[ad_1]

Currency traders are trading at Hana Bank’s trading room in Euljiro, Seoul on the 9th. On this day, the won-dollar exchange rate ended 90 before 1113 won to the dollar, which fell 6 won 50 earlier. It is the lowest after January 31, 2019. Reporter Eun-gu Kang [email protected]

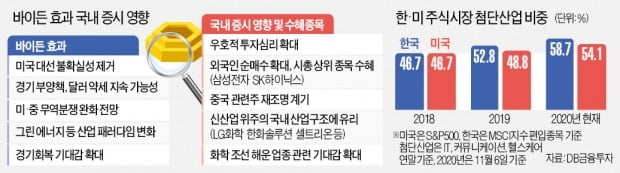

The foreigner has returned. From the beginning of this year to the end of October, he sold about 30 trillion won worth of shares on the stock market and the KOSDAQ market, and began to buy domestic shares beginning in the US presidential election. It is the “effect biden “. This is because the uncertainty about the US presidential elections disappeared. As with the Joe Biden promise, if a full-scale economic stimulus package is implemented, it reflected the expectation that the weak dollar and won will continue to be strong. The fact that stocks, which are seen as beneficiaries of Biden’s policy, are among the top 10 by capitalization of the Korean market, is also a factor that accelerates the entry of foreigners.

Foreigners returning from strong cattle

According to the Korean Stock Exchange on the 9th, as of this month, net purchases by foreign investors worth 2,566.63 billion won (as of 3:00 p.m. on the 9th) on the stock market and the KOSDAQ market. The superficial reason is that if the dollar continues to weaken, at the same time currency exchange gains and gains can be made from rising stock prices. The dollar is expected to continue to weaken as Biden, who will release narrat money and boost the economy, has been elected. It is not known how big the stimulus package is, but the Republican Party also agrees with the stimulus package itself, and experts believe the dollar will continue to weaken for the time being.

The weaker the dollar, the more likely it is that global passive funds, sensitive to currency gains, will flow into emerging markets. Seung-min Yoo, Head of the Global Investment Strategy Team at Samsung Securities, said: “Although the dollar has weakened and the won has strengthened, global funds have not moved out of the United States due to factors such as uncertainty. due to the reappearance of Corona 19 and the unilateralism and protectionism of the Donald Trump administration. ” After the presidential elections, these obstacles are solved one by one ”.

Total Bidnomics beneficiaries

Among emerging countries, Korea has fewer confirmed cases of Corona 19 compared to its population. In addition, the industrial structure is also attractive to foreign investors. Companies from first to ninth in market capitalization are targeting new industries such as bio (Samsung Biologics Celltrion), IT (Samsung Electronics SK Hynix Naver Kakao) and green (LG Chemical, Samsung SDI Hyundai Motors). It is second to none compared to the United States. The share of high-tech industries (IT, communications, healthcare) among the items in this year’s MSCI Korea index is 58.7%, surpassing the share of high-tech industries in the US S & P500. USA (54.1%).

In particular, it focuses on areas that are expected to benefit from the Biden administration’s policy changes. Representative fields are battery and bio. Biden’s main commitment is to shift the energy paradigm towards green energy. On this day, representative battery stocks such as LG Chem, Samsung SDI, and SK Innovation were up 1.94%, 6.81%, and 10.95%, respectively. The share price of Celltrion, a leading biosimilar (generic biopharmaceutical drug), rose 2.70%. Hanwha Solutions, a beneficiary of the solar and hydrogen industries, also emerged.

What to buy when foreigners return

It is also expected to benefit from stocks with higher market capitalization. This is because foreign investors buy entire indices through ETFs, rather than investing in individual stocks. The representative stocks are Samsung Electronics and SK Hynix, which are the first and second in market capitalization. The outlook for the industry is positive as semiconductor prices are expected to bottom out in 1Q12 and rebound.

Economically sensitive stocks are also trembling in anticipation of an economic recovery. Typical examples are the chemical and semiconductor sectors, and the shipbuilding, shipping and aviation sectors that are expected to increase in volume. On this day, the shares of Lotte Chemical (9.20%), Korea Shipbuilding & Marine Engineering (8.69%) and HMM (16.1%), as well as Korean Air (4.81%) and Asiana Airlines ( 7.25%), which had rarely gone up, went up. In the commercial sector, with the expectation of reestablishing the multilateral system, the forecast that the volume of goods will increase even more than before was reflected.

Experts believe that the KOSPI index will continue to rise for the time being. Lee Kyung-soo, Director of the Meritz Securities Research Center, analyzed: “With the power of individual investors, the index rises to the 2400 level and the stock market is very likely to maintain an uptrend until next year if foreign investors help. “

Reporter Jaeyeon Ko / Yerin Choi [email protected]