[ad_1]

Enter 2020.12.15 12:00

In case of violation, the commercial operator 20% tax penalty, the consumer 20% reward

Starting next year, if you pay more than 100,000 won in cash at a beauty salon, dog supply store, gosiwon, or reading room, issuing a cash receipt becomes mandatory. Companies in mandatory issue businesses are required to issue a cash receipt even if the consumer does not request a cash transaction of 100,000 won per transaction. If this is violated, the business operator is subject to an additional tax of 20% of the transaction price. Consumers can receive 20% of the unissued amount as a reward.

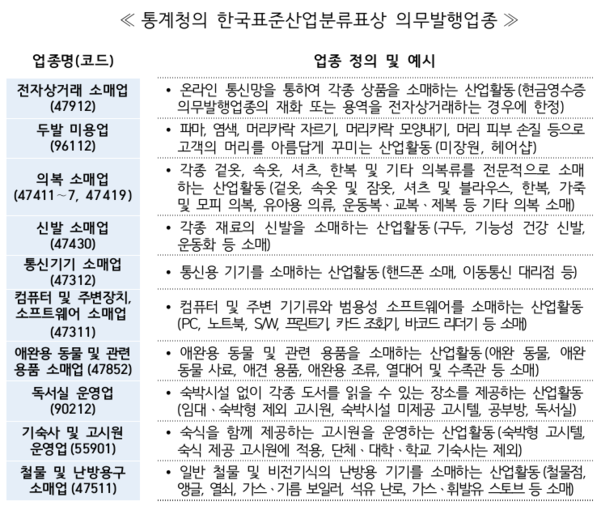

The National Tax Service announced on the 15th that it will add 10 businesses, including e-commerce and retail, to the mandatory issue business. Additional industries include ▲ e-commerce retail ▲ hairdressing business ▲ clothing retail ▲ shoe retail ▲ communication equipment retail ▲ computers and peripherals, software retail ▲ retail of pets and related products ▲ operation of reading rooms ▲ operation of goshiwon ▲ retail of heating hardware and equipment.

A National Tax Service official said: “There are about 700,000 business operators in the new compulsory issuance business based on business registration. However, it is judged based on the actual business, not the business with the symptoms of business registration, so you need to pay attention to the commercial operators in that business. ”He said.

For example, the additional business was marked as a shoe retail business, but if a shoe wholesale business sold shoes to consumers for cash, it would be subject to the mandatory issuance of cash receipts.

The National Revenue Service plans to actively promote the issuance of a business that has joined the mandatory issuance business by sending individual notices of issuance obligations and meetings with business partners to avoid disadvantages due to not knowing the changes.

If a business operator in the mandatory issuance of cash receipts receives the transaction amount of goods or services of 100,000 won or more per transaction (VAT included) in cash, but does not issue a cash receipt, a tax of 20 % on the transaction price. Furthermore, it is a violation of the obligation to issue cash receipts, even if there is an agreement with the consumer not to issue cash receipts at the time of the transaction under ‘conditions of cash transactions and price discounts’.

If a consumer does not receive a cash receipt after conducting a cash transaction of 100,000 won or more per case (including value added tax) with a mandatory issuing business operator, please attach documents confirming the transaction, such as contract, receipt and deposit without bank book, within 5 years from the date of the transaction. You can report the non-issuance through home taxes or by mail.

If the National Tax Service confirms that it has not been issued, a reward equal to 20% of the reported amount of the non-issue is paid to the reported consumer, and the employee may also receive a cash receipt deduction from income. The reward payment limit is up to 500,000 won per transaction and up to 2 million won per year for the same person.

Meanwhile, the issuance of cash receipts introduced in 2005 increased 6.3 times from 18.6 billion won in 2005 to 111.6 billion won last year. The National Tax Service will continue to promote the reporting rewards system and will focus on handling those who violate the obligation to issue cash receipts.