[ad_1]

![[단독] Succession · M & A · External director… National pension plan to intervene in all management](https://img.hankyung.com/photo/202011/01.24429839.1.jpg)

It has been confirmed that the National Pension Plan will introduce a guideline requiring corporate councils to draw up a plan for succession of management rights. It also contains restrictions on the administration’s defenses against hostile merger and acquisition attempts. It is the norm for the national pension, which is difficult to find anywhere in the global pension fund.

According to the administration and investment industry, on the 15th, the Ministry of Health and Welfare and the National Pension Service are preparing “ standards for the composition and operation of the directory of companies that invest in the National Pension Fund ” ( guidelines for the board) with the objective of a resolution of the Fund Administration Committee within this year. It was informed by the Fund Management Committee held on July 31 and was suspended. Kim Yong-jin, president of the National Pension Service, said at the World Economic Research Institute conference on the 9th that he will publish these guidelines soon.

The guidelines are made up of 10 basic principles and 20 detailed principles. This is a detailed guide to the governance structure, such as the board of directors, that the National Pension Service requires of investment firms. First of all, it is a “recommended matter”, but not following it suggests that the National Pension Plan will engage in “shareholder activities for management participation.” This means that it is really binding. There are only 300 national companies that are publicly traded with a stake of 5% or more in the National Pension Service.

![[단독] Succession · M & A · External director… National pension plan to intervene in all management](https://img.hankyung.com/photo/202011/AA.24429738.1.jpg)

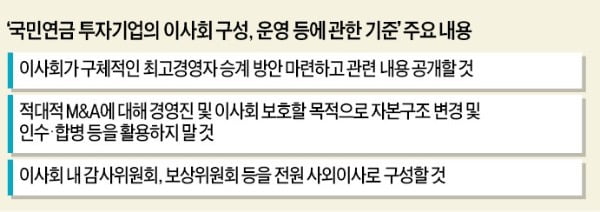

Controversial regulations of the guidelines are: △ The board of directors shall formulate and disclose a specific succession policy for top management △ Do not use changes in capital structure and mergers and acquisitions to protect management or the board of directors against hostile takeovers △ The audit committee and the compensation committee within the board of directors will be composed of external directors.

In response, an administration official said: “The National Pension Plan will be deeply involved in administration activities, such as succession of administration rights and defense of administration rights against hostile merger and acquisition attempts.” . May result in product exposure. “

Some point out that this guideline is too specific compared to related regulations for pension funds abroad. Global pension funds, such as the California Public Employees Pension (CalPERS) and the Netherlands Public Pension (ABP), only have principled guidelines for corporate governance. It means that you will disclose only the general principles in consideration of various business environments and will participate flexibly in the activities of shareholders.

Controversy over the guidelines of the Board of Directors of the National Pension Plan

The “ Rules for the composition and operation of the board of directors of an investment company of the National Pension Fund (hereinafter, the Board of Directors Guide) ” were introduced in July 2018, amid opposition from the administration code (principle of fiduciary responsibility), which is a fundamental principle of shareholder activity. It is an extension of the guidelines for the active rights of shareholders approved in If the systems introduced previously outlined an ‘overview’ of the general principles and procedures related to the activities of shareholders of the National Pension System, it was evaluated that the guidelines for the board of directors to achieve this contained ‘details’ related to corporate governance.

These guidelines were initially scheduled to be released in the first half of last year. However, it was delayed for more than a year as work on preparing advance guidelines of a more general nature, such as the guidelines for the rights of active shareholders, was delayed due to a backlash from the management community. This year’s last National Pension Fund Management Committee will be held next month. The Ministry of Health and Welfare and the National Pension Plan plan to present a final draft of the guidelines that will soon be approved later this year.

The management community has expressed concern about the implementation of the guidelines. This is because it is interpreted to mean that the national pension for the ‘whale in the pond’, which is larger than the national economy, will fully participate in the corporate board of directors. There are more than 300 national companies that are publicly traded with more than 5% participation in the National Pension Service. There are more than 100 companies listed with 10% or more. The National Pension Guidelines, referred to as the “overlord” of the capital market, do not have as much influence as the investment share of the national pension. National and foreign institutional investors also tend to follow the rules and judgments of the national pension. There is also a concern that the national pension may be an image of a company that will become a “target” of shareholder activities.

Not only the regulations that oblige the board of directors to prepare a succession plan in advance are criticized, but also the regulations that restrict the defense of management rights against hostile acquisition attempts. The new interim guideline for the board of directors is to “ protect the management or the board of directors, by issuing securities or new shares that can be converted into shares (such as convertible bonds) to change the capital structure of the company. , Contains the content that the means of management should not be used.

In this regard, a corporate finance executive said: “It seems plausible at first glance, but actually there is a high possibility that it will violate management activities to improve financial structure or corporate restructuring.”

For example, KDB’s recent support for the Hanjin Group acquisition of Asiana Airlines can also be interpreted as a misstep under the National Pension Guidelines. In the financial industry, the Korean Development Bank provided funds to Hanjin Kal, which is a dispute over management rights between the tripartite alliance focused on KCGI (Fortress Subsidiary Fund) and Hanjin Group chairman Cho Won-tae . The proposal to take over this Asiana Airlines is promising. Such financing is noted as a “ backup measure ” to revive the aviation industry from the government’s point of view, but is noted as going against the guidelines in that it can protect the interests of the airline. current administration in the event of a dispute over administration rights.

Some believe that the national pension will be an opportunity to fully participate in business management. After finalizing the guidelines for the board of directors, the National Pension Plan plans to create a pool of external director candidates to require companies to nominate external director candidates as part of the exercise of management participation shareholder rights. . For this reason, criticism has emerged that the “government spokesperson” can occupy a seat on the corporate board of directors.

A company official said: “The National Pension System is an entity that makes independent judgments, but it is very likely that it is politically contaminated because it is an opportunity to provide food to hundreds of people in power.” A management official also said: “Is it possible to trust the independence of the people selected by the National Pension System, who have not assured their independence from the government?

Reporter Hwang Jeong-hwan [email protected]