[ad_1]

Photo = Yonhap News

Demand for medium to large-sized apartments increased compared to small-sized apartments in Seoul, and Korea’s liquidity growth rate was the lowest among major countries. It is noted that there is a distance from the explanations of the main officials of the government and the ruling party, such as the Minister of Lands, Infrastructure and Transport, Kim Hyun-mi and Lee Nak-yeon, along with the representative of the Democratic Party, who cited generational separation and increased liquidity as factors in the jeonse crisis.

On the 25th, Hankyung.com News Lab analyzed the average rate of increase / decrease of deposits for apartments in Seoul. Last month, the average deposit for apartments in Seoul increased by 11.5% and 10%, respectively, from 40 pyeong and 30 pyeong, respectively. As a result, the demand was concentrated in medium and large apartments rather than in small apartments. As the government and ruling party explained that household separation was a major factor in the jeonse crisis, the demand for small apartments should have increased, but the statistics should not.

Furthermore, Korea’s liquidity increase this year was 7%, much lower than that of other major countries. Minister Kim Hyun-mi’s claim that increased liquidity caused the jeonse crisis is also a point of loss of confidence. Experts believe that the overheating of the housing market is more likely to cause the failure of government policies. They followed orders to expand the supply of real estate in the preferred regions.

There was more demand for medium and large vehicles

Kim Hyun-mi and Lee Nak-yeon “Bad the division of generations”

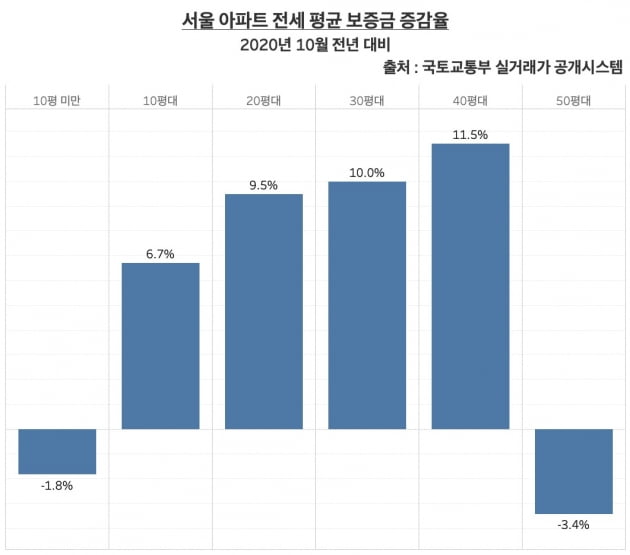

Average deposit for rented apartments in Seoul. October 2020 year-on-year increase or decrease. The average deposit growth rate for medium to large-sized apartments in the range of 30 to 40 pyeong was found to be more than 10%, higher than that of 10 to 20 pyeong. / Graph = Reporter Shin Hyun-bo, Hankyung.com

The average deposit for apartment rentals in Seoul in October increased 11.5% year-on-year, showing the largest increase. Then 30 pyeong showed a 10% increase. The 20 pyeong increased by 9.5%, followed by the 10 pyeong by 6.7%. Those under 10 pyeong fell 1.8%. It means that the housing market demand over the past year has been more concentrated in the 30-40 pyeong range, and the small pyeong’s water supply has been relatively fluid.

It’s a shame that high-level government and ruling party officials pointed to the division of one-person households and households as a factor in the jeonse crisis. If the segregation of single-person households and households is the cause of jeonse, then the deposit should be increased for an apartment of 10-20 pyeong, where the demands of these people are rushing, but the reality was different.

Democratic Party leader Lee Nak-yeon said of the jeonse crisis on the 17th, “There was not enough preparation for the explosive increase in one-person households with the separation of households.” Minister Kim Hyun-mi also replied, “There has been a lot of division of the stronghold generation” to the question of Rep. Kim Eun-hye, who agreed that the jeonse crisis has a great effect on the generational divide in the meeting of the National Land Transport Committee of the National Assembly on the 6th of this month.

Korea’s liquidity growth rate, the lowest in the G20

“Real estate overheating problem, blame government policy”

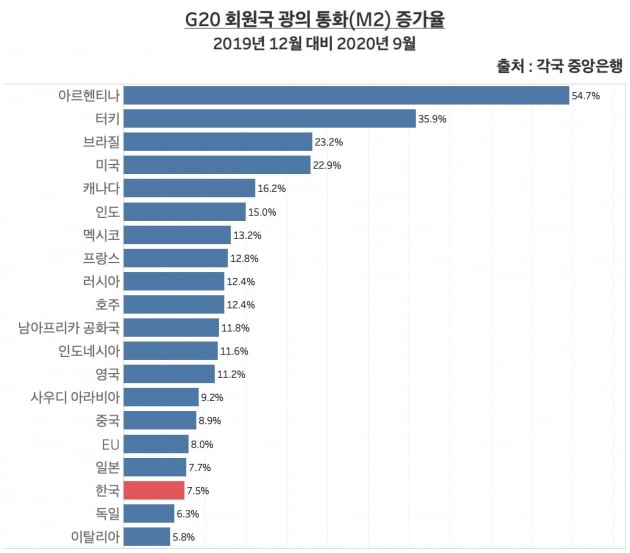

Overall currency variation of G20 member countries in September 2020 compared to December 2019. Korea ranked 18th out of 20 countries, and the increase in market liquidity among major countries after Corona 19 was found not to it was significant. / Graph = Reporter Shin Hyun-bo, Hankyung.com

The claim that the liquidity crisis caused by the rapid increase in liquidity due to the low interest rate was also confirmed as false by looking at the world currency volume index. Korea’s liquidity growth rate reached 7% this year, the lowest among the major countries. Experts argue that government policy failures, rather than low interest rates, are a direct factor that negatively affected the market.

In September, Korea’s general currency (M2, Won series) amounted to KRW 3.132 trillion, an increase of only 7.5% from last December. It is ranked 18th among the top 20 countries (G20). Argentina rose the most with 54.7%, followed by Turkey (35.9%), Brazil (23.2%) and the United States (22.9%). Germany (6.3%) and Italy (5.8%) were the only countries with lower liquidity growth rates than Korea. M2 is a representative liquidity indicator that represents the amount of money in the market and includes cash, demand payments and deposits for deposit and withdrawal.

Until now, Minister Kim Hyun-mi has argued that the real estate problem is due to low interest rates. Minister Kim told a plenary meeting of the Land Council on the 3rd: “The root cause (of the jeonse crisis) is that the standard interest rate has fallen to 0.5% while experiencing Corona 19.” Increased.”

The opinion of the academy is that the problem of the real estate market in Korea is the government’s policy initiative. The cause-and-effect link leading to low interest rates, higher liquidity, higher home rentals, and an intensified Cheonsei crisis, as mentioned by Minister Kim Hyun-mi, is pointed out as pointing out.

In August, the Korea Economic Association surveyed 37 economists and 76% pointed to the failure of the government’s real estate policy as the cause of the increase in house prices in the metropolitan area. 78% responded that the expansion of supply is a necessary policy to stabilize the price of housing.

Despite the recent deterioration in public opinion about President Moon Jae-in, the government’s real estate policy had a great influence. In the third week of November in the Gallup Korea poll, President Moon Jae-in’s negative assessment was dominant and “Real Estate Policy” ranked first for seven consecutive weeks as a negative assessment factor.

Shin Hyun-bo, Reporter for Hankyung.com [email protected]