[ad_1]

The comprehensive tax rate on real estate and the tax rate on capital gains will increase starting next year.

Owners of three or more houses or corporations that own houses must pay a maximum tax of 6%. The transfer tax levied by people with multiple dwellings in the area subject to adjustment also increases by up to 10-20 percentage points (p).

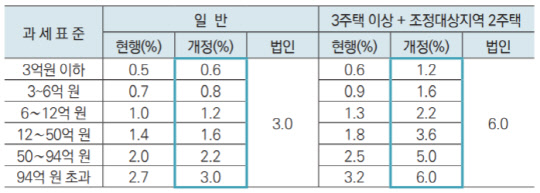

On the 28th, the Ministry of Strategy and Finance published ‘This will change in 2021’. According to the Ministry of Knowledge Economy, starting next year, multi-owners who own three or more houses or have two houses in the area subject to adjustment will be subject to a final tax rate of at least 1.2% up to a maximum of 6% for each section of tax base.

In the case of corporations, the higher individual tax rate of 6% is applied as a single tax rate.

In addition, the upper limit of the tax burden for two homes in the area subject to adjustment is raised from 200% to 300%, and the upper limit of the tax burden for corporations is eliminated entirely. The basic deduction (600 million won) is also scheduled to be removed when calculating the corporate income tax base.

On the other hand, the tax deduction rate for seniors who own a home and a house is raised by 10% p for each section to ease the burden on the real demand of the owners. Those between 60 and 65 years old increase to 20%, those between 65 and 70 years old increase to 30% and those over 70 years old increase to 40%. The combined deduction limit is also raised to 80%.

In the case of transfer tax, the residence period is in addition to the requirements for the special long-term withholding deduction for single-family single-family homes whose actual transaction exceeds 900 million won.

The deduction rate will change from 8% per year for the holding period to 4% for the holding period plus 4% for the residence period.

Additionally, the high tax rate applied when multi-dwelling individuals sell their homes in areas subject to adjustment is 10% higher than before. 2) The transfer tax of 20% p for homeowners (6 ~ 42% for each tax base section) and 30% p for third owner or more is high. The highest transfer tax rate is 62% for 2 owners and 72% for 3 or more owners.

In addition, the number of newly acquired homes next year is included in the number of homes to determine if there is a single or multiple owners in the area subject to adjustment.

When a corporation transfers a home, the tax rate for additional taxes in addition to the corporate tax rate (10-25%) increases from 10% to 20%. The Ministry of Science and Technology explained that “the additional tax rate also applies to rights to acquire housing owned by corporations (membership rights, sales rights), etc.”. Journalist Kim Dong-jun blaams89 @