[ad_1]

![On the 16th, an Asiana Airlines plane moves in front of a Korean Air plane on the Gimpo International Airport apron. The two airlines found that 48 of the international routes in service overlap. [뉴시스]](https://pds.joins.com/news/component/htmlphoto_mmdata/202011/18/2fe57f83-3c9c-463a-87d3-524b8e4f9b0e.jpg)

On the 16th, an Asiana Airlines plane moves in front of a Korean Air plane on the Gimpo International Airport apron. The two airlines found that 48 of the international routes in service overlap. [뉴시스]

The acquisition of Asiana Airlines by Hanjin Group has begun. As the launch of a uni-national airline is in full swing, internal Korean Air and Asiana Airlines employees who are concerned about the workforce restructuring are stepping up.

Korean Air begins the Asiana acquisition process

Saneun, 3 outside directors, nominated for auditors

500 billion won fine if agreement is violated

48 of 115 international routes of both companies overlap

“70% of our employees are on leave of absence.

Hanjin Kal, the holding company of Hanjin Group, signed an investment agreement with KDB Development Bank, Asiana Airlines’ main creditor, on the 17th. The agreement includes the business content and management of Hanjin Kal. The main point is that the Korean Development Bank monitors and controls Hanjin Kal’s management, and if he violates it, Hanjin Kal will bear a 500 billion won fine and liability for damages. In particular, the obligations specified in the agreement are ▶ Appointment of three external directors Han Jin-Kal and members of the Audit Committee appointed by Saneun ▶ Responsibility for the establishment and operation of the Ethics Management Committee ▶ Cooperation with the Evaluation Committee of the Korean Air management and management ▶ After mergers and acquisitions AND Asiana) Establishment and implementation of an integrated management plan ▶ Provision of guarantees for Korean Air shares and restrictions on sale. In the end, it meant that the Bank of Korea was deeply involved in the management of Hanjin Kal, so the bank could not escape responsibility for the misconduct of the Hanjin Kal management in the future.

The deal also included the provision of Hanjin Kal shares (6.54% ordinary shares and 0.53% preferred shares) held by Hanjin Group Chairman Cho Won-tae as collateral for the KDB. An airline industry official who requested anonymity argued that “providing all of President Cho’s actions as collateral will be a safeguard against breach of key terms of the commitment.”

‘Beautiful People’ in history in 34 years

Korean Air plans to acquire Asiana Airlines early next year, operate it as a subsidiary, and integrate it within a year or two. Consequently, already in 2022, the name of Asiana Airlines disappears in history after 34 years of its founding.

As the acquisition operation accelerated, the two airlines found themselves in an extremely disturbed atmosphere.

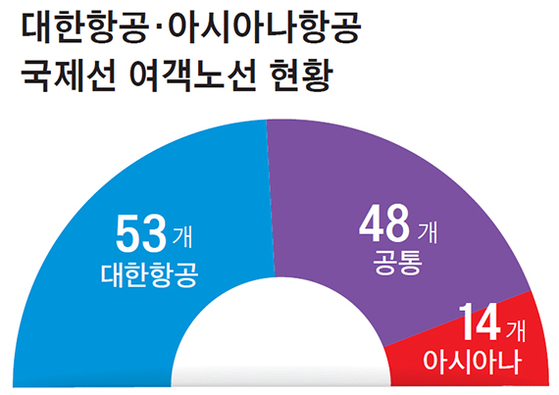

Current status of international passenger routes

Employees of both companies are especially concerned about large-scale restructuring. Both Korean Air and Mt. are drawing lines for artificial restructuring, but the industry view is that once the integration work begins in earnest, route and workforce restructuring is inevitable. Both companies have a total of 115 international passenger routes. Of these, 53 routes only served Korean Air and 14 routes only served Asiana. Excluding this, the remaining 48 routes (42%) are in operation with Korean Air and Asiana Airlines, so adjustments are inevitable.

Kang Seong-jin, an analyst at KB Securities, said: “As this is a private company, shareholders and employees may or may not have different understandings about the restructuring.” What to do, ”he said.

Asiana portrait book, Korean Air also from Sungsung

Asiana Airlines, the target of the acquisition, has the atmosphere of a portrait house. An Asiana Airlines official who requested anonymity said: “Saneun has been confirmed that there will be no restructuring on Hanjin Street, but due to the aftermath of Corona 19, approximately 70% of its employees are on leave.” “Obligation to maintain employment in accordance with the conditions of support to the Infrastructure Stability Fund” I do not know how the situation will change if it ends next April. An Asiana Airlines flight attendant said: “It was the wish of the employees that it would be good to avoid taking over the same industry (there is the possibility of overlapping routes and labor). Now, there is a spread within company that we need to find a job change as soon as possible. ” And conveyed the inner atmosphere.

Korean Air’s Largest Union “Consensus to Take Over” vs. Pilot-Asiana Union “Opposite”

Another employee complained: “When HDC Hyundai Development Co. takes over, it was discussed how the Asiana name could be kept.”

Korean Air, the subject of the acquisition, is not like a party atmosphere. Among executives and staff members, the atmosphere prevails that “the restructuring of Asiana Airlines is something that Asiana must solve, but Korean Air cannot be harmed by the acquisition.” The number of Korean Air employees (about 18,000) is double that of Asiana Airlines (about 9,000), but if overlapping long-haul routes are integrated and closed, and saturated short-haul and domestic routes are adjusted , Korean Air personnel will also be free from restructuring. Because I can not. A Korean Air official said, “The flight attendants and mechanics were proud that the class is different” compared to Asiana Airlines. “The decision to take over will be on the same level as Asiana Airlines. There is also a voice saying which is something “.

The problem of “no-no-conflict” has also arisen after the merger of the two main airlines. On the 17th, the Korean Air union, which includes Korean Air cabin crew members and office workers, issued a statement saying that it respects Hanjin Group’s decision to take over Asiana. The Korean Air union is the largest Korean Air union, consisting of 11,679 employees (as of August) in all occupations except pilots. The union said: “I agree that this decision was to increase the competitiveness of the air transport industry, which is the national infrastructure, and solidify the value of existence,” and said: “This acquisition is the best option for maintain employment of aviation workers. ” “The government and management of both companies will have to make clear the promise of job security for workers who are trembling with job insecurity.” The union also emphasized that “the highest priority of workers is not to protect the rights and interests of creditors and shareholders, but to stabilize employment” and “we will not tolerate any action that harms them.”

On the other hand, the remaining five unions, including the Korean Air Pilots Union, the Korean Air Employees Solidarity Branch, the Asiana Airlines Pilots Union, the Open Pilots Union (Asiana) and the Asiana Union, they opposed the Hanjin Group’s acquisition of Asiana Airlines and demanded the formation of a labor management council. They said: “The opinions of the workers of both companies were excluded”, and insisted: “Please give the responsibility of the managerial failure to the workers and stop the political and political battles to solve with the national blood tax.”

Reporter Kwak Jae-min [email protected]

[ad_2]