[ad_1]

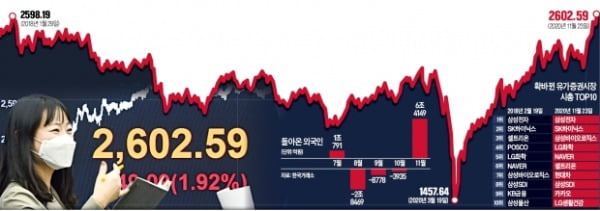

The ‘KOSPI Index 2600 Era’ was launched. The KOSPI index closed at 2602.59, up 1.92% on the 23rd. It is an all-time high based on the closing price. On this day, employees are busy moving around in Hana Bank’s trading room in Euljiro, Seoul. Reporter Huh Moon-chan [email protected]

The ‘KOSPI Index 2600 Era’ was launched. The KOSPI index closed at 2602.59, up 1.92% on the 23rd. It is an all-time high based on the closing price. On this day, employees are busy moving around in Hana Bank’s trading room in Euljiro, Seoul. Reporter Huh Moon-chan [email protected]

The share price exceeded the 2600 line and reached an all-time high. Samsung(67,500 + 4.33%) Market capitalization topped 400 trillion won first. The share price, which fell to 1,457.64 (close) on March 19 on Corona 19 fears, achieved a reversal, setting an eight-month record. In the crash, Donghak Ant supported the share price, and when expectations for the development of the corona vaccine rose, the returning foreigner raised the share price. Korean companies, strong in the crisis, posted earnings surprises one after another, attracting foreign investors.

The KOSPI index closed at 2602.59, up 1.92% on the 23rd. It exceeded the record (2598.19) based on the closing price established on January 29, 2018. The intraday maximum (2607.10) was not exceeded registered the same day.

On this day, Samsung Electronics was the leading player in the ‘top level’ KOSPI index. Samsung Electronics finalized the transaction at 67,500 won, up 4.33%, breaking the record again. Market capitalization (excluding preferred stock) reached 402.3 trillion won. SK hynix, second in market capitalization(100,000 + 3.31%)It also posted 100,000 won, an increase of 3.31%.

Foreigners posted net purchases of about 1 trillion won on the stock market alone, causing the share price to rise. It is a net purchase for 13 consecutive days. Foreigners who netted 27.8 trillion won in money on the stock market at the end of October this year made a net purchase of 6.40 trillion won this month alone.

It is analyzed that the share was bought anticipating that the performance of Korean companies, which have a large export share among emerging countries, will improve if the global economy normalizes with the development of vaccines. In addition to semiconductors, this is the reason why economically sensitive stocks like steel and shipbuilding have quickly recovered. These stocks took the lead after BBIG (Bio Battery Internet Game), which topped the national stock market after the collapse of Corona 19.

Vaccine development expectations are spreading, a catalyst for the soaring share price. On the 22nd (local time), “Vaccination can begin on the 11th of next month,” said Montseff Slawi, executive director of vaccine development at the White House. As a result, the voices to predict the 3000 KOSPI index are increasing.

‘Hakikjin Rally’ directed by Semiconductor

The KOSPI index, which overcame the ‘fear of the crown’, broke the record. It jumped more than 1,100 points in eight months after the accident (1,457.64) caused by the new coronavirus infection (Corona 19). It’s a dramatic turn. The overflowing liquidity, the achievements of the companies that overcame the crisis and the return of foreigners were right. It is similar to but different from the time when the semiconductor rally unfolded based on the strong January 2018 won, which was the previous high. Experts say the increase will continue until at least the first half of next year even during the ‘corona vs vaccine’ showdown. Securities companies are beginning to announce their estimate of 3,000 next year.

Story created by three beats

The new history of the national stock market unfolded at an unprecedented rate. The KOSPI index reached an all-time high within a week after crossing the 2,500 threshold. When it first crossed the 2,600 line in early 2018, it took three months for it to climb 100 points from 2,500.

High-ranking stocks in market capitalization rose all at once. On this day, the top 10 stocks in market capitalization jumped. With large-cap stocks leading the uptrend, the KOSPI 200 already hit an all-time high on the 16th. Daejangju Samsung Electronics was up 4.33% on the day. Most growth stocks and economically sensitive stocks ended higher.

It was the power of money that pushed the KOSPI index to the 1400 line by more than 1000 points in 8 months. Investor deposits, currently called stock market reserve funds, are the largest (63 trillion won) in history. Controversy over “overvaluation” and “overheating” continued to escalate, but abundant liquidity pushed the stock price into ridicule.

The money is destined to flock to the stock market, a risky asset in the era of zero interest rates. The same goes for the US NASDAQ, which hit an all-time high one step ahead, and Japan’s Nikkei 225, which hit the highest level in 29 years.

Virtuous Cycle Stock Market

There was a “major virtuous cycle” until the KOSPI reached an all-time high. Investors also led a virtuous circle. The ants bought net shares for more than 22 trillion won after the collapse of the crown (March 19). The stock market has established itself as a great hand. After that, the foreigners received their sale for profit. Foreigners flocked to Korea because of the weak dollar. Foreigners who sold 393 billion won net last month have been sweeping over 6 trillion won in stocks this month alone. Lee Chang-mok, director of NH’s Securities and Investment Research Center, analyzed: “It has broken the record due to the addition of abundant liquidity, economic recovery and currency effects.

Diversified Korean Stock Market

The situation in January 2018, when you first ascended Hill 2600, was similar. There was a semiconductor rally with the strong winners on the back. The domestic stock market has grown in correlation with the exchange rate since the financial crisis of 2008. There were many cases where the KOSPI index rose when the exchange rate fell. Foreigners flocked to Samsung Electronics and SK Hynix, which were first and second in market capitalization at the time.

However, the constitution of the Korean stock market has changed in two years. BBIG shares that emerged as the leading stocks in the 19 crown fluctuation market have significantly increased the market capitalization share on the KOSPI. In particular, the proportion of the pharmaceutical industry was only 3.71% in 2018, but now it is 7.69%. Samsung Biologics(804,000 + 0.63%), Celltrion(301,000 + 1.52%), Green Cross(382,500 + 0.13%) This is because the price of the shares of the back has risen considerably. The services sector also increased from 8.08% to 10.80%. Naver(281,500 + 0.18%)Wakakao(367,000 + 0.41%) NCsoft(822,000 -0.72%) The back strength was great. Battery (LG Chemical(748,000 + 3.31%)) Ecological (Hanwha Solutions(48,650 -0.31%), LEISURE(66,500 + 0.45%)) Cosmetics (LG Home and health(1,565,000 + 0.06%), Amorepacific(197,000 0.00%)) Petrochemical (SK Innovation(154,000 0.00%), Floor(66,500 + 1.22%)), etc., the share of the chemical industry increased slightly from 10.33% to 11.10%.

Ona at the age of 3000 KOSPI

Lee Jae-sun, Researcher at Hana Financial Investment, said: “The KOSPI Rally is structurally different from 2018 because the index rise is not focused on a specific industry. Okay, the stock market will keep going up. “

It is observed that the upward trend in the stock market will continue until the first half of next year. Some brokerage firms expect the KOSPI to hit 3,000 next year. The performance of companies that have overcome the Corona 19 shock is generating expectations. According to F & Guide, the estimated total operating profit of listed companies (276) with forecast for next year’s earnings amounted to 180 trillion 2.114 trillion won. This is a figure that exceeds 177 trillion 532.3 billion won in 2018, when these companies made the largest profits in history.

The variables remain. The reproliferation of the crown and the increase in interest rates are important. Ik-jae Cho, an expert at Hi Investment & Securities, said: “The core of the market next year is liquidity. If the Corona 19 gives way from the second quarter of next year, discussions on the policy transition can begin. monetary policy and strong volatility may occur in the global stock market. “

Reporter Park Jae-won / Han Economic Daily / Go Jae-yeon [email protected]