025 government fiscal rule reflects the rapid increase in financial spending due to the response to the new coronavirus infection (Corona 19) and welfare spending. Vice Premier Hong said in a briefing that day, “(due to Corona 19’s response, etc.) it was not appropriate to apply the fiscal rules of the year after fiscal deterioration, so a five-year grace period was granted. years.

○ Elastic band regulation without constraint

However, it is noted that the fiscal rule itself does not apply, and it is a ‘single pattern rule’ by opening the haven so that the government can use it at any time according to the taste of the regime. For example, even if a large-scale infectious disease incident is repeated in 2025 and the national debt ratio rises to 65%, it is only necessary to restore this ratio to 60% by the next government, 2029. In fact, the burden of the government to maintain fiscal soundness is modest.

In addition, exceptions apply even when the economic growth rate is slowing or employment is slow, and the standard of the deficit ratio of the integrated fiscal balance can be reduced from 3% to 4% for up to three years. However, there is no clear standard on how to judge the economic crisis or the economic slowdown. Above all, the biggest problem is that the specific figures of the fiscal rules, such as 60% of the national debt ratio and 3% of the consolidated deficit balance, are set by the implementing ordinance and not by the constitution or the law, so they can be modified every five years. If a populist fiscal contribution is necessary according to the inspiration of politicians or the needs of the government, the number can be increased or decreased like a rubber band only by reviewing the executive order at any time. This contrasts with Germany, where the constitution states that “the new debt is limited to 0.35% of GDP”, and France, where the law states that “the management of the fiscal deficit is within 0.5% of GDP” .

Kang Seong-jin, professor of economics at Korea University, said: “The fiscal rules announced by the government are not famous, so even if the rules are followed, it is difficult to avoid the deterioration of fiscal strength.” Indicated.

Sejong = Song Chung-hyun [email protected] · Reporter Nam Kun-woo

Copyright by dongA.com All rights reserved.