[ad_1]

(1) Declaration of ‘defect’ of the symbolic company of excellence in semiconductors

(2) Huge funding → leading to irresponsible management

(3) When the Communist Party is in trouble, it takes control of the Communist Party directly

At the YMTC plant in Wuhan, China in 2018, Xi Jinping (left), Chinese President Xi Jinping (center), walks the semiconductor production line with Zhao Wei Guo (center), president of Tsinghua Unigroup and Yang Shuning ( right) CEO of YMTC. / Photo = Tsinghua Unigroup

On the 9th, Tsinghua Unigroup (紫光 集團, Tsinghua Unigroup), which has been considered a symbol of the advancement of Chinese semiconductors, declared a default (default) again while a serious liquidity crisis continued. It was not possible to repay the corporate bonds that had matured again from last month.

In particular, this default is more serious than last month, since corporate bonds issued abroad, that is, bonds denominated in dollars with a high proportion of foreign investors. That is why the analysis suggests that the possibility of a chain default in the future is even higher.

For this reason, Tsinghua Uni’s corporate bonds listed on the Hong Kong Stock Exchange the day after the declaration of default were immediately suspended. Other corporate bonds issued by Tsinghua Uni and listed on the Hong Kong Stock Exchange also plunged more than 90% on concerns about the chain’s defaults.

Not only this. Tsinghua Uni announced via the Hong Kong Stock Exchange that separate corporate bonds worth $ 2 billion in additional maturities in the future also pose a default risk. In fact, the fate of the company is in the middle of a hundred.

Declaration of ‘defect’ of the symbolic company of semiconductor growth

Tsinghua Unigroup is a 51% -owned memory semiconductor specialty design and manufacturing company owned by the prestigious Tsinghua University, where Chinese President Xi Jinping (習近平) appeared.

Tsinghua Uni, which was founded in 1988 as Tsinghua University Science and Technology Development Corporation and established in 1993 as its current name, has NAND flash memory manufacturer Yangtze Memory (YMTC) and chip design company UniSOC mobiles. It is counted as a symbol of the ‘Japanese island)’.

According to the Chinese government’s ‘Semiconductor Industry Development Promotion Guidelines’, which announced that it will achieve 40% semiconductor self-sufficiency in 2020 and 70% in 2025 by investing 1 trillion yuan (about 170 trillion won), the world’s top three memory semiconductor companies for $ 23 billion. In 2016, it took over from Micron in the US and SanDisk, which makes NAND flash, but has a history of being broken by US government controls.

No matter how much money you invest, Samsung Electronics(73,400 + 0.69%), SK Hynix(115,500 -0.86%)The technological prowess of global memory semiconductor companies such as Micron and Micron was deemed difficult to pursue, so we bypassed the M&A strategy, but it was unsuccessful due to competitor governments’ controls.

In April 2018, President Xi Jinping visited YMTC, which was pushing for the construction of a NAND flash memory factory in Wuhan, Hubei province, for the first time on a visit to a semiconductor factory, saying, “We must hurry to achieve a breakthrough in semiconductor technology and reach the highest peak in global memory semiconductor technology. “He emphasized. After the merger and acquisition failed, he visited the Tsinghua Uni plant, a symbol of semiconductor excellence, and beat it again.

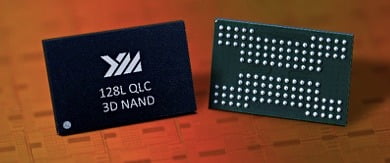

A 128 layer NAND flash advertised by YMTC. / Photo = Tsinghua Unigroup

Even after two years, the performance remains unclear. Although we are mass-producing some 256GB class NAND flash based products based on 64-layer 3D NAND, the performance compared to the amount of investment is still poor, so it is far from generating revenue.

In the past, Tsinghua Uni announced a plan to build a DRAM semiconductor production plant in Chongqing’s Yangjiang New District by investing several trillion won in financing and to start mass production from 2021, but from then no news has been delivered.

During this period, Chinese semiconductor companies are shedding huge amounts of money. In fact, investment by Chinese semiconductor companies amounted to 60 billion yuan (1.0 trillion won) in January and July this year alone. At double the level of the same period last year, this is mostly money from local governments. However, China’s semiconductor self-sufficiency rate is only 15.6%.

Operation shift … Managed directly by the Chinese government?

For this reason, it is analyzed that the Chinese government, which has grown the semiconductor industry by entrusting corporate management to the private sector and financing from behind, is changing to a strategy to directly grow the semiconductor industry through the nationalization and management control before the change of US regime. It means that the Communist Party is going to change it in a way that directs people to send and manage.

In fact, China’s National Development and Reform Commission said in July that “companies without experience, technology or manpower are entering the semiconductor industry and local governments are blindly supporting it.” I will be reprimanded if I do, “he warned.

Chinese semiconductors are in a state of large-scale bad news, such as sanctions from the US government.Since mid-September, Huawei has been unable to buy semiconductors developed and produced with American software and technology. SMIC, China’s largest foundry (semiconductor consignment production), is also astonishing, as it is on Huawei’s blacklist. This is because we are not receiving investments because we are not manufacturing products correctly.

On the 11th of last month, Tsinghua Uni announced that Long Dawei, the secretary of the state-owned Tsinghua Holdings, would participate in the management of the company. In June, the state-owned Yanggang Industrial Group announced that it will participate as a new shareholder with a 33% stake. In combination with Tsinghua University and Yanggang Industry, the Chinese government’s stake in Tsinghua Uni increases to 66.6%.

Another Chinese semiconductor company, Wuhan Hongshin Semiconductor Manufacturing (HSMC), which aimed to develop a high-tech 7-nanometer (nm) process, was acquired by the Dongxihu District Government, Wuhan City, due to financial difficulties. Since its inception in 2017, it has raised expectations by hiring several TSMC employees, but the R&D did not proceed as planned. More than 20 trillion won of funds provided by local governments in China are known to have been airlifted due to such failure.

Reporter No Jeong-dong Hankyung.com [email protected]

Ⓒ Hankyung.com prohibits unauthorized reproduction and redistribution