[ad_1]

Photo = Yonhap News

Starting next year, a single homeowner with a common name will be able to receive a tax credit by paying comprehensive real estate tax. Opposition parties and the Ministry of Strategy and Finance are interpreted to have accepted the point that the deduction for elders and long-term tenure is given to only one owner, which is reverse discrimination and goes against the trend. of the times.

The government belatedly admitted ‘0.5 + 0.5 = 1’

According to the National Assembly and the Ministry of Strategy and Finance on the 30th, the ruling and opposition parties tentatively agreed to review the tax law in the direction of applying the tax credit for seniors and long-term holdings to single-owner residents .

Currently, the tax deduction for seniors and long-term tenures is provided only to one household and one owner in the tax law. It was interpreted by the tax authorities that “a couple owned by half a home does not correspond to a house.” This has been criticized for violating the tax principle and countering the trend to broaden the scope of recognition of women’s property rights.

Representative Yoon Hee-suk reflected this and proposed an amendment to the tax law on November 2 to expand the tax credit for seniors and long-term holdings to a common home. The bill also included increasing the tax base for one homeowner from the current 900 million won to 1.2 billion won in the same name as the couple. Among them, the opposition parties agreed to apply the tax credit for seniors and long-term tenures only to a head of household with a common name, and decided to exclude the content of raising the tax standard of the tax for a single head of household.

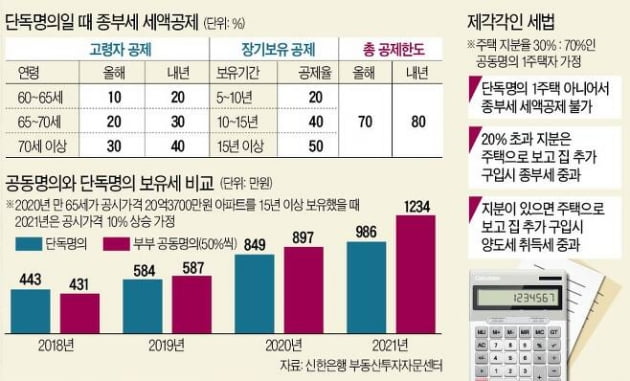

If the revised bill passes the National Assembly, it is noted that the tax amount for a jointly named house will be slightly reduced next year. This year, the tax deduction rate for people aged 60 years or older was 10-30% depending on age, and the long-term withholding deduction rate for 5 years or more was applied from 20-50% depending on the retention period. The combined deduction limit for the two deductions will increase from 70% this year to 80% next.

In addition, on the 30th, the Democratic Party and the government decided to eliminate discrimination between the joint name of the couple and the unique name in relation to the comprehensive property tax credit (deposit tax). This is interpreted as a measure to address the complaints of co-filers, whose tax burden has increased more than that of single deputies. Analysis that the Democratic Party and the government took a step back by showing signs of contagion to the fiscal resistance movement, mainly in some online cafes. However, many point out that it is not easy to completely solve the fiscal pump problem unless the government fundamentally changes the direction of housing policy.

The government changes its position as it spreads due to fiscal resistance

For reasons of fairness, the government has been in the position that it cannot grant tax deductions to co-filers. This is because the total basic tax deduction for the first co-nominee is 1.2 billion won, which is larger than the sole nominee (900 million won), but the benefits of the tax deduction cannot be awarded to the co-nominated.

However, as the potential for dissatisfaction around the joint name to spread to the fiscal resistance movement grew, it was decided to give joint nominees a tax credit for the tax deduction. Some interpretations have accepted that some point out that the tax tax, which discriminates in reverse of the common name, does not conform to the concept of gender equality.

The joint name of the couple has been extended since 2008. This is because the spouse’s gift tax deduction has increased from 300 million won to 600 million won and the tax savings benefit derived from the taxes has increased. If a house is owned by a single name, taxes are paid on the amount that exceeds the official price of 900 million won, but the joint name of the couple is subject to final tax on the amount that exceeds the official price of 1, 2 billion won. It was also recognized as an advantage of the joint name that the applied tax rate is reduced because the tax base is also divided in half between the pairs.

However, the situation has changed recently. As house prices rose, the number of homes with the official price of 1.2 billion won or more increased, and the number of single-family homes that paid the tax for the first time increased. In the midst of this, complaints from co-filers increased by not receiving the tax deduction for seniors and long-term holders.

The senior citizen deduction applies to people age 60 and over, and the long-term occupancy deduction benefit is available when the home has been in business for more than 5 years. The older and longer the holding period, the higher the deduction rate. Starting next year, the deduction for retirement and long-term possession will increase from 70% to 80%. Next year, if a 70-year-old single person owns a home for 15 years, a deduction rate of 80% will be applied to reduce the tax burden.

What if dissatisfaction among disadvantaged singles grows again?

Although the Democratic Party and the government have decided to fix some of the reverse discrimination problems under the common name, many say there is a long way to go. Conversely, increasing the benefits for co-complainants may increase the dissatisfaction of single people.

Rather, the world’s only punitive double taxation, taxpayer dissatisfaction, will not go away completely unless the final tax, which is the only punitive double taxation, is abolished or reasonably adjusted, experts predict. Otherwise, the number of taxpayers will increase dramatically and the amount paid will increase, and the resistance of the taxpayers can be repeated at any time.

In fact, as the number of apartment owners in Gangbuk, as well as Seoul, has expanded to one house in the metropolitan area, the number of taxpayers has increased significantly from 590,000 to more than 700,000 in one year. Compared to 2016, before the inauguration of the Moon Jae-in administration, the number of people increased by almost 400,000. This is because the quoted price went up each year and the quoted price update rate (the rate of reflecting the quoted price against the market price) increased. The most important reason is that the tax standard, set at 900 million won (one house for one home), has not changed for 12 years.

If the current tax system is left as is, the amount of the tax burden will increase starting next year. Not only people with multiple households, but also people with only one household and retirees who do not have certain incomes, will pay roughly double the taxes they have this year. This is because the published price increases due to the continuous increase in property prices. In addition, the official price realization rate increases and the tax rate increases. An increase in the fair market price ratio, which calculates the tax base, and an increase in the upper limit of itemized charges for people with multiple households are also factors that increase the tax burden.

Hong Ki-yong, professor of business administration at Incheon National University, said: “If reverse discrimination against the common name is corrected, the dissatisfaction of single people on the contrary may increase.”

Reporter In-Seol Jung / Dowon Lim / Minjun Seo [email protected]