[ad_1]

The door to Optimus Asset Management’s office in Samsung-dong, Seoul, is closed. The Financial Oversight Service announced on the 11th that the estimated recovery amount as a result of due diligence from the Optimus Fund of the accounting firm Samil is only 41.3 billion won to 783 billion won. / yunhap news

At least 430 billion won was found to have disappeared from the Optimus Fund, which has investments of 500 billion won. As a result of the fund’s due diligence, the recoverable money was only 40 to 70 billion won. This is the result of the main culprit of the Optimus fraud, and the investor’s money stolen. The amount they deducted by check was 87.8 billion won. It was discovered that there was little to salvage from the real estate, stocks and bonds from which the Optimus Fund’s funds flowed. Experts analyze that they only targeted poor investment destinations to facilitate the withdrawal of funds from the fund.

○ Unidentified 87.8 billion won per check

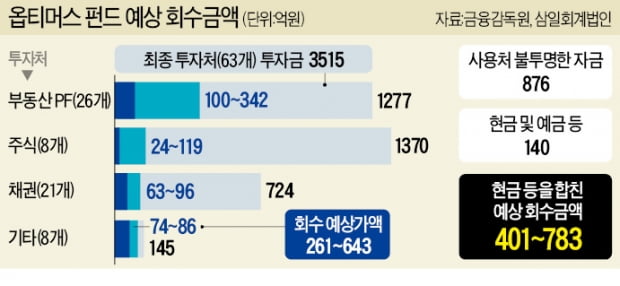

On the 11th, the Financial Supervision Service announced the results of the accounting due diligence of the Optimus Fund carried out by the Samil Accounting Firm for four months. As a result of due diligence, the recoverable amount was only 78.3 billion won (15.2%), from a low of 40.1 billion won (recovery rate of 7.8%) to a 5146 billion won maximum that fund subscribers deposited into 46 Optimus funds.

Optimus Asset Management created a fund that said it would invest in accounts receivable from secure public institutions and, in fact, invested in various real estate and stocks through numerous insolvent private companies. Samil Accounting Firm was able to confirm the final investment of only 351.5 billion won from the fund’s capital. The rest disappeared without a trace in the process of closing the fund. The Optimus bands were withdrawn by check and the amount of unused funds amounted to 87.8 billion won. An official from the Financial Oversight Service said: “We know that a lot of funds have been lost due to investment in futures and interest expense of Optimus Management CEO Kim Jae-hyun.”

Samil Accounting Corporation estimated the recovery rate through due diligence on the possibility of taking bond preservation measures, securing a collateral, and analyzing project progress and recovery risk for 63 final investment destinations where 351.5 billion were invested. of won. By type of investment, the Real Estate Project Finance (FP) business is worth 127.7 billion won, stocks 137.0 billion won, bonds 72.4 billion won, and another 14.5 billion won. . Among them, grade C, which is difficult to collect as a result of due diligence, accounted for the majority at 2.927 billion won (83.3%). Total recoverable A rating (4.5 billion won) and some recoverable B rating (54.3 billion won) were only 16.7%.

○ “Deliberately targeting poor investments only”

Most of the funds invested in real estate and stocks have evaporated. The Optimus Fund invested 127.7 billion won in a total of 26 FP real estate projects. Among them, the maximum amount of money that could be saved was found to be 10 billion won to 34.2 billion won. It is known that the Gumi Used Car Sales Complex (15.9 billion won) and the Konjiam Bonghyeon Logistics Complex (8 billion won) cannot get a penny back. An official from Samil Accounting Firm explained that “the amount of funds invested in projects that have not been approved for development or have been delayed due to non-payment of the balance amounts to 68.6 billion won.”

Most of the 137 billion won in the equity fund also evaporated. This is the result of investing primarily in companies that have been delisted or are in the process of being retired, such as Seongji Construction Haeduk Powerway Skin & Skin. Of the 72.3 billion won invested in bonds, it is estimated that the amount raised will not reach 10 billion won. Funds invested in Sungji Construction alone exceeded 100 billion won.

The reason the number of recoverable assets is so small is that the Optimus party was only targeting bad investment destinations from the start. Management industry experts say the purpose is to withdraw funds easily after investing or borrowing funds. One fund manager said: “The Optimus group has chosen only those places where common sense cannot convince and invest. It seems they were only targeting insolvent companies or limited partnerships in KOSDAQ to withdraw funds after burning money.

Reporter Cho Jin-hyung [email protected]

Ⓒ Hankyung.com prohibits unauthorized reproduction and redistribution