[ad_1]

In the early 2010s, the theme of housing 2030 was actively publicized. In December 2013, a group of young people held a press conference calling for a public housing policy for the housing poor. Provided by Slug Union

“It’s hard for me to get into Happy House, but I don’t know who 2030 is.” Mr A (31) felt deprived of ‘Youngcle 2030’, which recently appears mainly in the media. After living in a studio with a deposit of 10 million won and a monthly rent of 500,000 won, she recently won the Happiness House, a public rental housing for young people, but is hesitant to move due to housing expenses. Happy houses with good living conditions in the form of apartments have a low monthly rent of 200,000 won, but there is a deposit of close to 100 million won. For youth who have no assets, 80% of the deposit, up to 70 million won, is provided at low interest rates of 1.5 ~ 2%, but the interest on the loan is more than 100,000 won per month. Adding the administration fee of 80,000 ~ 100,000 won, the monthly cost of the house is approximately 500,000 won. Her monthly salary is barely above the minimum wage (as of 2020, monthly salary of 1.75,310 won). Regarding spending a third of his income on housing, he said: “I lived in a house in residential poverty where I could do nothing but sleep at home, but it was very difficult.” “If this is the cost of living in an apartment, it is true that the cost performance is good. But it is rare. It is a public lease introduced for the poor in housing, why is it still expensive for me? ”. For Mr. A, who gave up the living environment to save housing costs, gave up housing cost savings for the residential environment, and always had to live an alternative life in the private rental market, public rent is also a solution to catch both rabbits. I can not. ‘Hell, Ok, High School 2030’, which publicly discussed the housing issue of young people living in non-housing standards such as the underground basement, rooftop room, and Gosiwon, created a public rental housing for youth and a youth-only public rental policy, but there is still a long way to go. . The problem is that the ‘Youngcle 2030’, which appears as a regular in recent real estate articles, is absorbing the problem of the ‘house’ of the young generation like a black hole. Within the young generation, discussions are beginning about the side effects that occurred when ‘Hell Go 2030’ returned to ‘Young Cull 2030’. They pay special attention to the problems of real estate engineers who have presented ‘Young Kook 2030’.

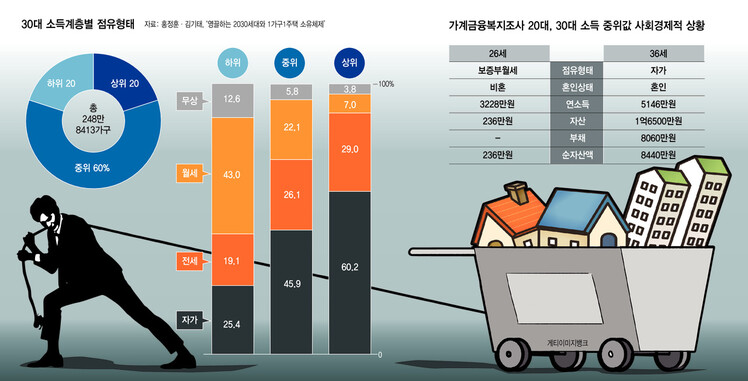

Unreasonable spirit? Accumulate assets of the class with sufficient purchasing power

According to a thesis written by researcher Jeong-Hoon Hong and Ki-Tae Kim of the Korea Urban Research Institute (‘Great Homes 2030 and a Home, a Home Ownership System’), those featured in the recent article on Real estate such as a ‘Young 2030’ case are between 30 and 30 years old, If you have been hired, it is likely that you have accumulated assets while doing business for almost 10 years. Examples of real estate items were those that had a cheonsei deposit of 300 million won or more as net assets, or a pair of regular workers who could repay the principal and interest on a home loan of approximately 2 million won per month. These are far from the 2030 ‘average’ drawn by the two researchers through the Household Financial Well-being Survey from the National Statistical Office. The “ median price ” for 20-somethings was 32.8 million won per year, with no debt and only 2.36 million won in net worth, while those in their 30s had an annual income of 51.4 million won. won, a debt of 80.6 million won, and a net worth of 84.4 million won. The top 20% of households had an annual income of 93 million won and a net worth of 280 million won. The ‘boring young 2030’ featured in real estate is most likely the top 20% group. The two researchers said: “The reality of Young-Kul 2030 is not an unreasonable panic purchase for the entire young generation, but rather an unreasonable home purchase by the top 20% of households that have accumulated income and assets. It is also possible to buy a house for the above amount. “The papers written by the two researchers will be presented at the Conference of the Social Policy Alliance on the 27th.

Regression of the housing right to property in the myth of the creation of a house

At the ‘Expansion Discussion on the Supply of Public Rental Housing’ held in the National Assembly on 19, when the government’s pre-generation plan was announced, Jung Yong-chan, an activist from the Min Slug Union, announced that ‘Increase the rent public and increase the possibility of burden to alleviate youth poverty in 2030. The Slug Union, which was created in 2011, is a representative residential organization that youth parties in 2030 put the theme of ‘youth residential poverty’ in the social agenda. In his presentation, activist Jung wrote: “Although some young generations who are about to own their own staircases worry about the stairs, most young people live exposed to poor residential environments as tenants.” As a result of a survey of 152 university dong houses in Gwanak-gu (62,683 people, 13.6%), where the largest one-person youth home this year, 51.3% (78 houses) were illegally reused or illegally extended or renewed. It was a building. The buildings in violation are not even transferred to the home.

※ Click on the image to enlarge it.

Activist Jung said in a call with and said: “The ‘Young Klo 2030’ in the real estate article is not a representative of a young man, but rather a young man with a vested interest in real estate who sees the house from the point of view of property instead of a house ”. “The image of the young generation of ‘youth without assets'” Only used to strengthen vested interests in real estate. ” Last month’s ‘Reviews on Young-Kul’s Speech 2030’ posted by Seung-Woo Gu, a researcher at the Shinchon Cultural Policy Research Group at the ‘Seoul Youth Association 2020’ organized by the Youth Housing Consultation Center of Seoul, also pointed out that real estate items use 2030 homes as a tool. . As a result of an analysis of 707 articles related to ‘Young Klo 2030’ from August 2019 to October 14, 2020, “many articles showed a tendency to use the Young Klo phenomenon as material to convene the phenomenon of the failure of Government policies”. Said. Researcher Koo said: “In Korean society, there is a side that focuses on buying a house, like providing a house, but it could become housing rights rather than being owned by youth housing organizations. As mentioned, social discussions focused on the right to housing have disappeared and are returning to debates on property-oriented housing prices ”.

The Third Leasing Law is a device to alleviate inequality between landlords and tenants.

Following the former researcher’s presentation, Jeong-Hoon Hong, a researcher at the Korea Urban Research Institute, took an interesting approach to comprehensive property tax and the three rental laws, which faced fierce opposition from landlords. He considered the strengthening of the taxation tax and the strengthening of the rights of tenants as devices to alleviate inequality between generations. By 2030, the final tax is “the regulation of households that dominate the city (multiple owners)” and the Third Leasing Law is “a means to counteract established households (owners) that have taken over the city.” He pointed to Korea’s ‘One Home Ownership System’ against the backdrop of a flood of real estate articles focusing on ‘Young Kul 2030’. Korea fully supports asset formation through landlord disposal. 1 The owner is exempt from the transfer tax in its entirety, regardless of how much the market earns for the price of less than 900 million won. The cheonsei system is a major reason for triggering the rise in business prices, and the difference in market tax gains for homeowners is far greater than the effect of home stability enjoyed by renters. Researcher Hong said: “Most 2030 households can no longer buy houses from older homes that already occupy the central parts of the city.” “As real estate engineers focus on the needs of a small elite group who want to buy houses, the annual salary is 1” The object and purpose of public housing policy are undermined, as is the concept of middle-class leasing that falls under the public leasing policy, which is required to provide public housing benefits up to KRW 100 million or more and return to the vulnerable. “After the flood of real estate related to the cheonsei crisis, where The class lived on a Cheonsei basis of hundreds of millions of dollars, in the end, the government devised a measure to supply multi-family housing with a unit construction cost of 600 million won through public jeonse. However, the real estate engineers were They cling to saying, “There is no apartment.” By Jin Myeong-seon, Staff Reporter [email protected]

[ad_2]