[ad_1]

Flags waving at Samsung Seocho office 〈This article will be available on October 25, 2020 at 3:30 p.m. It is shipped in advance for the convenience of customer production and should never be used before. (Seoul = Yonhap News) Reporter Hae-in Hong = Samsung Group Chairman Lee Kun-hee, representing the Korean business community, passed away at the Samsung Medical Center in Ilwon-dong, Seoul on the 25th. 78 years . It has been 6 years since he collapsed at his home in Itaewon-dong, Yongsan-gu, Seoul in May 2014 due to an acute myocardial infarction. The photo is the Samsung Electronics Seocho office building in Seoul that day. 2020.10.25 [email protected] (End) 〈Copyright (c) Yonhap News, Unauthorized reprint-redistribution prohibited〉

The death of Samsung Chairman Lee Kun-hee on the 25th marked a change in the governance structure of the Samsung Group. Samsung Electronics’ son Lee Jae-yong, vice president of Samsung Electronics, will assume the “key” of the group, but there aren’t many tasks until the governance structure is reorganized and the succession is completed.

Equity structure of Samsung subsidiaries and share price outlook

Jaeyong Lee → Production → Life → Electronic Structure

Affected by the C&T and Cheil Industries merger lawsuit

In the case of the ‘3% insurance rule’, electronic shares must be sold.

Market touch on stock price flows like Samsung Electronics

Under the Fair Trade and Monopoly Regulation Act (Fair Trade Act), the total number of Samsung Group is already Vice President Lee. In April 2018, the Fair Trade Commission changed the same person (total number) from the Samsung Group from the late Chairman Lee to Vice Chairman Lee. ▶ After President Lee’s illness, Vice President Lee’s decision led to major organizational changes, such as the merger of Samsung C&T and Cheil Industries, and the dissolution of the Office of Future Strategy. ▶ In February 2018, the Supreme Court ruled that Vice President Lee was the de facto head of the Samsung Group. ▶ We learned that Vice Chairman Lee has the largest stake in Samsung C&T, which is the highest in the governance structure of the Samsung Group.

In the FTC’s view, Samsung C&T is at the top of the Samsung Group governance structure. In fact, it acts as a holding company. The merger between Cheil Industries and Samsung C&T in 2015 further strengthened this structure. Samsung C&T’s largest shareholder is Vice Chairman Lee, who owns a 17.33% stake. Hotel Shilla Chairman Lee Bu-jin (5.55%), Samsung Welfare Foundation Chairman Lee Seo-hyun (5.55%), the late Chairman Lee (2.88%) and other family shares , along with 33.4% of family-owned Samsung C&T.

But there are big variables in each of these governance chains. First, a lawsuit is underway to determine whether the merger between Samsung C&T and Cheil Industries violated the law. The prosecution believes that the melt index was calculated in favor of Vice President Lee, who had no shares in Samsung C&T and owned a 23.2% stake in Cheil Industries. The post-merger governance structure may also be affected by the court’s decision in the future.

There are also big variables in the governance structure that lead to ‘Samsung Life → Samsung Electronics’. This is due to the revised bill of the insurance industry law, also called ‘Samsung Life Insurance Law’. Additionally, Democratic Party lawmaker Park Yong-jin proposed an amendment to change the ‘current market price’ of shares when calculating the asset ratio of an insurance company. After passing the National Assembly, Samsung Life will be subject to the ‘3% rule’, which requires holding shares of major shareholders or affiliates only within 3% of its total assets. It means that a significant portion of Samsung Life’s 8.5% stake in Samsung Electronics should be sold.

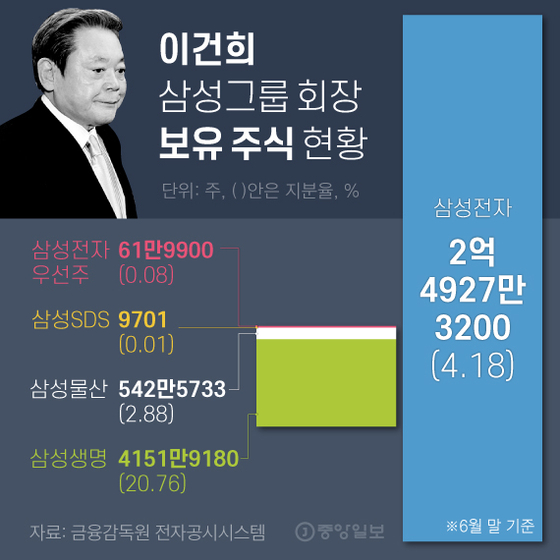

Share status of Samsung Group Chairman Lee Kun-hee. Graphic = Younghee Kim [email protected]

If this happens, the governance structure leading to ‘Vice President Lee → Samsung C&T → Samsung Life → Samsung Electronics’ may be broken. To change this composition to ‘Vice President Lee → Samsung C & T → Samsung Electronics’, a major reorganization is inevitable. Lee Sang-heon, a researcher at Hi Investment & Securities, said in the report: “Since Samsung C&T owns a 43.4% stake in Samsung Biologics, it can sell its stake in Samsung Biologics to Samsung Electronics and buy a stake in Samsung. Electronics owned by Samsung Life “.

One possible scenario is the conversion of a holding company that Samsung promoted and closed in 2016. However, not only financial resources, which is the biggest problem, but also issues to consider, such as the revision of laws, the reorganization of related organizations and the opposition of other shareholders, they are not one or two.

Interest is also being drawn by the move in shares in Samsung Group, including Samsung Electronics. Many experts believe that the possibility of a sharp fluctuation in the Samsung Electronics share price at this time is small. Kim Ji-san, director of the Kiwoom Securities Research Center, noted, “Because this vice president system has been in place for a long time, I don’t think it will affect the share price or future business performance.” Kim Yang-jae, a researcher at KTB Investment & Securities, said: “Because the National Pension System and the funds of many individual investors are pooled together to play the role of ‘nationalists’, the possibility of hostile mergers and acquisitions is also minimal “.

However, the share price of individual subsidiaries may be affected by the overall governance structure of the group or by inheritance tax. An analyst who wanted to remain anonymous said: “It is necessary to organize the bets among the family, focusing on Vice President Lee.” In this process, the share price may fluctuate depending on the interests of the affiliates.

Reporters Jo Hyun-suk and Jang Won-seok [email protected]

[ad_2]