[ad_1]

The share inheritance tax to be paid by Samsung Electronics Vice Chairman Lee Jae-yong, heir to the late Samsung Chairman Lee Kun-hee, has been confirmed to be about 11 trillion won. The heir must prepare an inheritance plan for President Lee Kun-hee’s legacy before April next year.

According to the business community on the 22nd, the amount of inheritance tax to be paid by grieving family members, such as Vice President Lee Jae-yong, is 11.366 million won. President Lee’s actions held on this day ▲ Samsung Electronics 72,300 won ▲ Samsung Electronics (right) 68,000 won ▲ Samsung SDS 177,000 won ▲ Samsung C&T 132,000 won ▲ Samsung Life 80,000 won Closed with.

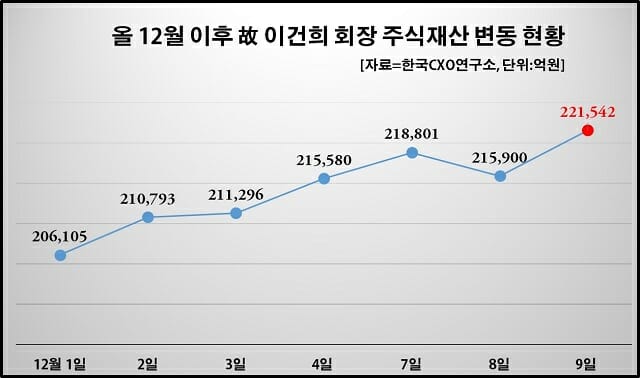

The share inheritance price is calculated based on the average closing of shares for a total of four months, two months before and after the death of the deceased (October 25).

The average value of the four-month listed shares owned by President Lee is ▲ Samsung Electronics 62,394 won ▲ Samsung Electronics (right) 55,000 won ▲ Samsung SDS 173,00048 won ▲ Samsung C&T 114,000,681 won ▲ Samsung life insurance costs 66,000 won.

The main affiliates of Samsung Group, owned by Chairman Lee Kun-hee, are 4.18% of Samsung Electronics ordinary shares and 0.08% of preferred shares, 20.76% of Samsung Life Insurance, the 2.86% of Samsung C&T and 0.01% of Samsung SDS.

Under the inheritance tax statute, a maximum tax rate of 50% applies when the amount of the gift exceeds 3 billion won. In addition, a 20% premium is added that is applied to the tax rate when the largest shareholder of a large company inherits or donates the shares it owns. In other words, the tax rate attached to President Lee’s stock valuation is about 60%, 50% of the valuation (120%) with a 20% premium.

Consequently, the total amount of the inheritance tax is approximately 11.40 billion won, even if a 3% deduction is applied due to voluntary filing. It is the largest in terms of inheritance tax share.

Furthermore, the actual total amount of inheritance tax is predicted to exceed 12 trillion won if real estate, cash equivalents, and other assets held by President Lee Kun-hee are added.

According to the deadline for the payment of inheritance tax, Samsung must prepare an inheritance plan for President Lee’s estate before April next year.

Related Posts

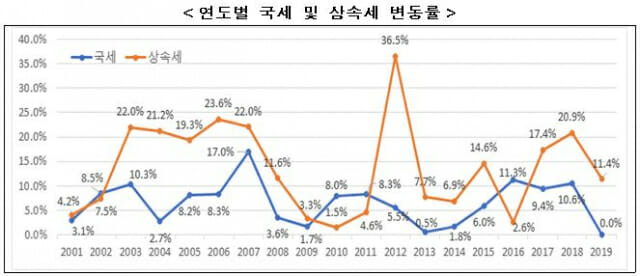

Samsung’s inheritance tax alone is ’10 billion ‘… “In 19 years, the inheritance tax burden increased 7.1 times”

Lee Kun-hee’s 22 ac share ownership ‘highest ever’ … likely to reach $ 11 trillion in inheritance taxes

Samsung Life expects to increase its dividend payment rate … Samsung family inheritance tax support?

“President Lee Kun-hee, the highest inheritance tax rate among OECD countries”

In fact, it is not possible to make a balloon payment, which increases the possibility of using the annuity. The annuity payment is an extension of the period so that part of the tax can be paid after the legal filing deadline if some of the requirements for the amount of tax to be paid are met.

Payments are made in installments over five years, which is an annuity payment period. It is a method of applying 1.8% annual interest, paying one sixth when reporting, and dividing the remainder over five years.