[ad_1]

GameStop’s share price plummeted on the 24th (local time). This is because he was unable to come up with a detailed plan for digital transformation in yesterday’s earnings announcement, and the possibility of a large-scale capital increase came up in the future.

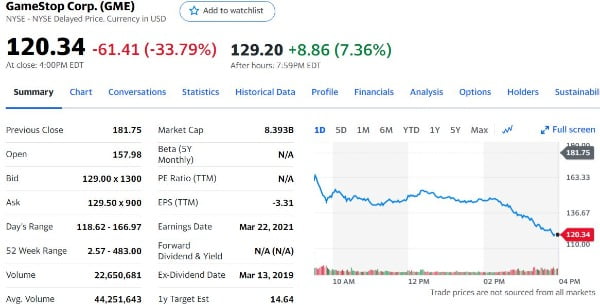

On this day, on the New York Stock Exchange, GameStop’s stock price closed at $ 120.34, $ 61.41 (33.79%) less than the previous day. GameStop announced that it had $ 2.12 billion in sales and $ 1.34 per share in the fourth quarter of fiscal 2020 after the market closed the day before. It was lower than Wall Street estimates compiled by financial reporting company Refinitiv (earnings per share of $ 1.35 and sales of $ 2.21 billion).

In particular, it did not provide specific earnings forecasts or restructuring plans for this year, nor did investors or analysts ask questions. This received a fierce reaction from Wall Street.

According to CNBC, Telsea Advisory analyst Joe Feldman criticized in his analysis report that “everyone was expecting great news about digital transformation through a new board of directors and they said nothing.” “The conversation about future strategy sounded like any other retailer – investing in technology, creating great customer experiences, expanding product offering, and so on,” Feldman said. Feldman lowered the target price from $ 33 to $ 30 and revealed that the current stock price ($ 181 the day before) is “divorced” from business fundamentals.

Gamestop’s share price jumped 1625% in January as a result of collective purchases by individual investors who flocked to the ‘Reddit’ online community, and is still close to 700% despite that day’s drop. . Gamestop also admitted that the rising share price at the beginning of the year “is not balanced or has nothing to do with the performance of the company,” in a disclosure document filed with the Securities and Exchange Commission (SEC) on the day. previous.

Bank of America (BofA) also criticized GameStop’s performance announcement. BofA criticized GameStop for not disclosing any details regarding the restructuring in its quarterly earnings conference call, and that there was no question-and-answer section on the 22-minute conference call. BofA analyst Curtis Nigel said in an analysis report, “GameStop has been very tough and needs a quick turnaround, but little details of its restructuring plan have been revealed.” shrinking fast. ”BofA offered a $ 10 price target for GameStop as before.

Securities firm Wedbush, like Telshi and BofA, presented a “low weight” investment rating. The median price target for Wall Street analysts was estimated at $ 25.

The drop in GameStop’s share price on this day also affected the fact that it was revealed that it could issue shares on a large scale by revealing its earnings after the previous day’s close. “Since last January, the company has been evaluating how to sell common stock in fiscal year 2021. It intends to accelerate future turnaround and raise general working capital,” he said in a filing with the SEC.

However, Jeffreys raised GameStop’s price target for the day by more than 10 times, from $ 15 to $ 170. However, the investment grade was reported as “pending.” According to Reuters, Jeffreys analyst Stephanie Wisink said in a report that “an in-house investment banking department was hired as a lead on GameStop’s potential capital increase plan.” He also added: “The company owns more than 1% of its shares in GameStop’s common stock through its affiliates or subsidiaries.”

Wisink analysts highly praised Jenna Owens, who had experience at Amazon and Google, as the new COO the day before. “The change in leadership, including the board of directors, executives and the hiring of new COOs, is a sign that we are completely reinventing our business model,” he said. “We will continue to assess the digital transformation that may warrant the mid-term review because GameStop’s share price clearly has volatility beyond fundamentals.”

Reporter Kim Hyun-seok [email protected]