[ad_1]

Woori Financial Management Research Institute Report

Average total assets of 765 million won … 76.6% of properties

[사진=연합뉴스]

The “popular rich,” who are in the top 10-30% of household income, have an average of 130 million won in loans, and more than two out of ten borrowers are using loans as mutual funds. The average wealth of the masses was 765 million won, of which the average value of the real estate owned was 600 million won. The wealthy responded that they plan to expand equity investment in the future.

On the 6th, the Woori Financial Management Research Institute, a subsidiary of Woori Financial Group, released a report on the “wealth management and digital finance usage behavior of the rich.” The institute defined households with the top 10% to 30% of family income as “popular rich.” This applies to households with annual income (before taxes) of 70 million won or more and less than 120 million won.

According to the report, 68.5% of the wealthy have loans and their average loan balance is 132.7 million won. Among loan holders, 44.2% use home loans (average balance 134.3 million won) and users of cheonsei fund loans (122.2 million won) and credit loans (53 million won). ) were 7.2% and 29.0%, respectively.

[자료=우리금융경영연구소]

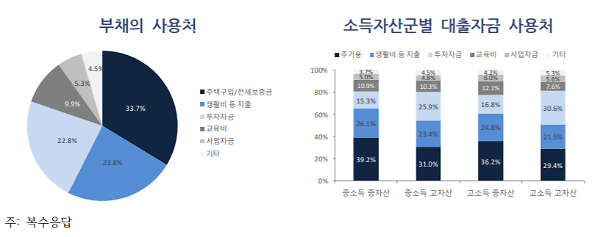

The purpose of the loans was to solve housing problems (33.7%) and use living expenses (23.8%). However, 22.8% responded that it was for use as investment funds. More than two out of ten wealthy creditors have initiated so-called “debt investment” (investing in debt).

The average total assets of the wealthy in the masses were 765 million won, and the net assets excluding liabilities were 646 million won. Of these, the median value of real estate is 69.3 million won and financial assets 125.9 million won. The proportion of real estate and financial assets is 76.6% and 18.9%, respectively.

Even within the wealthy group, the higher the asset holding, the higher the share of real estate assets, and the share of real estate among respondents in the metropolitan area was higher than in other regions. In the group with total assets less than 300 million won, the share of real estate was the lowest at 68.7%, but 83.5% in the group with assets greater than 1.5 billion won. In addition, the share of real estate in Seoul and Gyeonggi area was close to 80%, but the share of real estate in other areas was 71.1%.

The wealthy responded that they would increase their financial assets from 18.9% to 26.3% instead of reducing the share of real estate assets from 76.6% to 64.9%. Among financial assets, they responded that they would increase the participation of the investment in shares from 15.4% to 17.1%. The deposit ratio will drop from 45.0% to 42.3% and personal pensions will also drop from 19.1% to 18.8%.

The monthly mandatory living expenses for retirement that the wealthy think are 2.25 million won (based on households), and the additional living expenses including essential living expenses were 3.74 million won. It was found that 91.5% of those surveyed could cover essential living expenses with expected income, and 57.0% could provide additional living expenses. However, the ‘Retirement Readiness Score’, which self-assessed the degree of readiness for retirement, was an average of 3.5 out of 5 points. They gave high marks to family and social relationships, but low to financial readiness.

© ‘Journal of the world economy in five languages’ Ajou Economics. Prohibition of unauthorized reproduction and redistribution

[ad_2]