[ad_1]

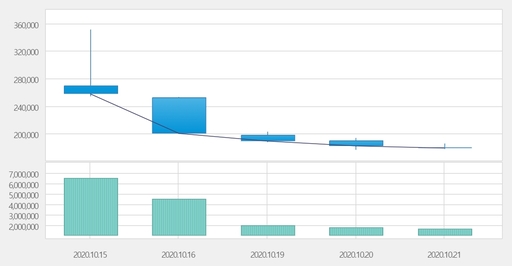

Changes in Big Hit share price and trading volume since trading on the 15th / Korea Exchange

Big Hit, which showed a continuous decline, ended higher after six days of trading. The ants (individual investors) are buying Big Hit, while foreigners and institutions are selling the opposite. However, the share price compared to the peak recorded immediately after listing was cut in half, and Big Hit’s fourth largest shareholder ‘Mainstone’ is known to have sold more than 360 billion won in stocks, and is considered the main cause of the stock price drop.

According to the Korean Stock Exchange on the 22nd, Big Hit closed the market at 180,000 won, 0.56% more than the previous day. Although it showed a slight increase, it is down 48.71% from its trading day high (351,000 won).

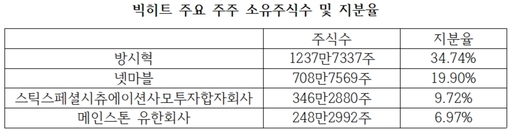

On the 21st, Mainstone Co., Ltd., Big Hit’s fourth largest shareholder, announced that it had sold 1.2 million and 769 shares of Big Hit shares on the 15-20 market. In addition, the Private Equity Association Easton’s No. 1, which was not on Big Hit’s top shareholders list, divested 38.1112 shares in the same period.

Mainstone’s average selling price per share is 22.9770 won, and Easton’s average selling price is 23.2296 won. With this sale, Mainstone and Easton secured 3.644 billion won and 88.5 billion won in cash, respectively. Through this sale, Mainstone’s stake in Big Hit was reduced from 6.97% to 3.60%, and Easton’s stake was reduced from 2.19% to 1.12%.

Since Big Hit’s listing, sales have spilled over from ‘other subsidiaries’, it appears that the sale of the shares of the two companies led to the Big Hit share price drop. In particular, in the case of Mainstone, it was possible to make a profit after listing because there was no mandatory holding period. It is noted that the largest shareholder would prefer to sell shares in large quantities, which generates distrust in the public offering securities market.

Mandatory holding period means an agreement not to sell shares held within a specified period on the condition that public offering shares are allocated. The mandatory retention period is established between 15 days and 6 months. Of Big Hit’s total public offering (713 million shares), 78.37% of the amount allocated to institutional investors has a mandatory holding period. This is higher than SK Biopharm’s 52.25% and Kakao Games’ 72.57%. Despite the controversy over overvaluation, it is an analysis that individual investors focused on the big hit due to the high ratio of mandatory holding period.

On the other hand, individual investors bought 550 billion won in sales during the same period and received sales from institutions and foreigners. Expectations that the stock price will hit a low and rebound again appear to have had an impact. In addition, from the 21st, foreign investors have turned to buying.

Lee Ki-hoon, a researcher at Hana Financial Investment, said: “Big Hit’s expected sales this year and next are 860 billion won and 1.5 trillion won. No matter how low, the sales of the second half will not fall below 750 billion won. ” This is very reasonable, but if it gets close to 500 billion won, it will be raised. “

On the other hand, Big Hit decided on the 28th of last month as the public offering price of 135,000 won, the top of the band of hope. The first day it was recorded at 270,000 won, recording a’tasang ‘(twice the starting price + the upper limit price), and it also recorded the upper limit price. Big Hit’s market capitalization reached 12 trillion won immediately after listing, but after six days of trading, the market capitalization fell to 6.143 trillion won, which is half the level.