[ad_1]

Resolution of the Council of State on the amendment to the Law of Loan Companies … In addition to the principle of maturity, relocations are also prohibited.

In the future, illegal private financial companies will not be able to receive interest higher than 6% per year.

At a meeting of the State Council on the 29th, the government voted to amend the law on the registration of loan businesses and the protection of financial users.

The amendment first changed the name of ‘unregistered lender’ to ‘illegal financial business operator’ and lowered the legal interest limit that illegal private financial business operators can receive from the current 24% to 6%, limiting their illegal profits.

Now, even if you are caught making an illegal loan, only the portion that exceeds 24% is considered invalid and eligible for repayment, but in the future, no matter how high interest rate is received, the interest that exceeds 6% can be invalidated and a refund can be claimed.

In the case of a demand for return, the assistance of a government attorney is also available.

Since this year, the government has been providing “free support to debtor agents and trial lawyers” through Legal Aid Corporation, helping a total of 869 people.

It is also considered invalid to start with a microloan and lend it again adding the principal due in case of default, or to borrow by oral or mobile messaging without a contract.

These are mainly techniques used by illegal private financiers to retain debtors and avoid regulations such as higher interest rates.

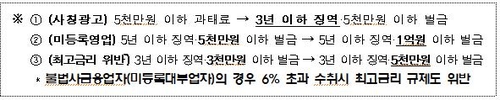

Penalties for illegal private financing are also reinforced.

Currently, even if he masquerades as government support such as Sunshine Loan or loans to financial institutions, he has been fined no more than 50 million won, but will face a prison term of no more than three years or a fine of no more than 50 million won.

The level of penalties for unregistered transactions and violations of the highest interest rate has also been reinforced with prison terms of up to 5 years or fines of up to 100 million won, imprisonment of up to 3 years, or fines of up to 50 million won. won, respectively.

Along with this, it stipulated that an act of intermediation of new loans is carried out, that they carry out the intermediation of loans through an online bulletin board, while receiving money on behalf of the registration or advertising fees, and a new obligation to repay the original lender’s contract.

The amendment is a follow-up to government measures to stamp out illegal private financing announced in June.

The Financial Services Commission announced that it will consult closely with the National Assembly so that the amendment can be approved by the National Assembly in the near future.

In addition, he emphasized that it will respond proactively to concerns about an increase in illegal private financing that may occur when the highest interest rate is reduced in the second half of next year (24 → 20% annually).

Meanwhile, the government cracked down on illegal private finance from June to November, arresting 4.84 people and arresting 49 people.

272,000 online and offline illegal private finance ads and 6,663 phone numbers were also detected and blocked.

/ yunhap news