[ad_1]

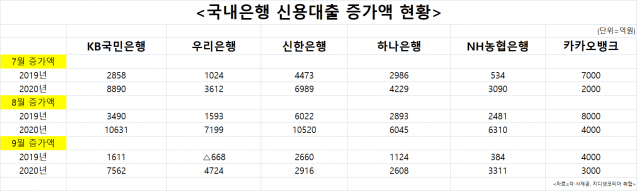

As bank credit loans increased from an average of 2 trillion won per month to 6.3 trillion won in August last year, the Financial Services Commission launched intensive deterrence measures against credit lending.

The goal is to reduce the level of loan growth by blocking one-dimensional “young-eul” (those who buy houses by gathering their souls), who often make up for insufficient home loans by receiving credit loans.

Additionally, the Financial Services Commission is actively discussing a plan to use the total debt service ratio (DSR) instead of the debt service rate (DTI), which was an indicator of the loan limit when buying a company. home, in the first quarter of next year.

On the 13th, a briefing was held at the Financial Services Commission of the Gwanghwamun Government Complex in Seoul. Lee Se-hoon, head of the Financial Policy Office at the Financial Services Commission, said: “Credit loans are leading the growth rate of total home loans and are expanding rapidly, he said.

Management increasing 2 trillion won per month … reinforcing job management

To reduce the increase in credit loans, the Financial Services Commission has implemented three measures. ▲ Reinforcement of self-management in the banking sector. ▲ Reinforcement of post-management of credit loans. ▲ Individual DSR management of those who received credit loans.

The strengthening of banks’ self-management will take effect on the 16th. The Financial Services Commission is expected to monitor compliance with the bank’s loan loan management objectives through monthly inspections. Director Lee Se-hoon explained, “We asked each bank to submit a loan management plan before the end of the year and we directed them to refrain from making excessive credit loans against income,” he said. “We plan to check this every week and guide them so that the content can be well maintained.” did.

As of the 30th, the purpose of the credit credit will be confirmed. A small number of credit loans do not ask where they are used, but in the case of credit loans that exceed 100 million won, the loan can be recovered based on use. If a person who has received a credit loan of 100 million won or more purchases a house in an overheated or speculative district within the credit loan maturity (one year), the credit is recovered.

In addition, the ‘Borrower DSR’ is extended, which was applied only when extending a home mortgage loan with a market price greater than 900 million won in speculative areas and overheated areas. The DSR of those borrowing more than 900 million won in regulated areas should have 40% of their income, but now, the 40% rule of the DSR applies to those who own a home that exceeds 900 million won or high-income people with an annual income of more than 80 million won.

In this case, a lender with an annual income of 85 million won and a home loan of 300 million won (assuming 3% per year, repaying principal and interest equally over 30 years) cannot receive more than 150 million won in credit.

Director Lee said, “If you receive a credit loan of more than 100 million won, we plan to take appropriate measures, such as recouping the credit loan if it is used as a means to circumvent mortgage loan regulation. We plan to strengthen follow-up management and implement DSR for borrowers in Japan. “

Considering the introduction of DSR instead of DTI in the first quarter of next year

In addition to the total household loan management system, it also introduced measures to curb loans, but the government plans to reinforce the reinforcement of household loans once again. While the loan cap has been set, the vicious cycle of not getting the full amount of loans continues as apartment prices across the country have skyrocketed.

The Financial Services Commission plans to establish a task force to prepare a ‘plan to advance household debt management’ within this month and finalize a new plan in the first quarter of next year. There are three options to consider. ▲ Introduction of DRS instead of DTI ▲ Regulation of 40% of DSR among all financial sectors ▲ Ease of regulation of the deposit rate.

The most promising thing is to calculate the loan limit in DSR instead of DTI. In this case, regardless of the price of the house, the borrower’s income or existing debts are important, so the total amount of loans is significantly reduced.

However, since apartment prices across the country have risen recently, end-user dissatisfaction is expected to increase as they cannot buy apartments without an immediate salary increase. According to KB Real Estate Liveon’s weekly KB real estate market trend, the national apartment increase rate as of the 9th was 0.3%.

Director Lee Se-hoon added: “The part where consensus was formed among the government to some extent is that the transition to the individual borrower ability to pay assessment system is taking place in the first place.” .

Related Posts

Government tightens loans to households … manages growth rate at 5%

Why do banks recommend savings when lending?

The threshold for credit lending has risen … National banks plummet in September rise

Other bank loans increased by 3 trillion won for 2 consecutive months

☞ What is DSR? DSR is the ratio of the total principal of the debt and the repayment of interest as a criterion to determine if the borrower (loan applicant) has the ability to repay the loan from his income. Calculated by dividing the repayment amount of all home loans by the annual income. The types of home loans included in the DSR calculation are ▲ home loans ▲ non-home mortgage loans ▲ credit loans ▲ cheonsei deposit guarantee loans, deposit guaranteed loans, securities guarantee loans ▲ other loans . Loans not included are: ▲ General Financial Products ▲ Small Credit Loans of 3 million won or less, Securities Secured Loans, and Jeonse Fund Loans ▲ Migration Expenses and Intermediary Loans.