[ad_1]

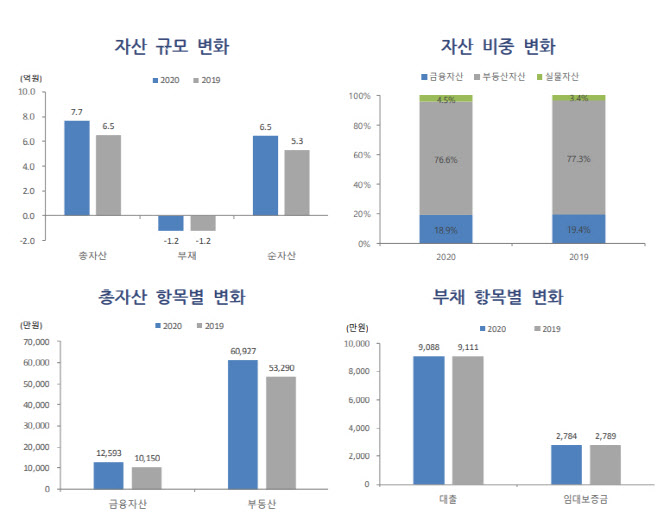

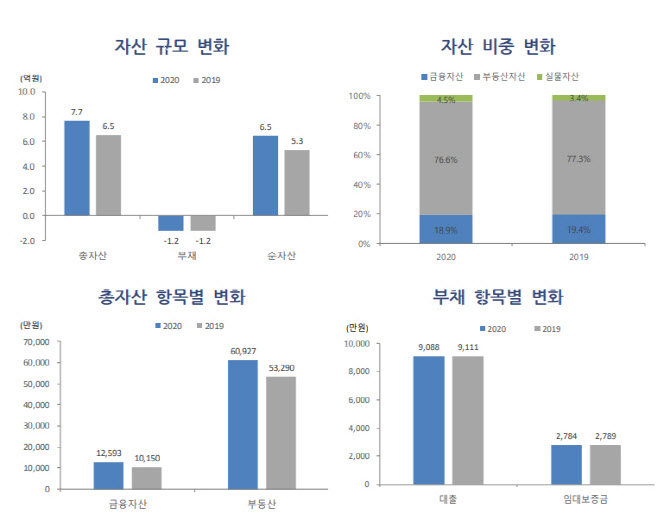

On the 6th, the Woori Financial Management Research Institute published a report on the ‘wealth management behavior and digital finance use of the rich in the masses’ and announced that in 2020, the net assets of the rich in the masses increased by about 223 million won over the previous year to 664 million won. The total assets of the massive floating larvae are 766 million won, of which the debt is 119 million won.

Since last year, the Woori Financial Management Research Center has been publishing a series of analyzes of the wealthy each year, and this year conducted a survey of 4,000 people across the country from September to October 2020.

This year, the assets of the rich rose evenly in real estate and financial assets. Real estate assets were 690 million won, an increase from 24 million won (24.1%) to 76 million won (14.3%) compared to the previous year, and financial assets 126 million won. .

|

The proportion of real estate assets and financial assets among total assets was 76.6% and 18.9%, respectively, showing the concentration of real estate as in the previous year. The total amount of debt was the same as the previous year, but the balance of cheonsei loans and credit loans (including card loans) increased.

In particular, the wealthy of the masses showed great interest in stocks this year. The proportion of deposits and savings among financial assets (45.0%) decreased 5.0% points compared to last year, but stocks showed the greatest increase with 3.0% points. Shares represented 15.4% of its portfolio of financial assets. The reason for the increase in the share of stock investing appears to be due to the strong aggressive investment trend, as the market interest rate fell after Corona 19 and the stock rallied. In fact, the “stability-seeking rate” and “stable rate” that low risk pursued last year were around 60% of the masses, but this year they were down to 41.2%. On the other hand, active investment and aggressive investment were 33.7%, 10 percentage points more than the previous year.

Furthermore, it was found that the wealthy of the masses are actively using digital finance. 95.1% of the respondents use financial applications and 73.8% of them use online channels for financial transactions. After Corona 19, the use of digital finance became more active. 44.3% of those surveyed responded that the use of digital finance has increased since the coronavirus outbreak, and the proportion of experienced users of non-face asset management channels, such as the Internet and mobile applications, also rose considerably from 11 , 0% last year to 56.5% this year.

The mobile asset management feature most needed by the wealthy population was “personalized product recommendation (20.0%).” In addition, ‘financial product information’ (17.8%), ‘consumption management’ (14.2%) and ‘asset portfolio design’ (13.2%) showed the greatest need for personalized services .

‘Kakao Bank’ was selected as the most anticipated place as a digital financial services brand in the future. Kakao Bank received high support of 27.8%, followed by Naver with 13.4%.

An official from the Woori Financial Management Research Institute said: “The financial assets of the rich and great are on the rise and are showing high utilization of digital finance. This is a factor that can expand the wealth management business of financial companies. “.